Aurora Backed By Amazon, Uber Latest To Set IPO In Sea Of Public Offerings

Aurora Backed By Amazon, Uber Latest To Set IPO In Sea Of Public Offerings

Aurora, the driverless vehicle startup backed by Amazon and Uber, announced plans to go public on Thursday at an $11 billion valuation through a special purpose acquisition company (SPAC) merger.

The company founded in 2017 by the former head of Google’s autonomous vehicle program, will give it about $2 billion in new cash when it closes.

Aurora will merge with Reinvent Technology Partners Y, a SPAC already listed on the Nasdaq. It’s run by LinkedIn co-founder Reid Hoffman, Zynga founder Mark Pincus, and investor Michael Thompson.

There are many other IPOs to consider.

One of the more positive aspects about all these IPOs: Marketers learn more about the financial stability of companies they might want to work with.

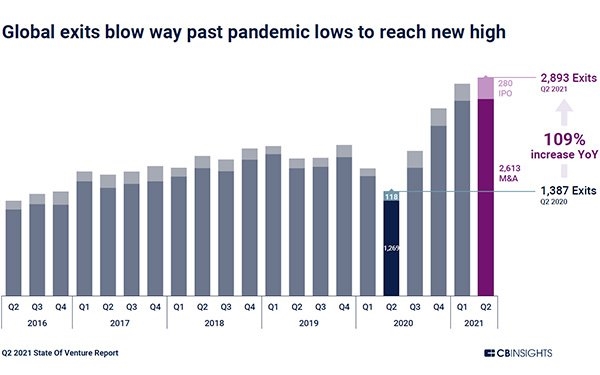

Global M&As and IPOs were hot in the second quarter of 2021, reports CB Insights. The number of global exits — mergers and IPOs — rose 109% year over year (YoY), reaching an all-time high of 2,893. Global IPOs peaked in Q2 2021, up from the previous high of 2,812 in Q1’21. Didi Chuxing’s IPO at a valuation of $73 billion sits as the largest exit of the quarter.

CB Insights also reported the U.S. led in investment deals with 5,531 for the first half of 2021, followed by Asia with 5,007. Europe came in third with 3,470 deals.

Outbrain, a company that works with websites to add “Recommended For You” sponsored content links, set the terms and official launched its initial public offering (IPO) on Nasdaq this week. It will issue 8 million shares at between $24 per share and $26 per share with the goal to raise up to $208 million. The stock will trade under the ticker symbol “OB.”

In its S-1, Outbrain execs wrote they expect to have about 53.4 million shares outstanding after the IPO, which will value the company between $1.3 billion and $1.4 billion on a non-diluted basis, depending where the IPO prices land.

Citigroup, Jefferies, Barclays, and Evercore ISI will serve as joint book runners for the proposed offering. JMP Securities, Needham & Company, and LUMA Securities will act as co-managers.

Outbrain, which had agreed to a merger with Taboola in 2019 that fell apart, reported its platform enables more than 7,000 online properties to engage their users and monetize visits by gathering more than 1 billion data events each minute.

Its key media partners include Asahi Shimbun, CNN, Der Spiegel, Le Monde, MSN, and Sky News and Sky Sports. In 2020, Outbrain provided personalized content feeds and ads to approximately 1 billion monthly unique users, delivering on average over 10 billion recommendations per day, with more than 20,000 advertisers using its platform.

Taboola agreed in January to go public by merging with a special purpose acquisition company (SPAC) and began public trading on June 30.

(27)