Will Sweden Be the primary country To get rid of cash?

Banks are ripping out ATMs. Even panhandlers accept bank cards. the tip of money in Sweden brings many advantages—and a few considerations.

October 26, 2015

a couple of main banks in Sweden not lift money, and if you wish to buy a sweet bar on the corner store, you pull out your phone. Even homeless folks selling newspapers on the street take bank cards. through the tip of last yr, 4 out of each 5 transactions in the united states of america were cashless. And new analysis has discovered that the sum of money in circulation has dropped around 40% to 50% over the last six years.

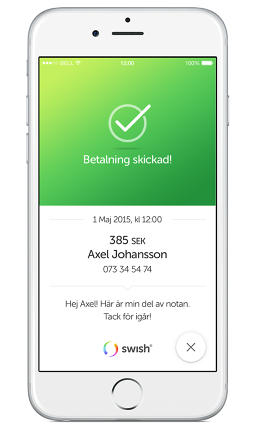

An app known as Swish, launched with the aid of Swedish banks, is helping drive the change. The app allows individuals to digitally transfer dollars between financial institution accounts as quick as handing over money (possibly more speedy in case your pockets could be very disorganized). “It takes about two seconds to transfer the cash, which supplies it a personality similar to cash,” says Niklas Arvidsson, a professor at Sweden’s KTH Royal Institute of know-how who research the transition away from money.

although different nations have equivalent apps, like Venmo in the U.S., they don’t work in real time; a switch may take someday or even two. The U.S. app Dwolla needs to circumvent the standard automated Clearinghouse device to make instantaneous transfers, but to this point only some banks of signed on to its carrier. Sweden, then again, has been quick to embrace it: Swish now has over three million customers, out of a inhabitants of 9.5 million.

Sweden has a historical past of being quick to adopt financial improvements. The usa installed its first ATM machine in 1967, two years earlier than the U.S. Now they are ripping the machines out (between 2010 and 2012, banks eliminated around 900 ATMs). The transfer to digitize the whole lot has been going down for awhile—Sweden was once also early to adopt direct deposits and paying with plastic. with the aid of this century, unions began pushing to get rid of cash with the intention to offer protection to workers like bus drivers from robberies—in the event you get on a bus now, you could’t pay with paper money.

“there may be additionally a demographic building behind this,” says Niklas Arvidsson, a professor at Sweden’s Royal Institute of expertise who studies the transition far from money. “younger people don’t start the use of cash but as a substitute move immediately into new services and products, whereas older individuals—who’re the most generic customers of money—cut back their spending as they grow old and older.”

The move helps make robberies much less likely and may cut back prepared crime (the banks that also settle for cash are suspicious when any individual tries to make a deposit) and tax evasion. it’s cheaper for the us of a overall, as a result of electronic transactions value not up to handing cash. And, for the general public, it’s extra convenient—think about never having to walk six blocks to the closest ATM once more.

in fact, even in hyper-connected Sweden, not everybody has a smartphone or a debit card. “the main challenges is to create a fee carrier machine that enables everyone in a society to make a cost and to obtain money in a convenient means,” Arvidsson says. “There are folks without bank debts, cell phone subscriptions and access to internet, and there have to be options also for them. money is an efficient answer for this group and there have to be options additionally in a cashless society.”

privateness is any other problem. “The questions of integrity and freedom are different concerns. If all payments are conceivable to hint and the government—for some reason or the opposite—just isn’t acting in the best interest of their electorate, there might be issues. having the ability to hint cash is of course excellent for a govt that wishes to scale back organized crime but there may be additionally a chance that this is abused through corrupt regimes.”

The united states will not change into one hundred% money-free instantly—the us of a’s valuable financial institution would have to change the legislation and say that money is not felony tender. “this is not likely to happen ahead of 2030,” says Arvidsson. “There aren’t any indication that politicians are considering that move. The introduction of latest Swedish payments and cash, which is taking place now, in reality points to the conclusion that the imperative financial institution and politicians plans for the likelihood that cash can be round unless as a minimum 2040. Then there will likely be a necessity for a decision that either says that we will have to introduce new bills and coins or to make the step right into a one hundred% cashless society.”

nonetheless, the country may get with regards to disposing of cash so much faster and will be very nearly cashless in eight to 10 years.

(62)