Warehouse On Demand

The designers of the Exploding Kittens card game originally thought they might need to print about 500 decks, and could handle fulfillment with help at a launch party. Instead, the game became a surprise Kickstarter hit during its 2015 campaign, raising nearly $9 million from over 200,000 backers. With multiple orders and the campaign’s stretch goals accounted for, the game’s creators had to produce and distribute around a million decks of cards.

Exploding Kittens breezed past the usual problems that stand in the way of success. Designing a compelling game is often difficult, and they came up with a catchy hook that plays well by all reports. Fundraising is tedious, but the two inventors brought in The Oatmeal’s Matthew Inman, who has a massive fanbase for his cartoons and other projects, and it quickly caught fire. To print and package the game, the team went to Ad Magic, which handles Cards Against Humanity (CAH) and many others.

For creative efforts such as this one, the hard stuff of e-commerce often winds up being moving pesky atoms around to get in the hands of people who pledged and paid. That’s where a division of Cards Against Humanity called Blackbox stepped in. Newly announced to the world, Blackbox is soon to split off into a freestanding entity. Exploding Kittens wound up being the largest project it’s shipped so far, after the best-selling Cards Against Humanity games themselves.

CAH doesn’t disclose its game’s unit volumes or other figures, but sales are estimated in the hundreds of thousands yearly. In the five years since its debut, most copies of CAH have been moved by Amazon’s Fulfillment by Amazon arm. That’s changing. Blackbox has a live ticker on its site showing “boxes shipped worldwide,” currently pegged at nearly 1.6 million.

The goal is to work closely with creators to offer a “buy” button for their website, backend e-commerce services, warehousing, and branded packaging (with no mention of Blackbox), all for a fixed price of about $5 per shipment plus 5% of the product’s retail cost—about $6 for a product with a street price of $20. For many physical goods, that’s a cost that’s hard to beat, due to the advantages in volume that Blackbox has and by the way it handles products: It never touches them.

A White-Label Black Box, As It Were

Blackbox is not a distributor. Nor is it precisely a “3PL” (third-party logistics) firm—a category of company that comes in a large number of sizes and capabilities, and wings stuff around the world through shippers and freight handlers.

More accurately, Blackbox is a front end to a number of warehouses around the country. It contracts with them to handle Cards Against Humanity, and now products made by other firms. The name is a giveaway: Blackbox serves as a black-box interface to fulfillment. CAH cofounder and Blackbox head honcho Max Temkin says he wants to build the fulfillment world’s equivalent of Amazon Web Services (AWS), a set of on-demand, cloud-hosted services that abstract the hardware away from the functionality.

“We contracted commercial warehouses that know how to do this,” Temkin says. “Wherever there’s a U.S. Postal Service smarthub where they intake the mail for the whole region, there are these other businesses that pop up around there. We built software that coordinates all these warehouses together.” He says the difference between Blackbox and managing one’s own inventory and shipping is like the difference between running your own hardware server and outsourcing the effort to Amazon Web Services.

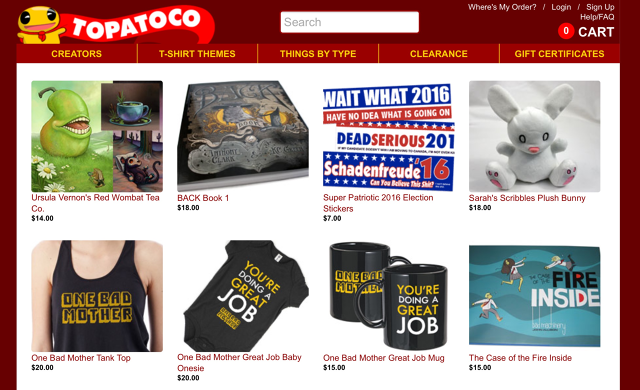

Blackbox has plenty of direct and tangential competitors. Some are traditional shipping houses, where a maker sends items and a list of addresses, and off they go. Others handle some combination of warehousing, order taking, packaging, and shipping. Still others offer soup-to-nuts coverage, like the appropriately named Make That Thing! division of web comics shop and fulfillment house TopatoCo. Make That Thing! can provide advice and management for creators ranging from conceiving a crowdfunding campaign through to sending out rewards and post-campaign sales.

David Malki, the cartoonist behind Wondermark and the head of book design and special products at TopatoCo, says that many artists and other creators want to produce a book or other products that complement their online work, but just because “not everybody has those skill sets doesn’t mean they shouldn’t be able to make that thing.”

For most creators, the amount of merchandise they have made for a crowdfunding campaign to bring to shows or sell online outstrips their ability to store that stuff, much less pack and fulfill it. “If you want to run an enterprise that involves manufacturing more things than you can fit in your Brooklyn apartment, you have to partner with somebody,” says Malki.

The firm Lumi has carved out a different slice of this market, providing a dashboard front end that’s similar to Blackbox, but designed to let customers create custom packaging material. The company’s cofounders, Jesse Genet and Stephan Ango, pivoted their firm from selling a unique light-sensitive fabric ink to leveraging the expertise they gained in building a distribution network.

Now the company works as a buffer for others, including T-shirt companies Threadless and Cotton Bureau, to manage sourcing, printing, and delivering the array of branded boxes, shipping envelopes, packing tape, rubber stamps, and other items that help firms provide a consistent identity from online ordering through delivery.

