Creativity or Compliance (It Can be Both!): Personalization for Financial Services

When you think about the financial services industry, what comes to mind? Regulations? Rules? What about creativity or innovation? Those last two words might not necessarily be the first ones that you associate with banks, insurance companies or other financial institutions, but it’s time to think again. Quite a few of these organizations are, in fact, applying data to drive creative, personalized customer experiences across channels and recommend next best actions. And with 98% of marketers saying that personalization improves customer relationships, the delivery of individualized experiences – in financial services and across other industries – is here to stay.

The process from campaign creation to execution, though, can take a little longer in financial services, compared to other industries. For example, financial services companies must navigate complex regulations, adhere to proper processes, involve legal (at times) in reviews, and, of course, ensure that customer data is carefully protected.

So how, exactly, can these firms balance the desire to engage visitors effectively at the 1-to-1 level with the need to adhere to strict guidelines in a highly regulated environment? At our last Personalization Summit, we had the privilege of learning how a few leading financial services organizations are applying data and delivering innovative personalization strategies amidst stringent rules and complex regulatory environments.

Where to Start

Possibly the most important step in planning and executing an effective personalization program is determining who your customers are, as individuals, and what they want and need. In large, complex organizations, different business units might have different ideas about who their ideal customer is – because they all have insights into various (or channel-specific) data points, behavioral patterns or engagement indicators.

Culling all this information into a unified customer profile (UCP) delivers a 360-degree view of each customer and breaks down data silos that inhibit organizations from creating seamless cross-channel experiences. With a UCP, companies can bring together browsing and conversion histories, referral sources, segment data, and individual or account-level attributes, among other things. Having all that data in one place – even if certain data needs to be omitted or ignored for privacy reasons – will make acting on it (through cross-channel personalization) a lot easier on the backend and smoother on the front end.

Complicated ? Effective

One excellent example shared at the Summit of how to use customer data to power personalized experiences came from the Business Development Bank of Canada (BDC), a bank exclusively devoted to supporting entrepreneurs with financing, investment and advisory services.

