Y Combinator President Sam Altman Is Dreaming large

The Silicon Valley startup factory that birthed Airbnb and Dropbox has grown much more ambitious below its new leader.

April sixteen, 2015

“¡Este sábado, a la una de la tarde Pacific time, a las cuatro de la tarde en Colombia, a las tres de la tarde en México, a las diez de la noche en España . . . “

I’m sitting in a cramped front room, being attentive to Christian Van Der Henst and Freddy Vega host Platzi reside. the two younger men, who are from Guatemala and Colombia, respectively, produce the weekly web series to promote their training startup, Platzi.

The exhibit is aimed at audiences in the Spanish-speaking world, but we’re actually sitting in a rental in Mountain View, California, the place Van Der Henst and Vega are in the course of a 3-month dash to try to develop their business.

“¡Vamos a tener, en vivo . . . Sam Altman, presidente de Y Combinator!”

Vega and Van Der Henst founded Platzi in Bogotá, Colombia, providing lessons in subjects corresponding to digital advertising and internet design, are living-streaming them on-line. presently, Platzi has eighty,000 monthly viewers and 15,000 paying shoppers, and is not off course to absorb $1.5 million this 12 months. not like smartly-funded competitors equivalent to Coursera and Udacity, which have struggled to get greater than 10% of scholars to complete classes (and which use prerecorded video), 70% of Platzi students full their lessons, an remarkable figure in on-line ed.

Or it might be, if Platzi could carry its profile among any person interested in training-know-how firms. Vega, the corporate’s CEO, knew that the best way to be greater than only large in Bogotá was once to fill out a brief software kind and send it to Y Combinator, the startup manufacturing facility that has emerged as among the best gateway to Silicon Valley success. remaining December, Platzi was certainly one of simply 114 startups chosen for the three-month application, out of 5,600 purposes. ahead of, Vega wouldn’t have dreamed of getting five minutes with a huge-title Silicon Valley investor. but right here he is, promising viewers an target market with Sam Altman, Y Combinator’s presidente.

Altman, 30, had been a marginal determine in Silicon Valley until February 2014, when he was once named president of YC and instantly was a tech famous person. “There are these surreal moments when people come up to me and ask, ‘What’s it prefer to run essentially the most highly effective startup organization in the world?’ ” says Altman, who now receives four hundred meeting requests per week from founders and investors. What they need, principally, is get right of entry to—an introduction to a current YC–backed hotshot or a YC accomplice, or an opportunity to enter the program themselves. Founders who’re frequent relocate to the Bay area for 3 months, giving Altman’s firm 7% of their companies in exchange for $120,000 and the possibility to be suggested by means of a secure of tech bigwigs. the very best graduates can expect to draw a whole lot of hundreds of thousands of dollars in project capital, to rent the best engineers, to get any meeting they ask for—in short, to be made men and women of Silicon Valley. traders who willfully misinform YC graduates are blackballed—banned from Demo Day, the twice-a-12 months adventure when YC’s graduates show off what they’ve made, and shunned through the two,000 alumni who have passed through this system. “Our founders speak to 1 any other,” says Jessica Livingston, a YC companion and cofounder.

