Google Insights: Search Trends for Post-COVID-19 Recovery

With countries gradually easing out of lockdowns, businesses are getting ready to open their doors to customers once again. Nobody expects life to return to normal any time soon but the latest data from Google suggests consumer activity is already on the rise.

The search giant has shared some key insights with us that reveal how the Coronavirus outbreak has changed consumer habits and priorities. Understanding this will be key to implementing recovery plans for businesses affected by COVID-19 and the lockdown.

Here’s a summary of the insights.

Domestic travel takes the lead

Unsurprisingly, international travel has plummeted down the list of priorities with 49% now favouring domestic trips and 30% preferring staycations. Sadly, UK tourism could face a slow recovery with demand for domestic travel lower than many other countries, possibly due to the UK being one of the worst-affected countries during the pandemic.

The reality for travel businesses in the UK is that, while things are set to pick up in the months ahead, the market size will be small and competition disproportionately intense. To make it through this, travel brands will have to be flexible and respond quickly to shifts in consumer demand, even if it means doing things a little differently.

Google data shows a surge in searches for “nature reserve” in the UK as would-be travellers show a stronger interest in getting outdoors.

Likewise, search volumes for terms like “camping” and “campervan” have significantly increased over the past 90 days as people in the UK seek out holidays that minimise the risk of infection.

The Coronavirus outbreak has also spurred a stronger interest in exercise and physical activities, such as surfing, mountain biking and open-water swimming – all of which travel brands can tap into by focusing on more “outdoorsy,” active holidays and weekend getaways.

Maximising search coverage will be crucial

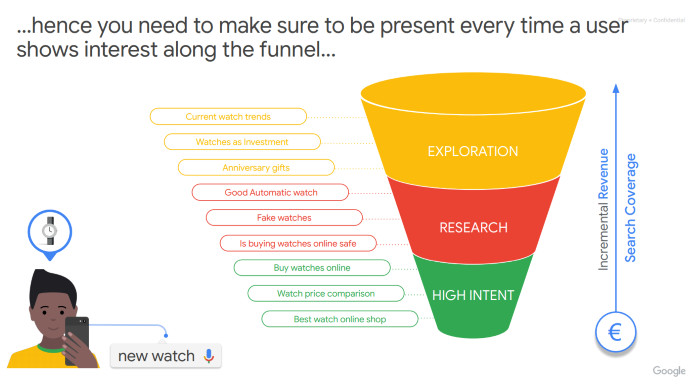

One thing that really stood out from Google’s latest round of insights is the importance of search coverage. This refers to how many of the search opportunities available to your brand you actually appear in. Businesses that hit the pause button on their SEO and PPC efforts during the lockdown, in particular, will have seen their coverage shrink during this period.

The sooner you start building this back up, the better.

At the same time, new opportunities are emerging as the Coronavirus outbreak changes search intent and behaviour.

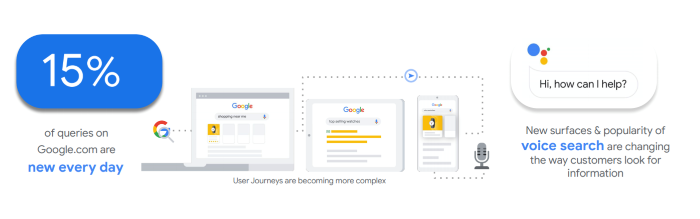

Google has said multiple times over the years that 15% of all search queries made have never been submitted before. This means new opportunities are a constant presence in Google Search and this, combined with the current shifts in search behaviour, means there’s a lot to play for.

Market sizes might be smaller right now but a lot of brands are going to react slowly to changing trends and fast-movers can take advantage.

One challenge Google was keen to highlight is establishing search coverage across the entire marketing funnel. The average consumer journey involves hundreds of touchpoints and many of these are different in a post-COVID-19 world. Search habits have changed drastically and what about that 15% of daily queries that are completely new?