Genet says that while companies can source material on their own, packaging supplies wind up being a horrible mess for firms that are above a small scale and below an enormous one. Those that ship tens of thousands of high-value items a year fall below the thresholds to work directly with big packaging companies, and often get foisted off to brokers, who add a markup and use outdated methods. “You need to order a box, and all of a sudden you’re faxing someone in New Jersey,” she says.

For clients who have their own shipping operations or contract with warehouses, these packaging materials wind up being a surprisingly weak link, and they’re expensive. Cotton Bureau, which prints carefully curated T-shirt designs after they’ve reached a certain preorder threshold, saved over 25% over its previous packaging bought through Alibaba, Genet says.

Like Malki and Temkin, Genet says Lumi is building a service and an approach for people like themselves. “We know what they’re going through; we know what they’re like,” she says.

Amazon: The 1,000-Pallet Gorilla

These smaller firms all contend at some level against Fulfillment by Amazon (FbA), a division of the online retailer, which can handle both shipping on behalf of its customers and listing inventory sold directly through Amazon.com. FbA’s advantage is scale and relatively low cost, and the fact that it lets creators sell products on Amazon’s own site, where they show up alongside Amazon’s own inventory.

But mastering FbA’s rules and pricing, which change regularly, can be overwhelming. Over two years ago, I managed to ship about 900 hardcover books through FbA, but it required tens of hours to learn the terminology and manage inventory via a seemingly late ’90s-era interface, working (via email) with an Amazon representative, and, at one point, dealing with a pallet stuck in a queue for unpacking at a Pennsylvania Amazon outpost for 10 days.

Still, FbA was affordable. The price? About the same as the Blackbox estimate. But the books were shipped in an Amazon-branded box and with a sticky Amazon barcode label adhered to each book.

Temkin knows firsthand one of the other problems: counterfeiting. Cards Against Humanity has battled since its rise on the charts to Amazon’s best-selling card game with ersatz products. “The counterfeiting, frankly, really became an issue,” he says. Amazon effectively treats all products with the same identity (a unique stock-keeping unit or SKU) as interchangeable widgets.

For years, unaffiliated firms would cheaply bootleg print copies of CAH and ship them to Amazon, and when CAH ran out of stock—a routine problem in years past—other inventory would take its place. “My customers go on Amazon and buy the thing I made; it says it’s for sale by CAH, they get it, and it’s in the wrong font, and it falls apart, and it’s poorly made,” Temkin says. He notes, “They don’t care who sells Cards; they care who is selling it at the best price.” (A request to Amazon to discuss its counterfeiting policy didn’t get a reply.)

More recently, Temkin says Amazon has given CAH higher status, and made it more difficult for other firms to offer CAH for sale in the same way. CAH has also improved its supply chain so it doesn’t run out of product, and it now puts holograms on its boxes. (CAH gives the game away as downloadable PDFs to print, but doesn’t authorize third-party sales.) But Temkin thinks of Blackbox as a way to provide guaranteed product to buyers.

The counterfeiting problem was part of a threefold set of concerns that prompted Cards Against Humanity’s creators to start Blackbox. The other two were the challenges of shipping small, odd, and non-standard products, and having a dependency on Amazon as its sole fulfillment partner. “We really needed an ‘in case of emergency break glass’ option,” Temkin says.

“If we wanted to do products that were really small or really large, we couldn’t afford to do it with FbA,” he adds. In late 2012 and for three years following, CAH experimented with using the USPS to send small expansion packs, letters, a tabloid-sized newspaper-style cartoon supplement, and other goods in holiday promotions. This helped them stage and manage their shift to shipping more of their own product and bringing Blackbox to life.

Not In It (Only) For The Money

Temkin says that Blackbox’s intent isn’t to challenge FbA, but stake out a “lifestyle” territory that returns a modest profit instead of the maximum theoretical profit. This is in contrast to conventional distributors of books, games, and electronics who charge a much higher fee, but also place products into retail channels. It’s tough to calculate how big its opportunity is, but the 3PL business is huge. Armstrong & Associates pegs revenue alone in the U.S. at over $70 billion in 2015; Global Market Insights suggests it could reach over a trillion dollars globally by 2022.

(Temkin, at one point during an interview at a cafe, leaned close to a reporter’s digital recorder, saying, “My personal plea to Jeff Bezos: Please do not destroy us. We mean you no harm. I think we built something that’s sustainable independent of Amazon . . . Please spare our families.” He was unaware that the cafe teemed with Amazon employees who work in Seattle’s South Lake Union neighborhood.)

For comparison, Kickstarter has collected over $2.2 billion on behalf of crowdfunding campaigns run on its site since 2009. This includes an enormous variety of projects, many of them producing an effectively digital end result, like a downloadable album or a digitally distributed film.

Every crowdfunding campaign won’t fulfill via Blackbox, although projects (like CAH and Exploding Kittens) that start strong with crowdfunding often go on to ship vastly more units in the years that follow. And there are plenty of small-time creators whose eyes may roll back in their head when they look at text found on a typical 3PL site (like, “make sure you understand the difference between Prepackaged and Ready-to-Ship and Not Prepackaged and Ready-to-Ship”). They may be eager to remove fulfillment from their list of things to learn how to do.

TopatoCo’s Malki, a friend of Temkin’s who has exhibited at shows with CAH, says he doesn’t view Blackbox as a competitor, because the companies typically slice off different parts of the idea-to-reality process. But they do share an ideology. Malki notes that TopatoCo’s founder, Jeffrey Rowland, is dedicated to maximizing value for the artists with whom the company works. “The margins in a business with that core philosophy,” he says, “are not as high as they would be otherwise.”

Fast Company , Read Full Story

(20)