Amazon Echo’s Huge Success Actually Bodes Well For Apple’s HomePod Debut

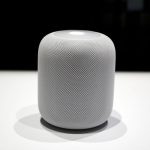

Apple’s new HomePod smart speaker will hit the market in less than six months, and some new market research suggests that conditions are falling into place that could lead to some early success for the much-anticipated device. The big question remains, how much of Amazon Echo’s market share can HomePod take, and how fast?

Amazon’s Echo device has overtaken Sonos speakers as the category leader, according to a report released today by Strategy Analytics, estimating that Amazon shipped more than 5 million Echo speakers during 2016, compared with 4 million speakers shipped by Sonos. “Sonos has long been synonymous with connected home audio and as recently as 2014, it accounted for 50% of the small but growing Wi-Fi speaker market . . . ” the report states.

No big surprise there. The reason Amazon’s Echo is doing so well versus Sonos is because it’s designed to be far more than a speaker–it’s loaded with third-party “skills” and can be used to control the connected home, among many other things.

In fact, Strategy Analytics says the future for dumber or purely audio-focused speakers isn’t bright. The firm believes smart speakers will make up 90% of all Wi-Fi speakers by 2022. That number was just 42% in 2016.

That bodes well for Apple’s HomePod, which, while being marketed as a high-end audio device, will act as a vehicle for the Siri assistant. Out of the gate it will act as an ambient voice control interface for Apple Music and Apple’s HomeKit connected home framework, but over time it will likely act as a control point for other Apple platforms (like HealthKit, for example).

Because the general public is now quite familiar with the Echo speaker and what it does (other than stream audio), the bar is raised on all other speakers. This expectation will benefit the speakers with the most AI behind them. Expect Amazon, Google, and Apple to lead the category by imbuing their speakers with the most intelligence–about the user, the context of use, and the world in general.

In a horse race between Amazon Echo, Google Home, and Apple HomePod, Apple will have advantages and disadvantages.

It will offer by far the most expensive speaker of the three, at $349 per device. (The Echo is $180, while the Home sells for $130.) Putting one in the living room, one in the kitchen, and one in the bedroom quickly adds up to more than a grand.

Also, smart speakers are emerging as a key front in the tech platform wars, and Apple’s entrant will be showing up late. Amazon started selling Echo in 2014, and Google began selling the Home a little more than six months ago. Apple is hoping to start selling the HomePod in December of this year. Consumers who invested in a smart speaker early on–even those in iPhone households–may be inclined to keep adding the same brand of speaker in more rooms in the house. Those who have already gotten used to talking to Google Assistant via their Google Home may be reluctant to switch over to Siri and HomePod.

Apple is hoping to win those consumers over by delivering a better music experience. In fact, I’ve heard all three speakers, and Apple’s sounds the best, in part because it simply has a larger woofer inside. I also heard HomePod in a head-to-head against the Sonos Play3, and again HomePod prevailed. No doubt Apple sourced some high-end components for the device.

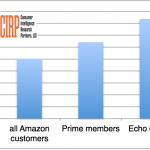

The good news for Wi-Fi speaker makers is that it’t not a zero-sum game: They’ll be fighting for slices of a cake that are growing ever larger. Strategy Analytics says that demand grew by 62% in 2016 to a total of 14 million units, with Amazon accounting for 77% of the increase.

Right now Amazon Echo is leading the Wi-Fi speaker market, which is increasingly dominated by “smart” speakers.

Apple’s new HomePod smart speaker will hit the market in less than six months, and some new market research suggests that conditions are falling into place that could lead to some early success for the much-anticipated device. The big question remains, how much of Amazon Echo’s market share can HomePod take, and how fast?

Fast Company , Read Full Story

(32)