Apple’s U.S. Jobs Announcement Comes At An Opportune Time

Apple’s Wednesday announcement of new investments in U.S. facilities, jobs, and companies is real news and good news. But, reading between the lines, it’s also a carefully crafted PR drill intended to stave off criticism and curry some favor with Washington.

The company is perhaps the nation’s biggest beneficiary of a new tax code that hands out massive tax breaks to U.S. corporations, especially multinationals. Along with a lower corporate tax rate, Apple can now bring back some or all of the roughly $252 billion in cash or cash equivalents it has parked abroad at a thrifty 15.5% tax rate.

The company said it plans to pay $38 billion in repatriation taxes to bring home about $246 billion in cash. (It had already earmarked $36 billion for the tax payment back in November.)

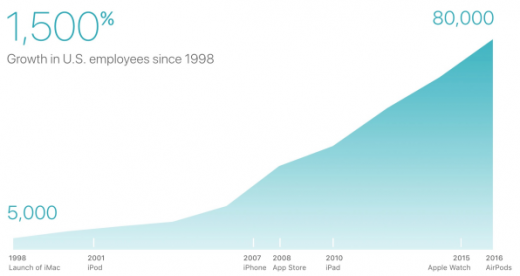

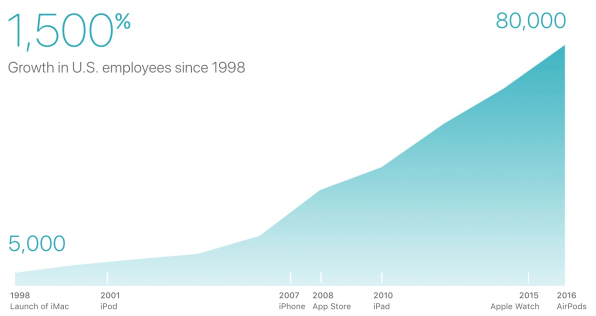

The major point of Apple’s statement—complete with tweetable images and infographics—is that it plans to spend about $30 billion of its repatriated cash, along with money it saves from lower corporate tax rates in general, to invest in new facilities that create U.S. jobs.

This type of statement from big U.S. companies has become commonplace since the passage of the GOP’s tax bill. Such announcements are designed to create the look that corporate tax breaks will be used to create jobs and help the country, not just enrich executives and investors. They often contain lots of bluster about the wonderful things a given company does for the economy. The bold initiatives mentioned, and the reasons for them, often have nothing to do with the tax breaks. When those irrelevant factoids are all cleared away, the real picture of how many jobs will actually directly result—if any—from the tax cuts starts to emerge.

Apple’s statement today contains some of those traits. The company crows about the money it spends to buy parts from U.S. companies for its phones and other products, an estimated $55 billion in 2018. It takes credit for the app economy that provides work for thousands of developers. It calls out “Apple’s ongoing tax payments, the tax revenues generated from employees’ wages, and the sale of Apple products.”

Manufacturing And Jobs (Just Not Apple Manufacturing Jobs)

To at least some degree, Apple’s statement probably was directly motivated by the tax cuts.

The company said that it will expand its Advanced Manufacturing Fund from $1 billion to $5 billion. The fund’s purpose is to encourage innovative U.S. companies, help innovative foreign companies move to the U.S, and create jobs. The fund last put $390 million behind Finisar, the Texas-based supplier of lasers used in the iPhone’s Face ID facial recognition system.

Apple also announced plans to build another U.S. campus, which would focus on customer support operations. It expects to add 20,000 new U.S. jobs over the next five years at its existing campus and at the new one.

“They were pretty clear that the money they will bring back into the U.S. will be for more jobs, strategic acquisitions, and more real estate and facilities to handle their expected growth,” said Creative Strategies analyst Tim Bajarin in an email after speaking to Apple representatives.

Apple may have felt now is the time to inoculate itself against criticism over how its repatriated money will be spent. The money from repatriation tax breaks in the past have gone mostly to white-collar benefits like stock buy-backs, investor dividends, and maybe some executive benefits. Some of Apple’s repatriated cash will very likely go to such expenses.

During the 2016 presidential campaign, Donald Trump criticized Apple for sourcing and manufacturing its products mostly overseas. (He called for a boycott of the company, though that hasn’t stopped him from using an iPhone as president.) Trump was not the first to criticize Apple for lack of investment in U.S. plants, but the company—like other U.S. tech giants—remains unlikely to bring large-scale manufacturing back to this country.

Still, adding a significant number of new U.S. jobs, even if they don’t involve manufacturing, is a good way to deflect at least some of those criticisms.

“As Apple nears the trillion dollar valuation and takes advantage of Trump’s tax plan with repatriation advantages, the company wants to remind people they do pay enormous taxes and are investing in American jobs, manufacturing, and education,” wrote Moor Strategy & Analytics analyst Patrick Moorhead in an email. “The company is getting ahead of potential issues, for sure.”

Fast Company , Read Full Story

(10)