Genfit Restructuring Cuts Staff by 40%, Creates Two New Subsidiaries

[Updated 10/1/2020. See below.] Genfit is halting all work on its lead drug in the fatty liver disorder nonalcoholic steatohepatitis (NASH) and implementing a corporate restructuring that will cut 40 percent of its staff, splitting the remaining workforce into two distinct business units.

The announcement after the market close on Wednesday follows the May failure of the drug, elafibranor, in a pivotal NASH study. At the time, the company attributed the surprising result to a higher than anticipated placebo response. Genfit (NASDAQ: GNFT) pledged to review the data to see if there was a path forward in NASH.

Speaking on a conference call Wednesday, Genfit CEO Pascal Prigent said that while the analysis did show evidence of activity in treating NASH, it was not enough to suggest that further research would be successful.

Lille, France-based Genfit is assessing all of its financial assets with the goal of reducing spending by more than 50 percent by 2022 compared to spending levels before the release of the Phase 3 NASH data. The company has already terminated the clinical trial work and activity related to the planned commercial launch of elafibranor in NASH. Genfit is also stopping further evaluation of the drug as part of any combination NASH treatments.

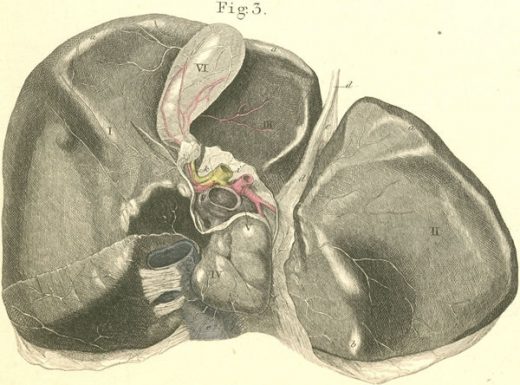

The restructuring plan aims to slash the headcount in the US and France by 40 percent. As of June 30, Genfit’s headcount was 203, according to its securities filings. The workers who remain will work in one of two new divisions of the company. The first will be dedicated to “specialty indications,” starting with continued evaluation of elafibranor in primary biliary cholangitis (PBC), a chronic disorder that leads to inflammation and scarring of the liver’s bile ducts. Genfit aims to offer an alternative to the only second-line treatment approved for the disorder, the Intercept Pharmaceuticals (NASDAQ: ICPT) drug obeticholic acid (Ocaliva). Prigent said that Genfit is proceeding with plans for a Phase 3 test of its drug in the rare disorder. Enrollment has begun; preliminary results are expected in early 2023.

The second business unit keeps Genfit in various aspects of NASH, with the exception of treating the disease. This “NASH solutions” entity would encompass products and technologies that identify, evaluate, and monitor NASH patients. Earlier this week, Genfit announced an agreement with LabCorp (NYSE: LH) covering the development and commercialization of a diagnostic test to identify patients at risk of developing NASH. The test will be based on Genfit’s NIS4 technology, which the company developed to find NASH from a small patient blood sample. The pact expands on an earlier partnership, in which LabCorp supplied the Genfit diagnostic for use in clinical research.

Prigent said the company decided to split into two divisions because each one targets very different markets. While NASH is a big market affecting millions of people, PBC is an orphan disease. The separate structures will enable each to support more partnership opportunities, he said. But both entities will remain part of Genfit.

[Paragraph added with analyst comment.] In a note to investors, SVB Leerink analyst Thomas Smith wrote that elafibranor has shown the potential to offer safety and tolerability, as well as efficacy, that patients and clinicians are likely to prefer over the Intercept drug. Regarding the plans to commercialize NIS4, he wrote that LabCorp is a “fitting partner” given its expertise and scale in diagnostics. But he added that until a NASH drug is approved, he expects only modest use of NIS4 in commercial settings.

As of June 30, Genfit reported having cash and cash equivalents totaling €225.7 million (about $264.7 million).

Public domain photo by Flickr user Qasim Zafar

(24)