65% Of Retailers Expect Returns To Jump During 2021 Holiday Season

65% Of Retailers Expect Returns To Jump During 2021 Holiday Season

U.S. consumers returned about $450 billion worth of goods in 2020, according to Gaurav Saran, founder and CEO of returns management system (RMS) technology platform ReverseLogix, and Tony Sciarrotta, executive director of the industry trade group Reverse Logistics Association (RLA).

Those numbers are expected to rise, creating an incentive for merchants to get a better handle on the problem.

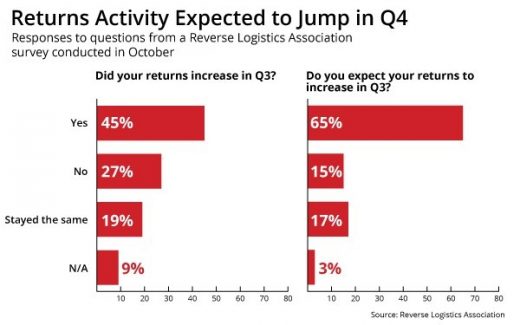

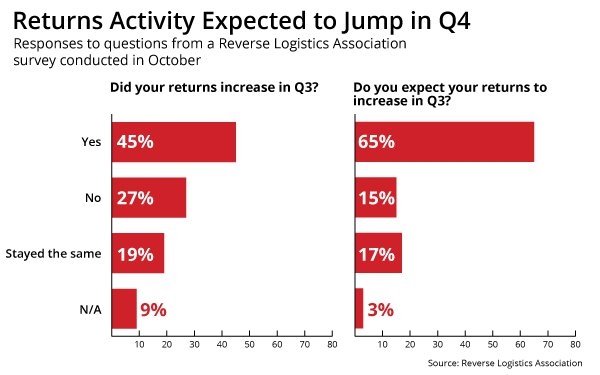

Some 65% of respondents to a Reverse Logistics Association survey said product returns will increase in Q4 2021, as ecommerce activity peaks this holiday season. About 32% believe their returns will remain the same or not increase.

With the holiday return season in full swing, Nikki Baird, vice president of retail innovation at Aptos — which supports enterprise software for about 1,000 retailers — provides insights on the holiday season return volumes that companies are likely to see this year.

Baird, who also worked as a retail analyst at Forrester, and PwC, suggests three ways that retailers can reduce the impact of holiday returns to their bottom line.

Mitigate the need for returns: Retailers need to invest in “fit” technology that helps people identify the size clothing they wear, and pay attention to things they do that drive returns. Reducing the amount of returns can pay off even more than trying to adjust or lower pricing to capture higher shipping costs, she says. If retailers can get customers to keep what they buy, then there are no shipping costs to bear for returns.

Retailers also can offset the costs of returns: One way to offset the cost is to remove operational costs in other areas with adjusted promotions. Many retailers are not passing along those higher costs, with the hope that the rise in costs is temporary.

Another option is to raise the floor required to get free shipping. Instead of spending $50 to get free shipping, retailers can require consumers to spend $100 instead. Some retailers might offer bundles, like for clearance, get a grab bag of 10 items in your size for $100, to make it more cost effective to deliver.

Encourage buy online, return in store: More retailers put a heavier emphasis on “return to store” as the more convenient option and the means to customers getting a refund faster or an option to pick the right item right away.

While this does not prevent returns, it does mean they cost less for the retailer.

When asked to forecast post-holiday return volumes in 2022, Baird said retailers have narrowed what they carry in stores as a result of the pandemic.

“When you have high uncertainty about consumer demand, you offer fewer choices and that helps mitigate your inventory risk,” she said. “I could argue either way that fewer choices generate more or less returns. Fewer choices mean you already down-selected to pick what you wanted anyway, so your pickiness might be lower.”

Fewer choices might mean people either buy less and buy less to return less because there are fewer choices to add to the cart anyway — or just buy less because a lot of purchases are discretionary and if the consumer doesn’t like an item, they don’t always have to buy it. Or, there may be more return volume because people are just less happy with the choices, but still try them all on and then just return them all, she said.

(27)