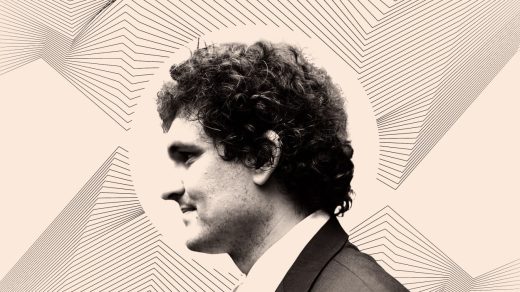

Famously fidgety SBF sits as still as a mannequin during opening arguments

On Wednesday, Samuel Bankman-Fried seemed—finally—to behave. During opening statements in his fraud trial, the onetime crypto billionaire, accused of stealing $10 billion from his customers, lenders, and investors, and who was jailed pretrial after repeated bail violations, was self-controlled, almost mannequin-esque in his body language. During the long morning session, running from 9:30 a.m. to well past 1:00 p.m., Bankman-Fried didn’t ever stretch, get up from his chair, or take a bathroom break.

Bankman-Fried, who founded and ran the crypto exchange FTX and the hedge fund Alameda Research, is on trial in federal district court in Manhattan for seven counts of fraud and conspiracy. With their opening statements Wednesday, both the government and Bankman-Fried’s defense lawyers gave the broad outlines of their cases. The government: that Bankman-Fried repeatedly stole money and lied about it. The defense: that he was a businessperson in an evolving industry trying to make good decisions on the fly.

Bankman-Fried seems to be trying to present himself as serious and respectful in court. His unruly mop of curls have been replaced with a close-crop cut, his wrinkled T-shirts and shorts traded in for a suit and tie. Once so distractible that he played video games throughout an hourlong interview, he appeared on Wednesday focused and alert, either watching the proceedings, talking to his lawyers, or tapping on his air-gapped laptop (he’s allowed it in court only to take notes, per the instructions of the judge overseeing the case). Bankman-Fried’s parents, Joe Bankman and Barbara Fried, whose role and influence in FTX is in question, attended Wednesday’s trial; their son didn’t visibly interact with them.

When prosecutor Thane Rehn spoke, Bankman-Fried assumed an almost frozen posture: gazing at his laptop screen, forearms resting on the edge of a table, hands poised over the keyboard, though he rarely typed anything. (It was a tuned-in-but-dismissive look that reminded me of Martha Stewart’s middle-distance gaze when opposing counsel was quizzing her at a civil trial.) When his lawyer’s turn came, by contrast, Bankman-Fried watched the proceeding, rested his arms on the chair’s armrests, and looked attentive, though once again preternaturally still.

Rehn’s outline of the prosecution’s case was clear and informative, and offered some details beyond what the prosecution had already filed in court papers. “One year ago, it looked like Sam Bankman-Fried was on top of the world,” Rehn said, pointing to Bankman-Fried’s use of private planes, his meetings with people like Tom Brady and Bill Clinton, and FTX’s Bahamas real-estate holdings. But in reality, Rehn said, Bankman-Fried was taking billions in FTX “customer deposits and spending it for himself.” FTX was supposed to be an exchange, or “a website where people could buy and sell crypto” and where FTX took a fee for each trade; and its terms of service, told customers “that their crypto belonged to them and not to FTX,” Rehn argued. However, Rehn added, Bankman-Fried took billions in customer money from FTX. And Bankman-Fried tried to hide his actions by routing the money through various bank accounts, sending political donations but asking friends to make them in their names, using “false documents” with lenders and “lying” to investors, Rehn said. In September of 2022, he talked with his top executives about how big of a hole FTX and Alameda were in, and told them “how customers could never be repaid,” according to Rehn.

On the contrary, argued Mark S. Cohen, Bankman-Fried’s lawyer, Bankman-Fried’s actions were those of an earnest entrepreneur (“he was a math nerd who didn’t drink or party,” Cohen said of his client) trying to make good decisions under novel circumstances, even if he didn’t observe the best risk-management practices. “This case is in many ways about the crypto world of 2017 to 2022,” Cohen said, adding that “Sam and his colleagues were building the plane as they were flying it.” Cohen suggested the defense would cast as legitimate many of the things the government cast as fraudulent: that the transactions between FTX and Alameda were “loans” that were “permitted”; that FTX bought its executives Bahamas real estate to try to entice them from companies like Google; that Bankman-Fried “acted in good faith and took reasonable business measures” to try to correct the companies’ courses when things started going awry. “Nothing wrong with that,” Cohen said several times in describing Bankman-Fried’s actions, adding that business decisions that don’t work out are “not the stuff of a criminal case.”

Both sides took pains to define finance terms simply for the jury, whether cryptocurrency, fiats or margin loans. The twelve jurors include a Westchester physician’s assistant, a social worker, a Metro-North train conductor, a retired correctional officer, and a vehicle-maintenance worker for the United States Postal Service. A man who volunteered that his wife’s law firm was representing the bankrupt FTX, a man who described his son’s college as the “MIT of the South” (Bankman-Fried went to MIT), and a woman who works at FINRA, the financial regulator, were all excused.

In a surreal cameo, Martin Shkreli, convicted on his own federal fraud charges in 2017 and sentenced to seven years in prison, attended the afternoon portion of the trial. He watched via feed in an overflow courtroom, chatting with a crypto influencer he had come with. Shkreli wore much the same garb he wore at his own trial—gray blazer, gray shirt—and took notes, chatted, played with his hair, read a book during the duller parts, and, of course, smirked (when a victim mentioned the “joke” cryptocurrency Doge, and again when a prosecutor played a chipper “get to know crypto” video that FTX used to have on its site).

(8)