Economists say these cities will be hardest hit by a COVID-19 recession

While our health is at risk during the COVID-19 pandemic, the repercussions on the economy are certain to affect almost everyone’s livelihood as the disease decimates businesses globally. Here in the U.S., economists and policymakers are increasingly anticipating a recession. Goldman Sachs recently estimated that the U.S. GDP will wither about 24% between April and June 2020.

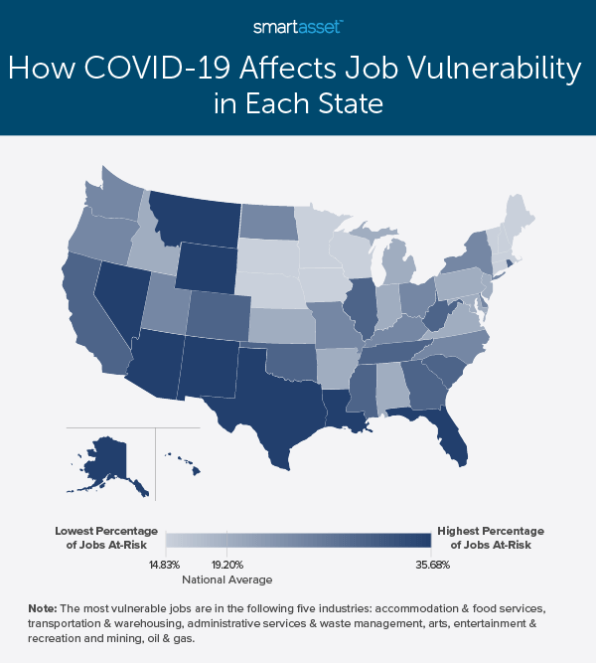

Some areas of the country will be more vulnerable to a recession than others. Among the hardest hit by this potential recession are Nevada, Hawaii, and Wyoming, according to an analysis of census data by SmartAsset.

That data revealed that more than one in four jobs in those three states is at risk because they rely on vulnerable industries such as tourism, arts and recreation, food service, and hospitality. The analysis revealed that nearly a quarter (23%) of Nevada’s and almost 17% of Hawaii’s workforce were employed in leisure and hospitality.

The third most likely state to suffer the effect of a coronavirus-related recession is Wyoming, which plays host to more mining, oil, and gas workers.

On the flip side, South Dakota, Iowa, and Minnesota are the most likely to be shielded from the coming recession because very small percentages of their workforces are employed in vulnerable industries.

SmartAsset also identified the 10 cities where workers in vulnerable industries make up the largest part of the workforce. Moody’s Analytics economist Mark Zandi estimates that 20% of those vulnerable workers in each of these cities could lose their jobs. They are:

To see the complete analysis by industry, click here.

(7)