This trio of Asian American twentysomethings wants to teach Gen Z how to invest

Trio Allan Maman, 22, Sonny Mo, 22, and Sam Yang, 20, are college dropouts on a mission to empower teens to invest. The three just raised $3.3 million in funding to start Bloom, an app to teach teenagers how to invest and give them a platform to do so. Bloom was part of Y Combinator 2021 and counts a U.S. presidential candidate among its investors, although the founders declined to say which one.

Maman has worked with both Andrew Yang and Michael Bloomberg. He got his start in high school where he made a fortune selling fidget spinners. Then he blew it on designer clothing and fancy meals. “I was reckless,” he says. “Had I known how to be smart about money, I wouldn’t have made as many mistakes.”

According to a 2021 study by TIAA, on average, two-thirds of Gen Z couldn’t answer more than 50% of TIAA’s financial literacy quiz, compared to 50% of Americans in general. Even more dismaying, Gen Z is more likely than any other generation to have exposure to financial literacy classes.

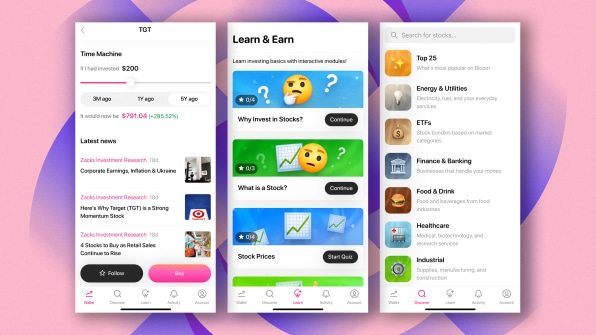

[Photo: courtesy Bloom]

“When you turn 18, you don’t magically become financially smarter,” Maman says. He points out the only difference between a 17- and an 18-year-old when it comes to finance is that the 18-year-old can now open a brokerage account, trade high-risk options, borrow money on margin, and access thousands of dollars’ worth of credit and loans.

Even if teens do have the know-how, their options for investing are limited. Currently, teenagers have the option of using traditional brokerage products in which the user experience can be clunky and fees high, or apps like Robinhood where their finances are comingled with those of their parents.

Mo had long been frustrated by the limited options teens have for investing. As an immigrant from Seoul, Mo became a personal finance geek in high school and managed to save $10,000 by winning multiple scholarships and working multiple jobs. However, he wasn’t able to invest any of it due to the high fees associated with index funds. Mo ended up dropping out of Brown because his student loans were so high. He came up with the idea for Bloom when he realized his 16-year-old brother was in the same position.

Start young, stay safe, be prepared

Bloom’s goal is to start educating teenagers when they’re 13 to 14 so they can make smarter decisions, and also have more runway to make long-term investments.

While Sam Yang, at 20, is the youngest of the three, he believes it’s never too early to start investing: “I regretted not having started just one year earlier—I would have had such an advantage in both knowledge and actual portfolio value,” he says.

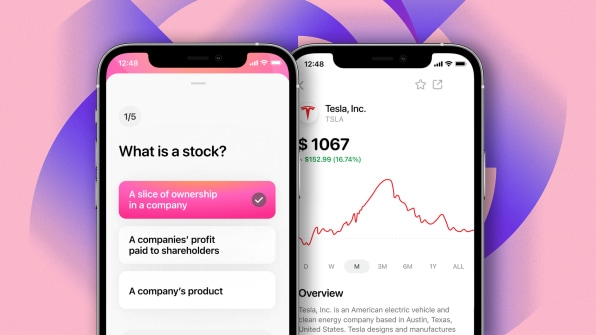

Bloom features a combination of parental safeguards and educational modules to make it teen-friendly. Parents can set up the app so they can approve or decline a trade their child wants to make and also put access-restrictions on certain types of stocks. There are 16 different modules for teaching teens about fin literacy. The app’s waiting list is 35,000 teens, and the trio expects to reach a million users by the end of the year.

“We have users writing to us asking for more,” Maman says. “It’s a lot easier to care about what a dividend is when you actually earn one.”

Bloom also allows users to purchase fractional shares, so teens can invest as little as $1. One testimonial comes from Landon, a 15-year-0ld Bloom user in Oklahoma: “I started using Bloom, and it has taught me so much about saving money and investing. I own some fractional shares of many companies and doing that as a teen makes me feel amazing.”

Maman is the child of two immigrants. He said that, growing up, his parents didn’t talk much about money. One of his favorite parts of running Bloom is when he calls users. Sometimes a parent who doesn’t speak English well will put him on the phone with their child who will start discussing their investments. “Kids are bridging the knowledge gap for finance and investing,” he says.

(31)