Desktop Search Ads Gain Marketing Dollars, Giving Microsoft A Boost

Desktop Search Ads Gain Marketing Dollars, Giving Microsoft A Boost

Apple, Amazon and Microsoft will report earnings this week. Since these companies last reported earnings at the end of the third calendar year quarter, each company’s stocks, advertising and product sales have risen substantially.

Merkle’s Q4 2019 Digital Marketing Report shows an overall increase in spending.

Text ads for advertiser brand keywords saw strong growth in the latter half of 2019, with clicks rising 21% year-over-year (YoY) during the fourth quarter.

Average click-through rate (CTR) for brand ads rose significantly since late 2018, as advertisers worked in partnership with Google to improve their creatives, expand ad coverage, and adopt the Responsive Search Ad format.

Six fewer days between Thanksgiving and Christmas — along with Amazon, which proved to be a more aggressive competitor for Google Shopping impressions — slowed Google’s growth to 15% YoY.

YouTube helped increase the amount spent with Google, as advertiser investment rose 43% YoY in the platform. For brands running both YouTube and Google search ads, YouTube accounted for 26% as much ad spend as Google search ads during the fourth quarter.

Mobile continues to outpace growth for other devices, but Google search ads on desktop have also been improving during the past year, with clicks rising for the first time in more than two years, and spending rising 12%.

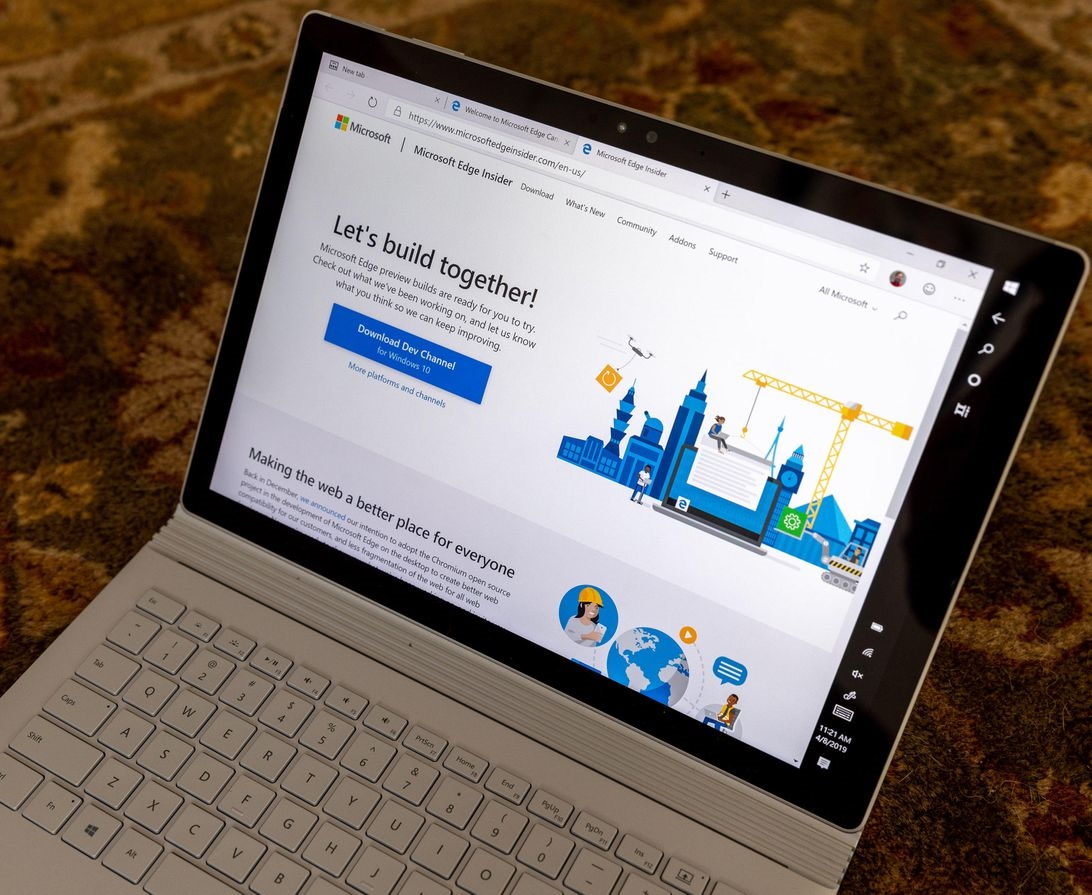

Perhaps that’s why Merkle’s data shows an increase in spending among marketers for Microsoft Advertising. Microsoft search ads rose 17% YoY, as clicks fell 10%.

This shift of slowing mobile, along with a jump in cost per clicks for advertiser brand keywords, has pushed total CPC growth on Microsoft search ads up to 29% YoY in the quarter.

Merkle also notes that Google Shopping ads saw slower growth, while other formats such as Google text ads saw accelerated growth. Google’s Local Inventory Ad (LIA) format saw its share of Google Shopping clicks rise throughout the quarter, and peak three days before Christmas.

Clicks from Google Maps ads hit their quarterly high on Christmas Eve. Google also produced more than 92% of U.S. organic search visits in the fourth quarter of 2019, while DuckDuckGo delivered 47% YoY growth in organic search visits overall.

As for Google’s closest competitor, marketers spent more on Amazon Sponsored Products ads — 63% YoY — during the fourth quarter of 2019.

Advertisers saw sales rise 106%, which Merkle attributes to the advertising format increase. Spending on Amazon’s Sponsored Brands ad format grew 56% YoY during the quarter, up from 20% growth in the third quarter of 2019, accounting for 18% of Amazon ad spend.

(8)