This Startup Promises To Make Paperwork Less Of A Nightmare For Freelancers

The number of nontraditional careers, from traditional freelancing to multi-job juggling in the gig economy, has only grown since the Great Recession. But taking the reins of your own employment means handling a litany of invoices, payments, expenses, and tax forms yourself. The startup AND CO launched a little over a month ago to support the freelancer lifestyle.

“When you turn freelance, you will Google something, you will read some blog posts about something, or you will ask your three buddies who are freelance, and that’s pretty much how you will get yourself set up,” says AND CO cofounder Leif Abraham. “Many freelancers are making the same mistakes over and over and over again because there is no standard to follow. Roughly nine freelancers out of ten are not doing anything; they might have a spreadsheet, or a Dropbox or a shoebox standing around to throw stuff into to keep track of things, but only one in 10 freelancers has a proper setup, using this for accounting and that for time tracking. Even in this best case scenario, there’s a massive learning curve,” he says.

Abraham and fellow cofounder Martin Strutz built AND CO to be a one-stop service for freelancers to sign up and forget about the paperwork headaches that come with tracking projects and handling your own finances. Abraham and Strutz started coding AND CO about a year ago, had a private beta back in October, and officially launched in mid-March after raising $2 million in seed funding.

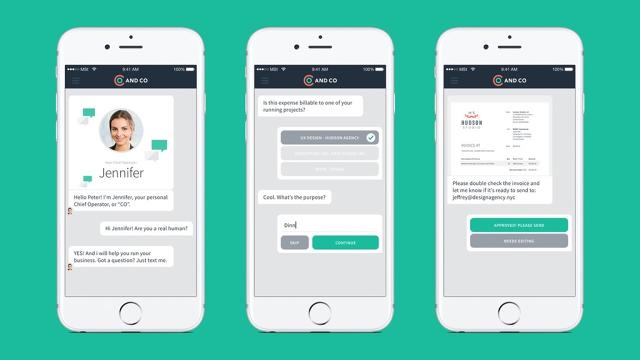

AND CO’s core product is $70 per month for on-call help, unlimited invoicing, project tracking, and reminders to take action. The on-call service is handled by AND CO staff in their NYC office, and although some user questions are handled by chatbots querying down decision trees, the user interface is entirely based in Q&A conversations. Unlike Quicken or other accounting products, AND CO doesn’t have a spreadsheet in sight, so there’s no software learning curve—just the assistance of a “chief operator” answering questions and taking care of paperwork in the background.

When building AND CO Abraham says he asked himself “What is the experience I wanted to have? I just throw it over the fence and it gets done. There’s where the idea of a chief operator comes in. If you’re an executive, you have a personal assistant you throw stuff at and they talk to the accountant, they talk to the lawyer, and what you need ends up on your desk. It’s creating a corporate support structure for freelancers.”

There is a “My Desk” section in AND CO where a chief operator will drop essential things that the user needs to take care of. These are the few things that are faster for freelancers to fill out themselves, like the purpose and amount of an expense, that AND CO will automatically prompt freelancers to fill out before handing off to a chief operator. But for the majority of tasks, chief operators handle things in the background, talking to tax professionals and CPAs on behalf of the user.

Adjustable Service For Fluctuating Workloads

AND CO recently introduced a free tier, but unlike the free options for other SaaS products, this isn’t simply a stripped-down trial version. The free tier includes access to the chief operator service while covering six invoices and 300 expenses per year, satisfying the needs of freelancers who only have a few projects. Instead of cancelling their service entirely, freelancers having a light month can move down to the free tier until work picks back up, ensuring a filing continuity to pare down tax annoyance. In a few weeks, AND CO plans to release a paid middle tier that bridges the free and full options, fleshing out their model for freelancers to change tiers as their fluid workload demands.

There still aren’t too many well-known services designed for self-employed people working multiple jobs, Abraham says, seeing these gaps as a market slow to adapt to how careers have evolved. Baby Boomers stayed in the same job for 20-30 years and corporations took on social responsibilities; those support structures crumbled by Generation X, whose workers stayed in jobs for 3-5 years before moving on but kept a fairly linear career path. Today’s careers involve multiple overlapping jobs, sometimes even in different professions. Abraham says that AND CO helps support what he calls the “modern career.”

AND CO has gotten over a thousand users in the month since it launched, but as more people sign up, he believes that AND CO could offer freelancers even more services—specifically, through their data. While Abraham maintains that all user data would be anonymized and users would be able to opt out of letting that data factor into AND CO’s analyses, such a standardized data set of freelancer activity would be a goldmine. Abraham envisions AND CO to be a sort of proactive data-driven union, leveraging tracked transactions between users and companies to go to bat for freelancers.

“We would know how a company actually pays based on financial transactions we tracked. It doesn’t mean they’re evil, but if you track your cashflow, as that reaches scale in theory, then we can basically create a proactive leverage. A company should have an interest in treating an AND CO member well because they would like to hire them in the future,” says Abraham.

But that’s all in the distant future. In the next few months, AND CO plans to add W2 support and several tools to beef up the service, along with that middle price and options tier—all more services to be there when the self-employed need it most.

“We have a sentence that we use: basically, working independently doesn’t mean you have to work alone,” says Abraham.

Related Video: Eight Ways You Can Make working from home more efficient

Fast Company , Read Full Story

(22)