eMarketer: U.S. CTV Ad Revenue Up 44% In 2021, Hulu, YouTube, Roku Still Lead, Newer Rivals Gain Share

eMarketer: U.S. CTV Ad Revenue Up 44% In 2021, Hulu, YouTube, Roku Still Lead, Newer Rivals Gain Share

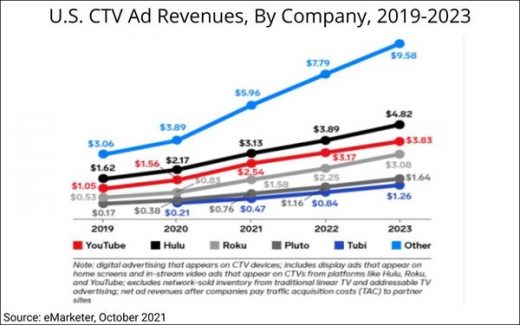

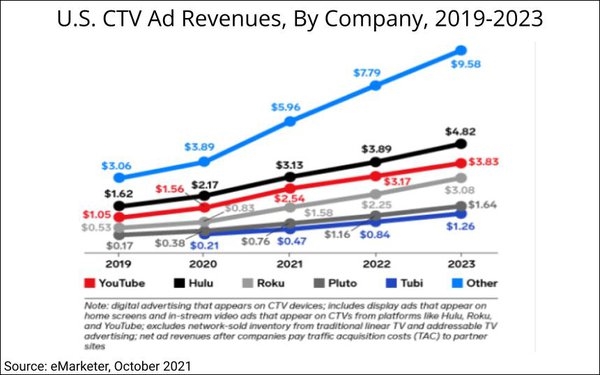

U.S. connected TV (CTV) advertising revenue will reach $14.4 billion this year — up 44% from $9.04 billion in 2020 and 125% from 2019’s $6.43 billion, according to the latest estimates from eMarketer.

The forecast calls for the total to grow by another 67.7% by the end of 2023, to reach $24.2 billion.

Hulu, YouTube and Roku will continue to dominate ad revenue going forward, but fast-growing newer rivals Pluto TV and Tubi (and to a lesser extent, smaller verticals) will continue to eat away at their shares.

Although Hulu’s lead has been gradually declining since 2017 due to growing competition, it will retain its No. 1 position for at least the next two years.

Hulu will log a 44% gain this year, to reach a projected $3.13 billion, and another 54% by the end of 2023, to reach $4.82 billion.

Hulu’s share of the U.S. CTV ad revenue total declined from 25.2% in 2019 to 24% in 2020 and 21.7% this year, and is projected at 20% by 2023.

Hulu, already majority-owned and operated by Disney, is expected to acquire Comcast’s one-third stake by 2024, if not sooner.

Google’s YouTube continues at No. 2, with impressive projected growth of 62.8%, to $2.54 billion, this year, and 50.8% growth between 2021 and 2023, to reach $3.83 billion,.

YouTube’s share of total is projected to rise to 17.6% this year — up from 16.3% in 2019 and 17.3% in 2020 — but dip to 15.8% by 2023.

Roku — founded in 2002 and gaining advertising momentum since the 2017 launch of the Roku Channel — is forecast to jump by 90% this year, to $1.58 billion, and log another 95% increase, to $3.08 billion, by 2023.

Roku’s estimated share of total has risen from 8.2% in 2019, to 9.2% in 2020, to 11% in 2021, and is projected to increase to 12.7% by 2023.

Pluto TV’s U.S. ad revenue rose 50% in 2021, to $0.76 billion, and is projected to rise 116%, to $1.64 billion, by 2023.

The platform, launched by ViacomCBS in 2013, had a 2.6% share as of 2019 and 4.2% as of 2020 and is projected at 5.3% this year and 6.8% by 2023.

Fox’s Tubi, launched in 2014, saw revenue growth of 124% in 2021, to reach $0.47 billion, and is projected to grow 168%, to $1.26 billion, by 2023.

Its share reached 2.3% by 2020, and an estimated 3.3% this year, and is projected to reach 5.2% by 2023.

“Other” CTV platforms, beyond the top five, saw their collective U.S. ad revenue rise nearly 95% between 2019 and 2021, to an estimated $5.96 billion this year. This segment is projected to grow by 30.7% in 2022 and 23% in 2023, to reach $9.58 billion.

As of 2019, the largest players weren’t all that far ahead of the “other” segment, with collective shares of 52.4% and 47.6% of U.S. CTV ad revenue, respectively.

However, the big players’ collective advantage continues to grow. eMarketer’s estimates would put the top five at 58.6% of total as of this year and 60.4% as of 2023.

(54)