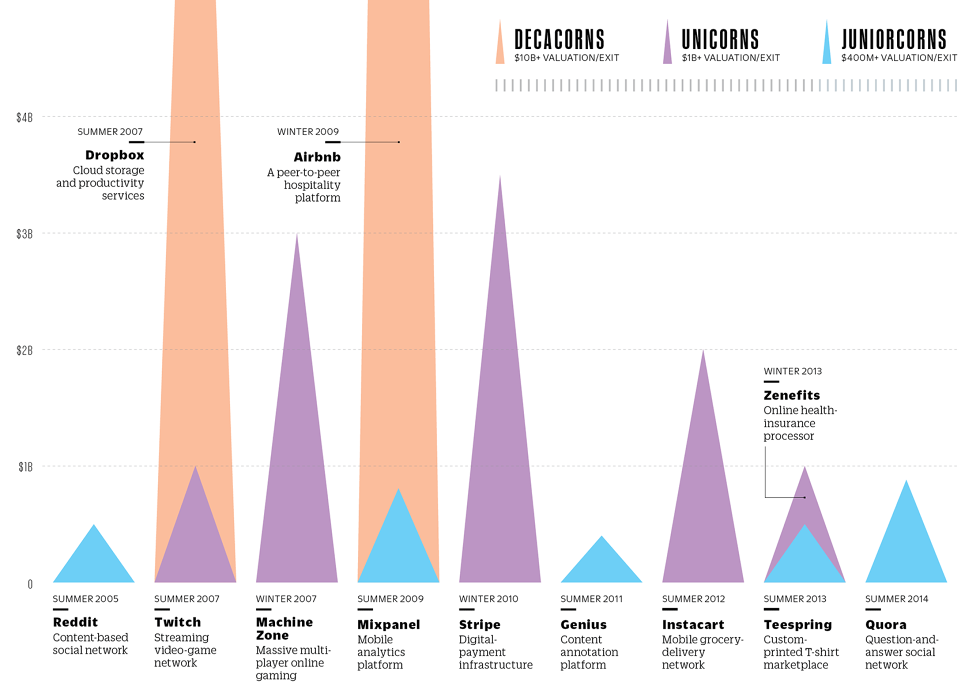

the entire price of YC–birthed startups is approximately $50 billion; the worth of the present YC investment portfolio is likely over $1 billion. Dropbox and Airbnb are both valued at greater than $10 billion. Stripe, which gave the impression of a PayPal knockoff in its early days, is now value $3.5 billion and methods funds for Apple and Kickstarter. YC’s popularity for manufacturing success is now so deeply ingrained within the Valley zeitgeist that the legendary angel investor Ron Conway calls it “a one-cease retailer for the perfect-quality internet companies.”

Altman’s profession used to be born here. In 2005, he was selected to participate in the first Y Combinator category, on the time a type of experimental summer camp created through Paul Graham, the programmer and essayist who is simply known as PG via those in the be aware of. (Altman has a nickname too, “Sama,” though it’s much less widely used.) Over the span of only some years, Graham went from being an obscure figure in Silicon Valley—a Birkenstock-sporting butt of jokes concerning the dopiness of some web 2.0 concepts—to, as undertaking capitalist Fred Wilson put it, “a cult chief.” traders commenced clamoring to attend Demo Days, pressing for introductions to Graham’s billion-dollar babies. closing yr, Graham, who still favors the sandals, turned the group over to Altman, with a mandate to grow it as quick as he could.

Altman hasn’t been shy. Y Combinator’s wintry weather 2014 “batch,” as YC calls every cohort, was the ultimate Graham helped run, and integrated seventy five startups. the current crew, which I’ve spent the past 4 months following as part of a fast company series, is almost 50% larger. The plan is to maintain expanding. And Altman isn’t simply seeking to make YC greater; he desires to be broader. He’s common dozens of outfits pursuing world-changing concepts in biotech, alternative energy, and, yes, schooling. Which is why he agreed to move on Platzi’s show, and why, after I see Altman on the YC places of work earlier that day, he is reviewing a speech that begins with the words, “Bienvenido, yo soy Sam Altman.” Altman doesn’t speak Spanish—not in point of fact, anyway—however he’s not bad on Google Translate and he’s bought self belief to spare. “folks relish when you are making an effort to speak their language,” he says.

There’s audacity right here, and hubris too. Y Combinator was, for years, a one-man express, fueled with the aid of the charisma of its founder. Now Altman has to show he can flip it into an institution.

Altman, the son of a dermatologist and an actual property developer, and the oldest of 4 youngsters, found his strategy to Y Combinator by means of St. Louis. He was once, he says, a peculiar child: a vegetarian in smokehouse united states of america, a computer geek who happens to like classical music, a younger gay man from a metropolis not trendy for its tolerance. He spent two years at Stanford, the place he majored in pc science before cofounding Loopt, a smartphone app that allowed pals to share their locations with one every other. Then he applied to YC. the primary-ever workforce integrated eight startups from a pool of round 200 candidates. They have been all younger men from high-tier colleges, and most had been instrument hackers in their mid-twenties. Altman might program well sufficient, but he was once best 19 when he utilized. Graham prompt that he could be at an advantage waiting a year. Altman’s response was succinct and definitive: He used to be coming. Graham was charmed.

Graham, who’d sold a startup to Yahoo in 1998 for $49 million, created YC as a venue to test ideas he’d been growing within the wake of the dotcom bust. Graham hypothesized that the commodification of laptop hardware had made it less expensive to start a big tech firm than somebody realized. He gave each startup $6,000 per founder, cooked them dinner each Tuesday, and, on the finish of three months, gave them each and every 15 minutes to pitch a couple of of his investor chums. YC members were discouraged from hiring legal professionals, PR individuals, bankers, salesmen, or anyone else. Graham advised his charges to do all that work themselves and to attempt not for greatness, but for “ramen profitability,” dwelling cheaply sufficient to duvet their prices with out raising big quantities of seed capital. Graham most popular small hacks over large ones. Founders, he believed, will have to simply “make one thing individuals want,” and iterate from there.

