Are Millennials Making prepaid playing cards the “will need to have” fee Product?

may just 9, 2015

some of the persistent subject matters on the subject of financial services and products and Millennials is that they don’t like bank cards. probably the most up to date numbers are telling:

- 63% don’t have a single bank card, in keeping with a Bankrate survey.

- 36% have never had a credit card, based on research from CreditCards.com.

For Millennials, the prepaid card seems to be the manufactured from option. A recent find out about by TD bank found that 33% of Millennials currently use or have a reloadable prepaid card. As not too long ago as a couple years ago, standard wisdom was once that prepaid cards were easiest for extraordinarily specific segments like youngsters, older adults or the underbanked. but it appears that Millennials are as soon as again disrupting the landscape and bucking that standard considering.

but why is it which can be prepaid playing cards seem to be gaining popularity while credit cards are fading? Three thoughts come to mind:

- It’s a cashless world – Millennials grew up in an age of plastic when credit score and debit cards have been taking on money and exams because the major the right way to pay, so it’s pure that they might are seeking for a card cost software.

- Staying in keep an eye on – And but, credit cards lack the spending controls of prepaid playing cards. With pay as you go that you can’t overspend and get into debt as a result of which you can’t spend what you don’t have.

- mobile integration – Millennials continue to exist their phones, and the prime prepaid card issuers additionally provide cellular apps giving cardholders capacity to make transfers, take a look at balances and observe spending in real time.

specializing in pay as you go over credit to focus on Millennials may require some financial institutions to rethink their product and marketing approach. listed below are a couple of suggestions that now we have to assist:

think product “integration” over product “migration”

transferring Millennials from pay as you go to credit score is a key goal for FIs. but expecting Millennials to get up someday and abruptly switch from prepaid to credit appears unrealistic. We’ve mentioned product migration in the past, but possibly it’s time to begin enthusiastic about integration. FIs can seem to pair products collectively so that prepaid becomes part of an total providing alongside checking and credit. The advantage is that banks have extra to supply than non-bank prepaid issuers, and Millennial shoppers might start to slowly migrate from prepaid to other cost options. for instance, BB&T offers the MoneyAccount Visa pay as you go card that’s positioned as a companion to a checking account, now not a standalone product.

beef up the value proposition

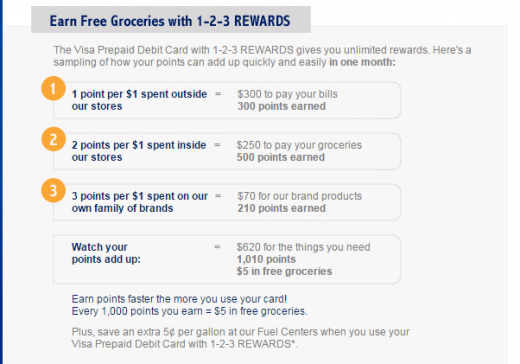

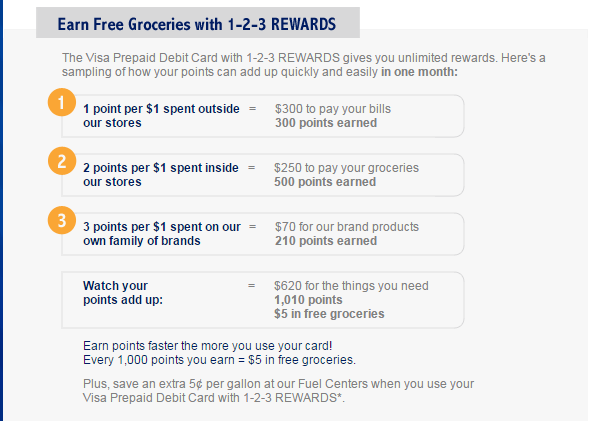

prepaid cards are somewhat transactional, and most lack the sturdy price propositions which might be viewed in bank cards. but if issuers recall to mind them as utilitarian, they’re lacking a possibility. after all the uses for the cards beyond POS funds (like bill pay or getting money) are evident things to name out. but some playing cards go additional, including to the value proposition of the cardboard.

A reasonably “low raise” example is the Visa Buxx card which lets in teenagers to customize their seem with over one hundred pre-set card designs to choose from and the technique to add a photo of their very own. however the Kroger co-brand pay as you go card goes as far as to add rewards to the product offering. These value proposition additions lend a hand set these two playing cards except for opponents and provides Millennials causes to stay loyal.

supply a strong cell app

The all the time on-the-go Millennial generation is mobile first, so a a success prepaid product needs to have a powerful cellular app. Many issuers supply apps, however it’s essential to understand that this can be a very cellular savvy target audience. powerful features and advantages are key, however so is an effective consumer interface.

After a snappy look at among the apps available in the market, the American specific Serve card app caught my eye. The appear of the app could be very smooth, and it has an awfully long checklist of options making it extra of an general money administration software than a easy method to move or deposit cash.

the brand new information on pay as you go card use with the aid of Millennials is telling. apparently this all important section may just end up preserving on to these “starter” merchandise longer than issuers would prefer. And with fierce competition to succeed in Millennials with related monetary merchandise, issuers are certainly going to leap on the pay as you go bandwagon and either add products or up their current choices. So it’s crucial that you’ve a solid product offering and a prepaid card to be able to appeal to Millennials, together with clear how you can promote those cards and begin to build long term loyalty.

trade & Finance Articles on business 2 group

(169)