Can Earnest convince Graduating Millennials to speak About (Gulp) Their price range?

Founder Louis Beryl wants you to refinance your scholar debt (and then brag to your pals).

may 26, 2015

Nothing says “congratulations on your commencement” like an e mail from your pupil loan servicer reminding you that your first funds will soon be due.

That five- or six-figure invoice is the monetary hangover that heaps of newly minted graduates are waking up to this month as they reenter the body of workers, diplomas in hand. “recreation of Loans: passion is coming,” one Wayne State college senior wrote in protest on her graduation cap. “I obtained 99 issues and pupil loans are all of them,” any other tweeted.

but if graduates are fast to vent their anger and nervousness (#StudentDebtStress has been trending on Twitter), they are not essentially keen to interact in a deeper conversation with a monetary consultant or their peers. Enter Earnest cofounder and CEO Louis Beryl: He desires millennials to harness their frustration, and take motion.

“in reality fine quality, excessive-doable younger people are just being dramatically overcharged and mispriced through the credit machine,” Beryl says. “You’ve heard all of this stuff—you wish to go get a J.Crew card, and pay it off—that’s crazy! all the workarounds—the machine isn’t constructed right.”

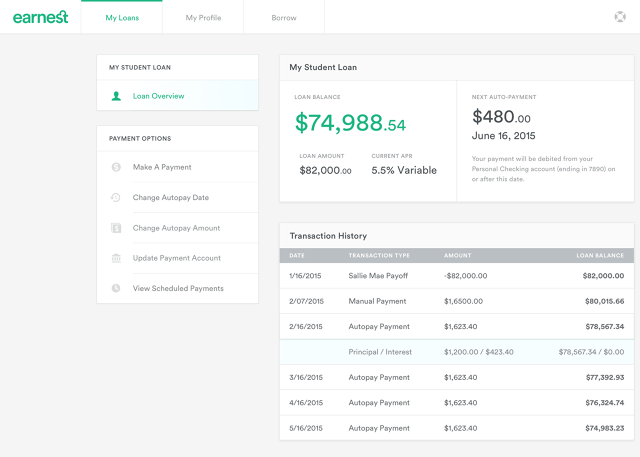

Earnest is an try and perfect those flaws, and within the course of store younger borrowers hundreds of dollars. Beryl and his rising team launched the company final 12 months with a non-public mortgage product designed to quilt main existence occasions like relocation or marriage, and offered a pupil loan refinancing product in January. not like conventional loan providers, which evaluation debtors’ credit score histories in the course of the lens of the FICO gadget, and unlike startups similar to LendUp, which mine fb and social media to check debtors’ possibility of default, Earnest approves applicants according to a complete image of their profession historical past and their price range.

“It’s all concerning the causal elements that have an effect on your capacity to repay—so your earnings, your money flows,” Beryl says. “we’ve got you connect your bank account, your lively bank cards, your house mortgage, your student loans. We additionally supply folks the chance to connect their asset money owed.” the end end result: “It dramatically reduces fraud. It dramatically reduces our costs. And it permits us to cross on those savings to customers.”

That message is resonating: Earnest is not off course to hit a lending run fee of $1 billion by using the top of the yr. according to the corporate, the typical purchaser paying off a bachelor’s stage will save $11,143 with Earnest; savings are even larger for graduate-level level-holders like MBAs ($14,740) and legal professionals ($30,715).

one of the vital clients who participated in the firm’s pupil loan refinancing pilot, Beryl says, was once a librarian with a master’s level in English literature. “This particular person makes a librarian’s cash but can pay all payments on time and saves a huge amount of cash each month.” In Earnest’s world, that borrower can refinance and retailer thousands of bucks, in keeping with these excellent habits.

Play out these attainable savings throughout the 40 million americans who owe pupil loans, to the tune of over $1.2 trillion, and the affect could be transformational. research express that pupil loans are appearing as an financial headwind, slowing growth by using curbing millennials’ capability to purchase housing, automobiles, and other major gadgets. For the 8 million borrowers in default, the situation is even more dire. Policymakers, excited about those effects, are ultimately responding to the 28,000 formal complaints logged in opposition to pupil mortgage servicers over the past two years.

“pupil loan servicers continuously make more cash once they spend as little time as possible on a pupil’s account,” Richard Cordray, director of the shopper financial protection Bureau, mentioned earlier this month, as he invited public comment on the rules that govern the industry. President Obama has requested a document recommending modifications to the present device by Aug. 1.

Earnest shouldn’t be alone in seeing an opportunity to make the most of the existing system’s shortcomings. Startups CommonBond and SoFi, for example, also offer refinancing at decrease charges. however Beryl is assured that Earnest’s versatile edition, which allows debtors to adjust their fee agenda with only some clicks, will win over his millennial friends. Earnest also lets in debtors to set terms consistent with their most well-liked month-to-month outlay, and benefit from the decrease rate of interest associated with ending payments in 7.8 years versus 10, or 14.1 years versus 15. the average Earnest loan term: 8.four years, a metric that would be nonsensical for other mortgage servicers with same old 5-, 10-, or 15-12 months terms to investigate. Between 6-10% of Earnest’s buyers have already refinanced with any individual like a CommonBond—and but are choosing to fill out the refinancing paperwork for a 2nd time, in order to make the most of those benefits.

“We’re not looking to get into a price war with the opposite guys,” Beryl says. “but we are seeking to win on customer support and design and better tool.”

to not point out Bloody Marys. When Earnest observed that many prospective clients were losing off on the point the place they wanted to track down their unique student mortgage documentation (no small process), the company determined to launch a $200 brunch reimbursement program. the idea was once easy: end the administrative tasks related to refinancing, and then deal with your friends to pancakes. The “click through” on that phrase-of-mouth marketing has been robust, with Earnest’s natural website online site visitors hovering north of ninety%. “We’re trying to construct a company that will be awesome for the next one hundred years,” says Beryl—one facet of Francis Bacon at a time.

quick company , read Full Story

(140)