Good news, giant corporations: IRS audits are down

A recent look at IRS audit trends reveals what many of us have guessed–corporations just aren’t being audited the way they used to be.

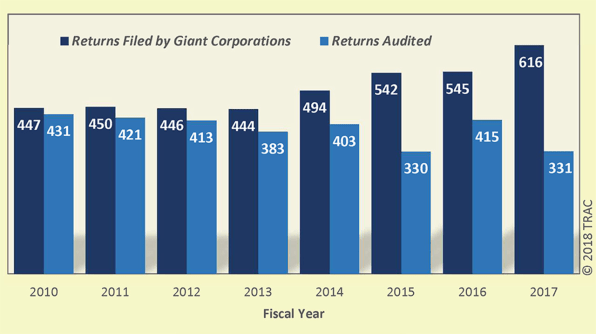

According to TracIRS, a nonpartisan group run by Syracuse University researchers that keeps tabs on the Internal Revenue Service, a growing number of corporations report $20 billion or more in assets. But while the number of these giant companies filing their giant tax bills has grown by 38% over the past seven years, the number of giant companies being audited has fallen.

Just a few years ago, 96% of these large corporations could expect to be audited by the IRS. By contrast, only about half of these corporate returns were audited last year. We assume that means the IRS is just trusting big companies to pay their taxes as required by law. What could possibly go wrong? Oh, right.

As the Center for Budget and Policy Priorities points out, the budget for the IRS has fallen over the years. While corporations may be enjoying the whole not-getting-audited thing, the IRS is probably going to need help as it implements a new tax law that “creates massive new tax avoidance opportunities.”

(24)