The means used to be radical, flying in the face of the usual challenge-capital playbook at the time, which keen on making a small collection of multimillion-buck investments in change for large fairness stakes and an lively role in management. Most VCs didn’t hassle writing $600,000 exams, let on my own one for $6,000. In 2007, Nick Denton, the founding father of Gawker Media, described YC derisively as churning out startups that have been “constructed to flip.”

Amazingly, Graham’s manner worked. Reddit, the now wildly fashionable social-information web site, staggered its means out of the inaugural software and sold itself to Condé Nast in 2006, making its founders millionaires. Justin Kan and Emmett Shear auctioned their online calendar app, Kiko, on eBay for $258,000, then reentered YC with a video startup that at last was Twitch, which Amazon purchased remaining August for $1 billion. Altman raised $17 million for Loopt from investors—on the time, greater than any of the other founders within the crew—and talked his way into offers with cell-telephone carriers comparable to increase cellular, sprint, and Verizon. In 2012, Altman offered the business to the reward-card company inexperienced Dot for $forty three million, including a $9.8 million earn-out for Altman and his employees.

these days, Altman speaks of Loopt as a failure, which, by using Silicon Valley innovation standards, it sort of used to be. “The market is much smaller than we thought,” he says wistfully, prior to including, “i might be truly bummed if anyone got here along and made it work.” but Graham was impressed. “Loopt was a smartphone app, but it used to be created ahead of there were smartphones,” he says. “anybody would have run into a wall. It was once handiest as a result of Sam is this master negotiator that he did not have it thrust in his face that ‘this can be a silly concept.’”

The boundlessness of Graham’s admiration for Altman—”Sam is Superman,” he tells me at one level—can appear unearned. In 2009, as Loopt struggled to procure customers, Graham put Altman on equal footing with Steve Jobs, writing on his weblog, “On questions of design, I ask, ‘What would Steve do?’ however on questions of strategy or ambition, I ask, ‘What would Sama do?’ ” When Graham announced that he’d tapped Altman as his successor last year, some puzzled the choice. It got here just weeks after Graham was embroiled in a minor scandal over comments he’d made to the information that gave the impression to shrug on the low share of women beginning tech corporations. Valleywag, the elbows-out weblog that has been critical of Y Combinator, referred to Altman as Graham’s “youthful version,” quoting anonymous sources that dissed Altman’s technical skills and skill as an investor.

alternatively, Graham was once by no means a super fit as YC’s public face, either. Most notoriously, in 2013, he joked to a new york instances writer: “i will be able to be tricked by somebody who looks as if Mark Zuckerberg.” He was making an attempt to poke enjoyable at buyers’ biases. but taken out of context, it appeared as if the most important gatekeeper in Silicon Valley was once pronouncing that he simplest needed to fund white brogrammers. “It sort of crept up on me,” Graham now says. “everyone talked about YC being a big deal, and i understand now that it’s kind of an important deal. however you don’t are aware of it while you’re working it.”

Altman, for his part, is coming near his new position like a political operative. all over our interviews, he steadily tried to direct the story i would write. (“What’s the first sentence?” he asked playfully at one level. “What am I going to love least?”) he is also acutely aware of the affect he makes on others. “Our first rule is that we will be able to now not fund any company that cannot be a $10 billion firm,” Altman says, forearms resting on the desk, elbows bent, head jutting ahead. He’s silent for a second and then rearranges his physique, letting out a bit grunt. “Heh,” he says. He has been straining to read my workstation. “i will be able to’t help it,” he says, apologetically.

“David, Sam,” Altman barks into an iPhone, and names a sum in the millions. “I’m in.”

