here’s what number of Gigs Are in the Gig economy

if you wish to measure the 1099 financial system, it is smart to count 1099s.

September 16, 2015

The increasing collection of impartial contractors in the “gig economic system” is readily becoming a political problem, with presidential hopefuls Hillary Clinton and Jeb Bush weighing in on reverse ends of the controversy over whether it’s indicative of a return to sweatshop labor or innovation. The flesh presser asking the more pertinent question, on the other hand, is Senator Mark Warner from Virginia.

past this month, he officially asked the U.S. Secretaries of Treasury, Commerce, and Labor for higher data about how many people are if truth be told transitioning from full-time employment to freelance jobs.

As issues stand, it’s difficult to understand how large the gig financial system is or how fast it is rising. The Labor department used to track what it calls “contingent work” via a survey that integrated temp staff, nevertheless it stopped doing so in 2005 after Congress voted against funding the record. different warning signs are complicated and continuously conflicting.

the proportion of workers who record being each self-employed and unincorporated has declined over the past decade, according to the Labor department. however when economic Modeling specialists Intl. compiled Census and Bureau of business diagnosis information, they discovered that the selection of staff labeled as staff is falling, while the quantity categorized as miscellaneous owners is rising. Estimates from non-public corporations vary between projecting 7.6 million freelancers through 2020 to claiming there are at present fifty three million people within the U.S. working freelance in some capability. There are also difficult incongruities in government data. “The employment rate is declining similtaneously the unemployment rate—staff are chucking up the sponge of the personnel (and due to this fact aren’t counted in reliable govt statistics), so how are they earning profits?” says Steven Hill, the creator of uncooked Deal, an upcoming e-book concerning the perils of the “Uber financial system.”

Patrick Kallerman, a research manager at the Bay space Council economic Institute, was in a similar way pissed off with the conflicting metrics. So he asked the IRS for a very simple data set: what number of 1099 forms are employers submitting? (Employers who pay a freelancer or contingent employee are required to file 1099 forms.)

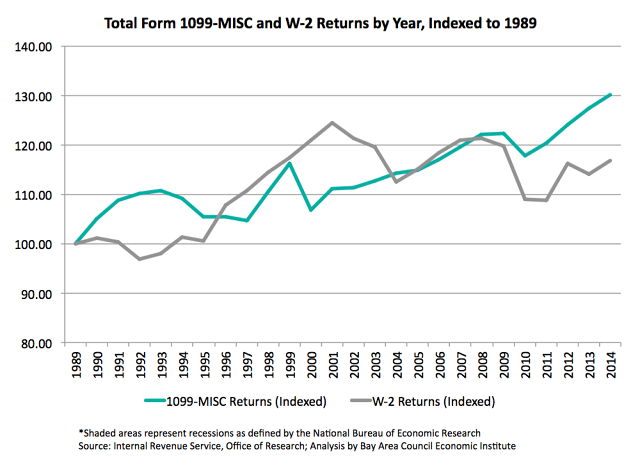

In 2010, the IRS acquired about eighty two million 1099-MISC varieties. final 12 months, it received about 91 million. This graph shows how the selection of 1099 forms has grown due to the fact 1989 compared to the growth of W2s, the kinds associated with employees.

As you will find, the expansion of 1099 kinds filed to the IRS is increasing faster than the expansion of W2s (which you can learn Kallerman’s diagnosis here).

The choice of 1099s represents the choice of gigs. It’s no longer the number of people that turned in freelance work, and it doesn’t say anything else about the measurement of the roles that they’re working. each 1099 kind might characterize a $600 freelance writing assignment or a $50,000 consulting gig. There are additionally nuances in which varieties of independent work are growing that it doesn’t embody. “In a method, this is additionally not a super knowledge set, but in in a different way, at least it’s the actual thing that we wish to know about,” Kallerman says, “and we’ve got an exact, professional account of it.”

The collection of 1099s is consistent with the selection of U.S. nonemployer companies, every other metric in keeping with tax return data that shows the number of companies that don’t have any paid workers (freelancers, for the most part) and is regularly rising.

“[The gig economy] is just not growing at a breakneck p.c., to be able to all take a deep breath,” Kallerman says. “however it’s right here to remain, so we will have to be excited about policy options.”

Correction: A previous version of this article incorrectly said that a 1099 kind can be filed for a $50 job. the example has been up to date to mirror that profits below $600 per year requires a distinct type.

(95)