Disney stokes anger with ads for the bundle while its channels are dark on Spectrum

TV viewers rejoice!

The Walt Disney Company and Charter Communications have reached a deal to bring Disney’s television channels back to almost 15 million Spectrum cable subscribers, putting an end to a bitter carriage dispute that some industry observers said threatened the future viability of the entire cable-TV business model.

The deal will see the return of ESPN and ABC just in time for the NFL’s Monday Night Football. Perhaps more critically, it will offer a path forward for Charter to carry Disney-owned streaming options, including a planned over-the-top version of ESPN. Though no date has been announced on such a product, Disney CEO Bob Iger has hinted that it is only a matter of time, making its theoretical existence a major sticking point in the carriage dispute.

In the shorter term, here’s what Spectrum customers can expect from the new deal:

Although carriage disputes are commonplace in the world of pay TV, this one had many commentators wondering aloud if years of cord-cutting and price increases had finally pushed the traditional cable-TV model to the brink.

“The transition to a video-less future could be painful for Charter; it would cause disruption and customer frustration, neither of which Charter is eager to face,” analysts at MoffettNathanson wrote last week. “But it’s not as though Charter believes that video can be saved over the long term; video is inarguably in secular decline, so the question is only how quickly video goes away.”

Original story:

The pay-TV stalemate that has left millions of Spectrum cable subscribers unable to watch more than a dozen Disney-owned television networks is showing no signs of letting up.

With the impasse now entering its second weekend, Spectrum owner Charter Communications and the Walt Disney Company have both stepped up efforts to let customers know they have options, with Charter openly steering customers toward alternative streaming services, such as Sling and FuboTV; and Disney pushing its own homegrown streaming packages, which bundle Hulu’s live-TV service with other products.

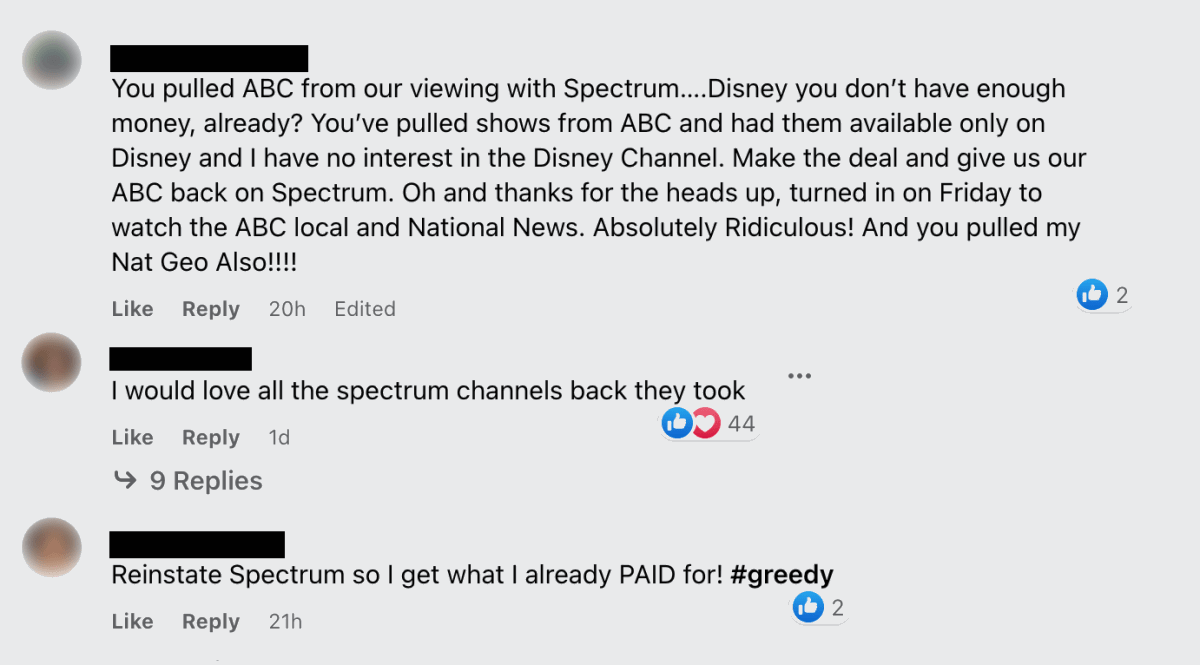

But if online responses to these pitches are any indication, customers are not looking to sign up for another service just to watch the content they’d assumed they were already paying for. They just want Charter and Disney to get their acts together.