Altman is hunched over a spiral computing device with about 50 to-do gadgets written in a tiny chicken scratch whereas he talks to David Kirtley, CEO of Helion power, a YC–backed startup. Helion is special to Altman. the company is trying to construct a business nuclear fusion reactor—an extended-sought-after ambition of scientists that would simultaneously finish our dependence on fossil fuels and dramatically lower the cost of energy manufacturing. Funding a fusion company is as shut Silicon Valley has ever gotten to making a bet on an invisibility cloak producer, and it’s a part of a push via Altman to seed more formidable technology companies. “The areas the place it is possible to have a fast-rising firm have improved dramatically,” Altman explains later. Ten years ago, YC’s edition handiest worked for two sorts of companies: client-dealing with websites and endeavor-device companies. Now, Altman says, the plummeting costs for pc hardware and the increasing significance of device in all areas of existence have brought about YC’s scope to widen to incorporate what he calls “onerous technology” firms. during the last yr, YC has seeded a driverless automobile firm, 20 biotech companies, and two nuclear vitality corporations.

investors have replied slightly ambivalently to this point. Helion, with a workforce of just seven full-time employees and $1.5 million from buyers, has already constructed a purposeful prototype that can heat plasma to more than 50 million Celsius, however it hasn’t managed to lift further money. Altman’s funding pledge might be a stretch for him, however he believes that jump-beginning Helion and its promising tech is value it. “shame on Silicon Valley for now not funding this firm yet,” he tells me that evening.

Altman has been granted ordinary leeway to reshape YC. As a part of the hand-over, Graham gave up most of his fairness stake. Altman then divided the equity amongst YC’s partners and installed a board of “overseers,” composed of Livingston (Graham’s spouse and a partner), Altman, and 7 YC alums. during the last 14 months, Altman has nearly doubled YC’s full-time associate count and delivered a 1/2-dozen new section-time partners, together with Ali Rowghani, the previous Twitter COO, and Peter Thiel, the entrepreneur and venture capitalist. Graham still spends a couple of hours every week talking to YC startups, however he has no working position. He skipped that week’s YC dinner—Ron Conway used to be conversing—to take his 6-yr-old to dinner.

Altman is getting animated. we’re sharing meze and a bottle of syrah at Evvia, a Greek restaurant in Palo Alto, and he’s talking passionately about Y Combinator’s role in pushing VCs to act otherwise. With high investors an increasing number of taking cues from the combination of companies at YC’s Demo Day, “figuring out what YC will have to do,” as Altman places it, has cascading impact. “If we start funding more science firms, then other folks will begin funding science companies,” Altman causes. “to finish my rant on VCs,” he continues, “these companions have $5 million salaries. They don’t wish to chance shedding that. if they invest in every other iPhone app and it doesn’t work, they’ll preserve their salaries going. but if they lose money on an formidable expertise firm, that’s viewed as pretty dumb.”

I level out that Altman may be partly answerable for the present scenario. He’s a guy who made his money via creating an iPhone app, after all; Y Combinator, meanwhile, has served as a filter for VCs, pointing the right way to startups with less risk. He rejects this characterization. “Most VCs handed on Airbnb, Dropbox, Zenefits,” Altman notes, citing the YC–backed advantages-management firm. He used to be the primary outside investor in Zenefits, which is now rumored to be worth $1 billion. As Altman likes to claim, results of startups are hardly ever clear throughout their early years. Airbnb gave the impression silly when it was three guys, a couple of air mattresses, and loads of Paul Graham’s chili; now it’s reshaping the hospitality industry and was not too long ago suggested to be raising extra funding at a $20 billion valuation. Platzi may just look dinky now, however however, it seems to be less dinky than Airbnb did at this stage.

Altman’s criticism of challenge capitalists is more than armchair quarterbacking. a few of his moves sign a want to compete with Silicon Valley’s prime VCs. for example, last 12 months he introduced that YCVC, a syndicate of prime-tier corporations that had invested $eighty,000 in each Y Combinator startup, would no longer accept cash from traditional challenge capitalists, instead drawing money best from so-called limited companions, similar to rich folks and college endowments.

Altman says he has no plans for YC to steer sequence A and B investments—the financing rounds value between $5 million and $50 million that are the bread-and-butter for many high Silicon Valley VCs—but the negotiation I witness is proof that he’s not ignoring the distance, both. over the last 12 months, Altman has reportedly invested his own cash in 9 firms, together with Instacart, exchange.org, and Reddit—which received a $50 million collection C investment that Altman led as part of the company’s spin-off from Condé Nast. The round was once in many ways a flag-planting moment. Altman insisted that 10% of the shares purchased with the aid of his syndicate—which also includes Andreessen Horowitz and Sequoia Capital—shall be back to Reddit customers, a move with little precedent in Silicon Valley or anywhere else.

