Google Shares Exclusive Data On B2B Buyers’ Emotional State, Spending Habits During COVID-19

Google Shares Exclusive Data On B2B Buyers’ Emotional State, Spending Habits During COVID-19

Buyers indicate a higher likelihood to switch suppliers in the next 30 days compared with the past 30 days, according to data released by Google. Their likelihood to switch suppliers rose to 65% in August 2020 compared with 59% in June 2020.

While a high percentage of buyers cited the likelihood to switch, just 30% in August and 30% in June said they did switch or add a new supplier in the past 30 days.

Google commissioned Ipsos to survey marketers and buyers across B2B industries in a multi-wave study, with Wave 1 fielded in June and Wave 2 fielded in August 2020.

In the 10-minute online survey, respondents were asked about their general reactions during the COVID-19 pandemic, their behavior and perceptions as a marketer or buyer, and the future outlook for business.

The increase in switching is largely driven by enterprise-level buyers. Broken down, the numbers look like this: 35% for small, 67% for mid-size, and 72% for enterprise.

The study also identified the importance of understanding the emotional state of customers. Some 72% of buyers in July were optimistic about recovery in the first wave of this study, and 36% felt well prepared in their current job role, compared with 49% in In August.

Buyers want to feel supported, especially after a purchase. One in three buyers still indicate that suppliers under-deliver on post-purchase support. They are also looking for reassurance throughout the purchase process.

Some 65% said they want more communication during the research stage, while 67% want more communication while making a purchase, 67% during installation and post purchase, and 69% after using the product.

This is a sign that companies want emotional support and reassurance as they continue to pivot their offerings, budget allocations, media strategies, and the role of sales teams. All must adjust to the roller-coaster lockdowns and openings based on COVID-19 government regulations in multiple geographic areas.

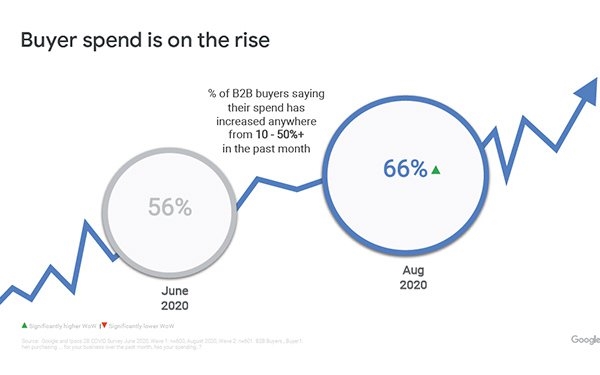

Despite the chaos caused by the pandemic and the safety nets put in place, the percentage of B2B buyers who say their spend rose anywhere from 10% to 50% in the past month dramatically increased, from 56% in June to 66% in August 2020.

Self-service and digital features continue to influence buyer decisions, despite less of an emphasis on mobile in this report. The factors influencing the decision to purchase from a supplier fell in two categories, remained the same in one, and rose in another.

- User friendly website 82% (June) 81% (August)

- Optimized mobile experience 77% (June) 72% (August)

- Online or app-based chat 70% (June) 70% (August)

- One-click checkout 67% (June) 69% (August)

Buyers still feel that experiences online are below expectations, but less so in the latest numbers compared with the first. Self-service options impact their purchase decisions the most with 75% saying it impacted their decision in June vs. 76% in August.

Some 82% of B2B buyers In June compared with 81% in August felt the experience of websites impact their purchase decision. Some 36% in June compared with 31% in August said websites delivered below their expectations.

Most marketers still don’t invest in improving areas that impact buyers the most.

The data shows that in August, 45% of marketers said they are updating their website, while 38% said they are increasing online and app-based chat systems, 34% said they are improving mobile websites, and 26% said the are improving self-service transactions on websites.

(35)