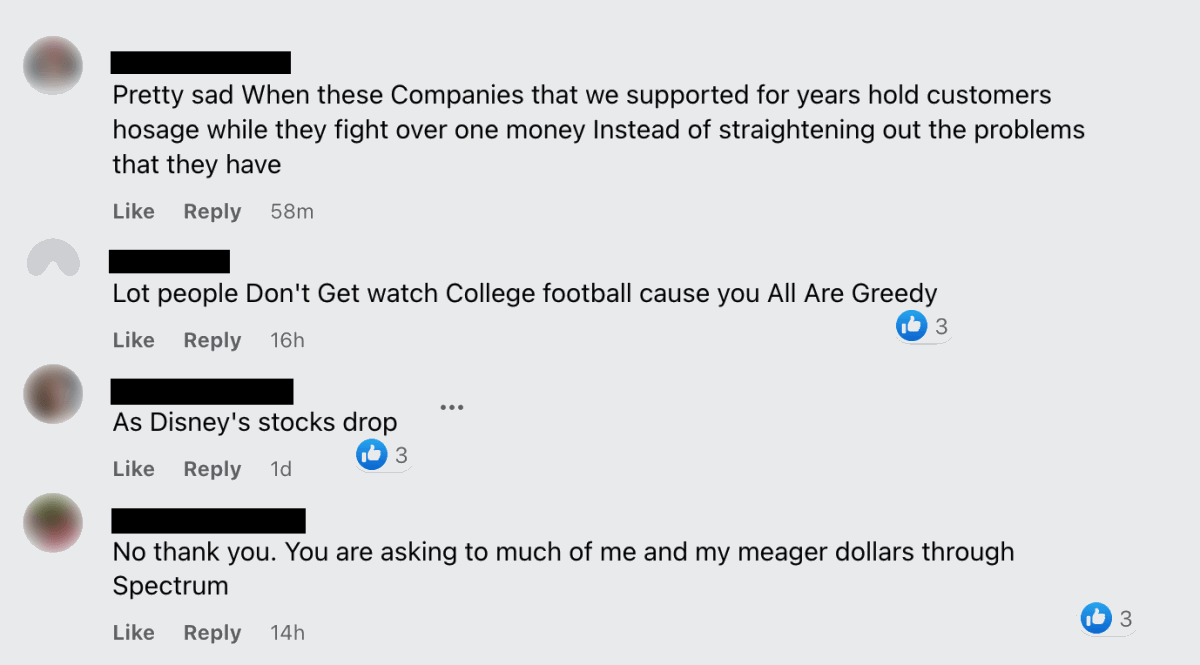

“Pretty sad when these companies that we supported for years hold customers hostage while they fight over money instead of straightening out the problems that they have,” reads one comment under an ad for Disney’s bundle that’s currently running on Facebook. Spectrum’s social media handles are, likewise, filled with angry comments and threats of cancellation from its subscribers.

These are among hundreds of comments expressing similar sentiments on major social media sites this week, a cacophonous display of anger and frustration that, when taken together, presents the kind of consensus one rarely sees in any online forum. TV viewers may vehemently disagree on the types of shows they like, which sports teams to root for, or whether or not Disney has gone too “woke,” but they seem fairly aligned on at least one point: They don’t like being caught in the middle of a contract battle between two corporate giants.

Reached for comment about the backlash to its social media ads, a Disney spokesperson referred Fast Company to an earlier statement insisting that the company had tried to extend negotiations with Charter in good faith, and that Charter had instead “abandoned” its customers by pulling Disney’s channels off its network. The social media ads predate the blackout, Disney says, and are not a direct response to the dispute, although many customers may see it that way regardless.

Charter, meanwhile, maintains that Disney is asking for an “excessive” price increase to keep carrying its content, which includes ESPN, FX, the Disney Channel, and National Geographic, in addition to many local ABC affiliates. The blackout of Disney’s channels comes in the middle of high-interest sporting events such as the U.S. Open tennis tournament, start of the NFL regular season, and college football games.

Although drawn-out carriage disputes are nothing new in the pay-TV business, some industry observers see this one as a potentially meaningful flashpoint. Cord-cutting, long past the point of being considered a fad, has proliferated to the extent that distributors like Charter, which are also broadband companies, have fewer and fewer reasons to invest in the cable side of their businesses.

“Years and years of asymmetric leverage in carriage negotiations have given the media companies superior pricing leverage,” said analysts at MoffettNathanson in a research note on Friday. “And it has left their linear video distributors economically indifferent; video is no longer a meaningfully profitable line of business for cable operators. It’s tough to win a negotiation with a counterpart who has nothing to lose.”

When it comes to public sentiment, though, both sides in this dispute may have more to lose than they realize. A survey earlier this year from the W. P. Carey School of Business at Arizona State University found that “customer rage” is at an all-time high and that companies in the aggregate are risking some $887 billion in future revenue due to the poor handling of complaints.

(42)