One solution Google recommends is combining broad match keywords and Dynamic Search Ads in Google Ads. Broad keyword matching allows your ads to show for the widest range of variations while Dynamic Search Ads (DSAs) use the content on your website to make the copy in your ads more relevant to the exact keywords users type in.

So, basically, you get the wide reach of broad match keywords while maintaining ad relevance. Google finds that DSAs result in 15% more clicks, 35% higher CTRs and 30% lower CPAs.

Going back to something we touched on earlier… you’ll also find that a lot of your competitors have pulled back on their SEO and PPC investment over the past few months and this will reveal some new opportunities for you that were previously out of reach. So now is a good time to keep on top of your competitor research and gap analysis to make the most of their weaker presence coverage.

Searches are on the up… but priorities are different

Generally speaking, search volumes are increasing for most categories although there are a few expected declines in areas such as parties and weddings.

There are some interesting trends that illustrate changing consumer priorities, though:

- Searches for “blinds, shades and shutters” are up by 109.95%

- Searches for “office furniture” are up by 83.74%

- Searches for “bicycles and accessories” are up by 71.32%

- Searches for “bakeware” are up by 66.85%

- Searches for “yard, garden and patio” are up by 57.81%

- Searches for “home improvement and maintenance” are up by 45.07%

- Strong decline in searches for consumer electronics

- Strong decline in searches for clothes, cosmetics and beauty

In terms of more general trends, Google says the Coronavirus outbreak has made shoppers even more conscious about sustainability and ethical brands – and this concept has been enhanced further by the anti-racism movements taking place across the world right now.

Brand ethics are under the spotlight and consumers are even calling out companies for virtue signalling and contradicting their own statements. You can’t just say what people want to hear any more; you have to back your statements up with actions.

Meanwhile, separate research from McKinsey suggests UK consumers are expected to do even more of their shopping online, even as the country emerges from lockdown. This means online retailers need to step up with free delivery options, same-day deliveries and same-day collections while contactless payments and other safety measures will be crucial in physical stores.

‘Near me’ searches are back

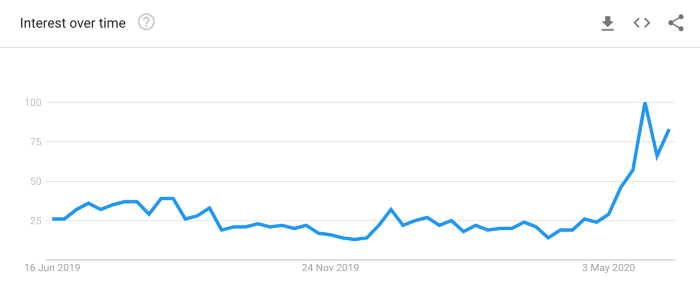

During lockdown, “when will” searches became the new keyword trend with the whole country wondering when all the things we used to take for granted will be possible again.

With lockdown gradually easing, though, “when will” searches are on the decline and the return of “near me” searches is upon us. Over the past two weeks, generic search terms like “what is open” have turned into “what is open near me” as consumers come to grips with the idea that living locally is going to become the new normal for a while.

Interestingly, Google says searches for “car dealers near me” have drastically increased in the UK while “stores near me” is also on the rise. So it’s vital that businesses with physical locations keep those Google My Business details up-to-date and let people know they’re open for business again – and show what steps they’re taking to protect their staff and the general public.

The good news for businesses is that the lockdown is easing and consumer activity is on the rise. It’s too early to say whether there will be a surge-like recovery in the near future but the latest data suggests consumer behaviour could look very different, even when spending returns to pre-COVID levels.

In the meantime, brands will have to move quickly to make the most of new opportunities and adapt to the new normal of consumer behaviour. Competition is going to be fierce, particularly in the industries worst-affected by the outbreak, and responding quickly to new opportunities will make all the difference.

Digital & Social Articles on Business 2 Community

(35)