One afternoon, I watched Altman take conferences with founders. He made introductions, offered advice, and suggested different YC partners for them to talk with. At one level he scolded a pair of founders for pressing him for fundraising recommendation upfront. “You shouldn’t try to manufacture growth,” he said. “individuals are looking for the hack, the key to success with out onerous work,” he tells me later. “they think, ‘well, if the YC companions love me, they’ll discuss me up,’ or ‘the click will write about me and investors will love it.’ they usually speak about it love it’s the shortcut to in reality being just right. the reply is simply to be a perfect firm.”

Over the 4 months that I spent reporting this story, I saw Altman act as a fixer to YC’s startups—alternately pragmatic and exhorting wild ambitions. one of the vital stars of the present YC class, an organization referred to as Plus Labs, started out with a plan to create a digital medical-tool trade. consumers may use its iPhone app along side an off-the-shelf blood drive gauge to track their hypertension. The app would warn them through textual content message in the event that they gave the impression at risk of a stroke or coronary heart assault and provide stress-relieving tips. The app did neatly, nevertheless it didn’t trap fireplace. So CEO Mike Chen constructed a aspect challenge, Magic, that promises “whatever you need on demand without a hassle” using the corporate’s outdated textual content-message interface. (Orders are fulfilled with supply products and services like Instacart and Postmates.) by the end of February, demand for Magic was once so excessive that Chen had hired 15 friends and had amassed a ready list with 30,000 names clamoring to use the instant-gratification gambit. With YC’s blessing, Chen put the blood power trade on hang to focus on Magic. “YC says, ‘Make one thing people want,’ and you’re like, ‘really, that’s all?’ ” says Chen. “nevertheless it in fact is.”

the present batch nonetheless contains 5 medical-device companies, two working to make stronger cancer therapy, and one creating a new roughly low-price public transportation. There are dopey-sounding startups too, and there are audacious ones like Bagaveev Corp., which needs to deliver very small satellites into earth’s orbit on 3D–printed rockets.

Bagaveev’s founder, Nadir Bagaveyev, was once born in relevant Russia and dreamed as a boy of turning into a cosmonaut. He emigrated to the U.S. at age 19 and enlisted within the U.S. military as a helicopter mechanic—as a result of it was the closest he may get, as a noncitizen, to flying a military airplane. Bagaveyev sooner or later landed a job on the private aerospace firm XCOR, then quit 18 months in the past to start Bagaveev Corp., which raised $1 million and was everyday into Y Combinator. “i believed, Let’s build our own rockets,” Bagaveyev says. “It’s the American manner.”

after I met Bagaveyev, he was just a few weeks from trying out his first prototype. The plan is to send a 15-foot rocket 10 miles into the troposphere from the back of a homemade launchpad in the Mojave wasteland, then enable it to parachute back to earth. That’s not even just about outer area, however he thinks it’ll be a long way sufficient to steer buyers.

Altman is already yes. He tells me he plans to fly out to the Mojave with just a few other companions. the possibility of Y Combinator, which could barely springboard iPhone apps a few years back, launching a literal rocket is too delicious for him to ignore, although he rings a bell in my memory that, as with every early-stage corporations, it’s vital to maintain one’s expectations muted.

“I mean, it can blow up,” he says, offering a goofy shrug. “both manner, it’s going to be great.”

World Beaters from YC’s wintry weather 2015 class

Tiffani Ashley Bell, govt Director, Detroit Water project.

Bell’s no longer-for-revenue helps folks in peril of having their water grew to become off by way of making it that you can think of for strangers to pay the invoice.

Jeff Huber, CEO, standard Cyborg

Huber makes 3-d–printed synthetic limbs which might be much cheaper than standard prostheses.

Edwin Broni-Mensah, CEO, GiveMeTap

Broni-Mensah sells water bottles which can be then refillable at no cost at lots of of taking part cafés, decreasing the wish to purchase plastic bottles. He additionally makes use of some of his income to construct wells within the creating world.

Anisa Mizra, CEO, Giveffect

Mizra’s low-cost instrument platform helps now not-for earnings modernize on-line fundraising so extra donations can go to their cause slightly than in opposition to administration.

The Unicorn Breeder

The startup factory Y Combinator has birthed at the least 34 companies valued at greater than $100 million; 12 in way over $500 million; seven at $1 billion (a “unicorn” in Silicon Valley parlance); and two, Dropbox and Airbnb, at or above $10 billion.

[photos: Chloe Aftel, Shot on place at Monte Bello Open house protect, Los Gatos, California]

fast company , learn Full Story

(221)