Brands Learn A Wealth Of Details About Consumers During COVID-19

Brands Learn A Wealth Of Details About Consumers During COVID-19

The one transformation that brands are reluctant to talk about is how many insights they are gaining from transactions as consumer behavior continues to change based on COVID-19.

After all, the majority of transactions in the United States are being done digitally, from banking to buying.

Data from offline transactions have shifted online since the start of the pandemic. Everyday tasks such as ordering food, buying books and movies, or visiting doctors continue to move to digital through apps, retailers and marketplaces like Amazon.

“If you didn’t shop on Amazon or have the app on your phone, you probably do now,” said Daniel Owen, EVP at Direct Agents, suggesting that the industry has reached an inflection point in terms of consumer data and changes in behavior. “If you didn’t use Door Dash before, you probably do now.”

Behavior is being mapped through the mounds of data collected. Food delivery companies like Door Dash now understand consumption behavior and preferences.

While overall meal delivery grew by 14% from February through March, DoorDash earned more than half of that growth. Uber Eats received nearly one-quarter, and Grubhub took a tenth, according to Second Measure.

Online transactions have grown exponentially, identifying changes in consumer behavior from food preferences and time of day, to the highest-spending consumers and who they buy and order from.

The COVID-19 pandemic has motivated millions of people to learn how to use apps and get what they need digitally. Along with that move comes the mounds of data identifying consumer behavior and change.

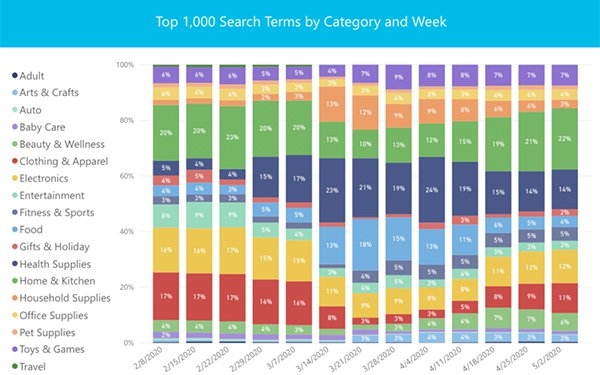

Direct Agents has been monitoring searches on Amazon in which it supports between 30% and 40% of its clients.

Swimsuits for woman, sandals, bathing suits and other outdoor gear are some of the top searches this week on Amazon, moving from face masks, Mother’s Day gifts, toilet paper, hand sanitizer, and Clorox wipes. Mother’s Day gifts also are a top-trending search term.

“Last year consumers did not shop for Mother’s Day until one to two weeks out,” Owen said. “This year they started three to four weeks out because they understand Amazon and other retailers have delays in shipping.”

Amelia Rance, senior director of data strategy and analytics at Fullscreen, also believes ecommerce behaviors being formed now will continue. She said the data will fill in the gaps in term of spending. It’s helping brands understand customers better, though she understands why brands are hesitant to talk about it.

A recent Fullscreen survey of more than 500 adults between 18 and 36 aimed to determine changes in behavior, habit and emotion when coping with COVID-19. From the data the company identifies that grocery and consumer product goods categories will continue to change in buying patterns and in a digital-first buying mindset.

Beauty is no longer skin deep as the data reflects an overlap with prioritizing internal as much as external beauty. The self-care market is experiencing a spike during this crisis, and with new consumer routines being established, Fullscreen forecasts continued consumer investment and experimentation with new brand relationships established.

Rance said the data brands are collecting should identify a positive impact on categories like “me time,” “fitness,” and “do it yourself,” whether from the content being watched or the products they buy. The data would identify family dynamics such as whether they have young or older children, as well as brand preferences and qualities bought.

“It would provide more information on the path to purchase and whether they’re exposed to a brand and if they immediately purchase the product,” Rance said.

(7)