what to expect Now that the Fed has Hiked interest rates

December 17, 2015

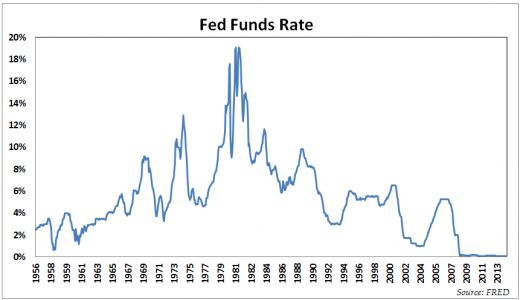

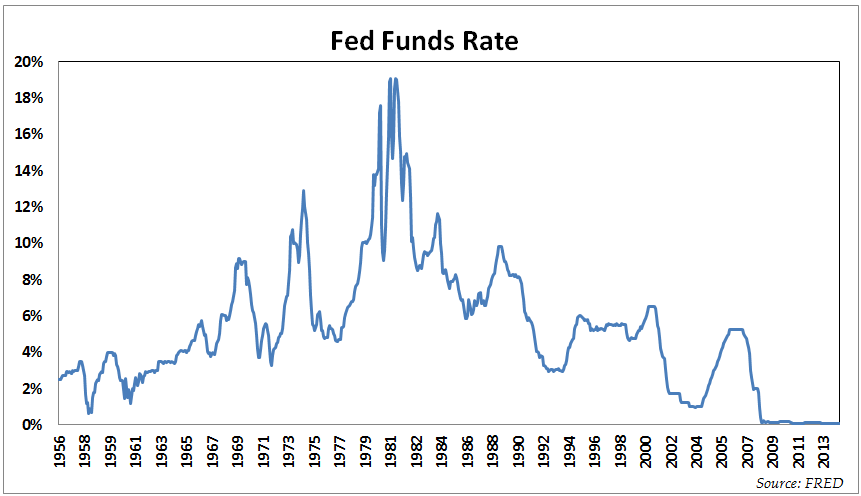

The Fed money fee is Now zero.50% and the USD is Bullish

On Wednesday, sixteen December 2015 at 7 PM, Janet Yellen, the chair of the Federal Reserve financial institution announced that the Fed cash fee could be increased to zero.50%. This marks the primary elevate in the rate of interest due to the fact 2006, and it’s a vital transfer that has some distance-reaching economic implications. The Fed has set an inflation target of two%, and it’s reasonably assured that the us financial system will hit that focus on over the medium-time period. extra importantly, the choice to hike rates of interest has been completed in a dovish method, and this means that any future charge hikes might be gradual versus sharp and unexpected. The consensus forecast for the decision on Wednesday used to be 0.5%, and this is precisely what the real resolution was. within the run-up to the rate decision, investors, analysts, currency speculators and merchants have been reluctant to invest on the USD, choosing rather to attend unless the choice had been made.

The Bulls come Charging with the us buck

in the aftermath of the Fed price hike, america buck Index surged. It comes as no shock that the demand for the usa greenback could be rampant after a Fed rate hike. this is certainly indicated on the dollar Index Spot, which is now trading at 98.ninety one (+1.11%). america greenback index started the day at ninety eight.610 and hit a high of 99.041 in early morning trading. yesterday’s shut was 97.871. For the 12 months up to now, merchants might be smartly pleased with the efficiency of the greenback, which has again 9.sixty three% on america greenback Index. whereas the dollar has simply over 2 points to head to hit its fifty two-week high of 100.510, it is clearly on an upward trajectory now that the Fed has moved. merchants shall be looking at all method of monetary assets shifting ahead, including greenback-denominated forex pairs, indices, stocks and commodities.

Already we will see some interesting route taking place with the following currency pairs:

- The EUR/USD currency pair is trading at 1.0846 (-0.60%) which is sharply better for the USD, given euro potential in up to date weeks

- The USD/CAD foreign money pair is trading at 1.3940 (+1.16%) and in addition showed robust gains

- The GBP/USD currency pair is buying and selling at 1.4907 (-0.sixty five%) which is also an development for the USD with a year-to-date return of -4.30%

- The USD/ZAR forex pair has also won sharply and is trading 1.eighty five% greater

In all cases the USD has shown resilience against a basket of currencies, and this trend will continue via the brand new yr. Of explicit difficulty is the impression of a Fed charge hike on rising market countries. it is evident that these countries are characterised by way of unstable political frameworks, economic uncertainty and excessive volatility. As such, when an financial system equivalent to the usa will increase the Federal cash rate, it has the impact of accelerating capital flight from EM international locations, and causing a plunge within the forex exchange rates of emerging market economies. we’ve already seen such measures happening in the form of sharp depreciations within the exchange charges of BRICS currencies. As a working example, the South African Rand has misplaced substantial value within the 12 months up to now, but it’s not alone in this regard.

The impression of a robust US buck on commodities

throughout the board, a powerful USD is dangerous for trade. that is genuine for the reason that more desirable the dollar is, the more severe off foreign patrons of commodities are. we are able to see for instance that a poor correlation exists between the demand for gold and the potential of america buck. Now that the Fed has elevated the rate of interest, the USD has rallied and the fee of gold will possible transfer decrease. a lot the identical is right for greenback-denominated commodities on the global markets. What is certain is that a lot of the hype across the Fed pastime-price hike has already been factored into equities markets, commodities, currencies and indices. The Fed commentary is an important file which signifies the course and scope of any future rate hikes. For now, the volatility in markets has declined and it’s going back to trade as general.

industry & Finance Articles on industry 2 group

(19)