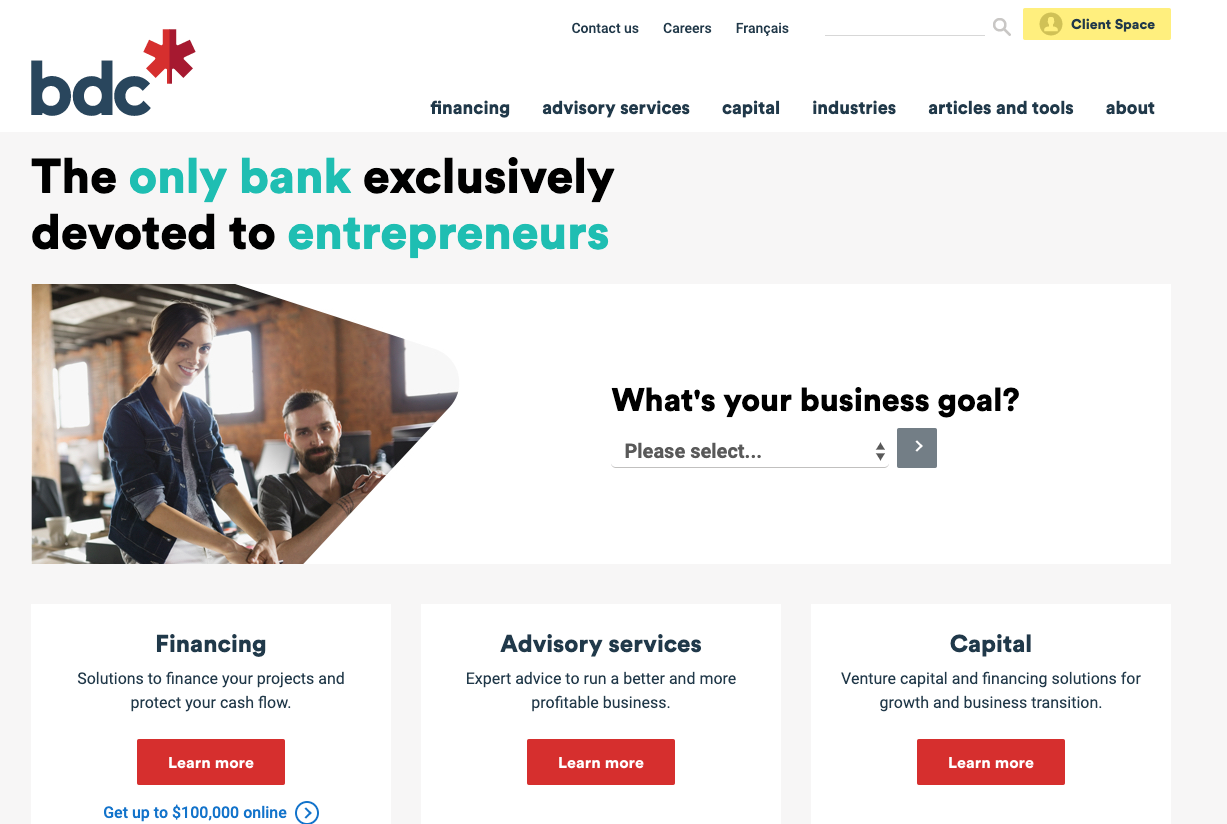

BDC began implementing personalization solely within its email channel, but as time went on, it wanted to expand its strategy to other channels and capabilities. Soon marketers at BDC were personalizing content across ad campaigns and on its website – including deploying surveys to first-time visitors, and dynamically triggering personalized experiences based on their responses. In the example shown below, new visitors to the bank’s website see a one-question survey (“What’s your business goal?”). How they respond (choices include “managing my cash flow,” “finding the right loan” and “getting new customers”) dictates what they see next, with BDC immediately presenting relevant content and solutions suited to each visitor’s expressed needs.

How visitors respond to the survey above, prominently incorporated into the hero area, affects what they see immediately afterward.

BDC uses personalization in other ways, too, to improve the customer experience across channels. For example, when an entrepreneur (their target prospect persona) clicks through to the site from a BDC ad, the page they land on will be personalized with the same image as the ad – creating a seamless experience and more unified journey.

Financial Services Through an E-Commerce Lens

While financial services organizations do have to abide by different industry standards and regulations than retailers, both types of organizations can borrow strategies from each other – with financial services, for example, looking to retail for cues on ease-of-use in a check-out flow (and retailers often gleaning inspiration for things like integrating blog content across their site).

From a personalization perspective, both types of organizations often have similar goals. They both want to understand their customers and present them with relevant information, content, recommendations, etc., that drive loyalty and conversions. So it’s important to synthesize and use data wisely. If you have anonymous or first-time visitors, use the opportunity to learn more about why they’re on your site in the first place (with a brief survey and/or through behavioral tracking, etc.).

For another financial services client, a global money-transfer provider, this kind of e-commerce-like approach has helped them distill the mountains of data they said come in through email, social, ad and call center channels, and create highly relevant experiences for customers. In the example below, the company was able to personalize based on stage of the customer journey. If a customer returned after not engaging for a certain period of time, they were greeted with a promo code pop-up message, encouraging them to take action.

The targeted offer shown above drives urgency and motivates customers to take action.

Final Thoughts

As financial services companies embark on personalization journeys, it often helps to take a crawl-walk-run approach and to be realistic. Regulations and compliance concerns need to be addressed, but that doesn’t mean personalization for financial services is out of reach. There’s an opportunity for marketers to think both pragmatically and creatively about what they can achieve within the confines of the industry landscape. Everyone has to start somewhere, and as we’ve seen time and time again, sometimes even simple ideas can have a huge impact.

Business & Finance Articles on Business 2 Community

(6)