How Advanced Automation Generates Higher Profits for Financial Services

— December 14, 2018

Up until now, the technology and capabilities for leading financial institutions and service providers have been focused primarily on improving the speed and efficiency of transaction processes to minimize cost and improve the visibility of information. They rely on this data to provide relevant information to their customers in a variety of areas that support their revenue streams, such as asset, portfolio, risk and regulatory management. By streamlining and automating their processes and eliminating manual, paper-based processes, these Best-in-Class companies have improved their time to information for providing key insights to their customers.

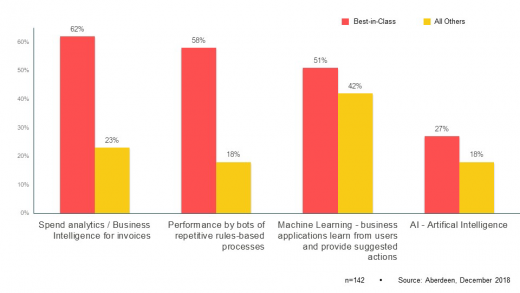

Figure 1 identifies the advantages that Best-in-Class companies have established in automating their financial processes, compared to their competition.

Figure 1: Best-in-Class Advantage in Financial Process Automation

Managing the volume and variety of data itself in an efficient manner has been the challenge, often characterized by the term Big Data. Extracting insights has been about the mining of this data in a timely manner and applying analytics to convert it into valuable information for better visibility and direction for customers. Best-in-Class companies have demonstrated a clear advantage in streamlining and automating their processes, as well as extracting intelligence from printed documents using cognitive document recognition, and digitizing them so they can be processed efficiently.

Best-in-Class companies also clearly demonstrate a competitive edge in the use of robotic process automation (RPA) to further streamline and expedite the automation process to extract data for insights. However, the majority of companies (All Others) still lag significantly behind in the adoption of these capabilities.

Analyst Commentary

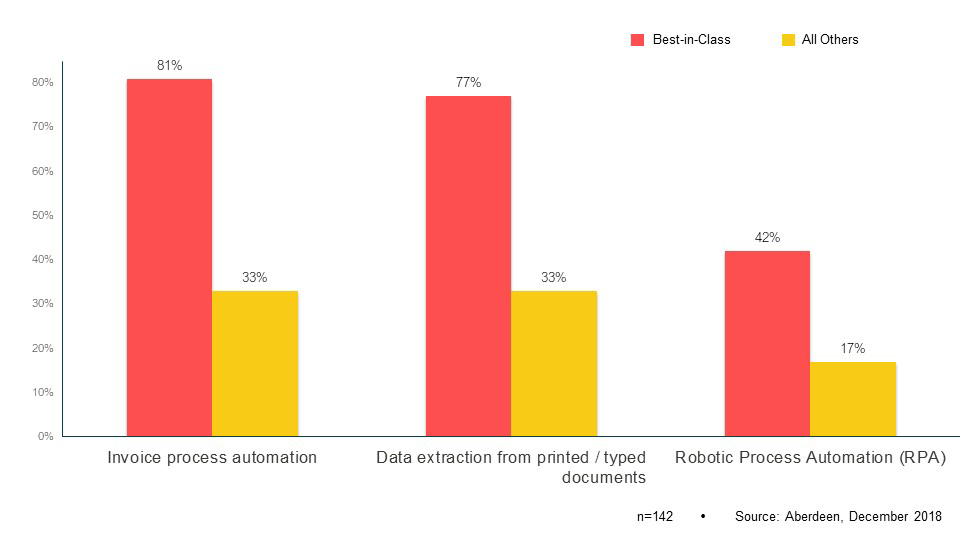

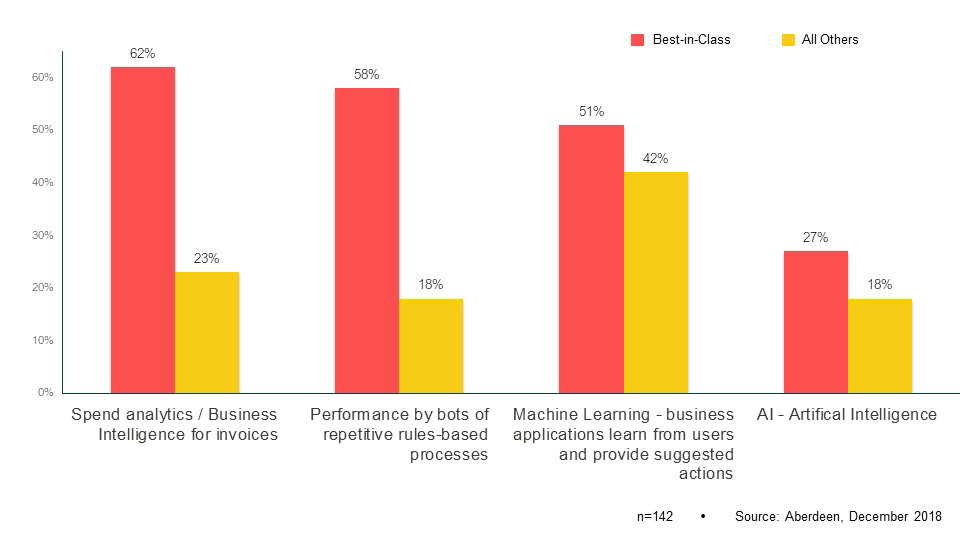

Even though Best-in-Class companies have a clear competitive advantage, is it enough? Since these leading financial institutions and service providers depend on technology to mine valuable data from a multitude of complex and diverse sources to enrich and analyze it across many topics, they are constantly looking for ways to improve their competitive advantage over other leaders in the space. Although they have already demonstrated superior skills and a competitive advantage, the adoption of new technologies is now changing their environment, as shown in Figure 2.

Figure 2: Leveraging Advanced Technology for the Future

1. Best-in-Class companies have a significant advantage across the board in technology adoption.

2. The Best-in-Class are moving beyond the processing advantages and leveraging improved technology to provide better intelligence.

3. Adopting machine learning to expedite the recognition of patterns and issues and recommend possible alternatives creates enhanced insights more quickly.

4. AI can more quickly find patterns not previously seen.

5. Increased RPA use to mine these patterns faster can provide the competitive advantage of speed to information, keeping the organization ahead of the pack.

Applying these advanced capabilities to enhance revenue streams for these financial institutions and service providers can put them ahead of the competition.

Asset Management – Major reduction in unproductive time spent digging through data sources, both internally & externally.

Investments – Use of dashboards to create push-based solutions by proactively presenting the most relevant information in real time.

Risk – Use of machine learning and AI to find patterns in unstructured data to further minimize risk and optimize performance.

Regulatory Compliance – Faster classification, reduced costs and risk of fraud, with exhaustive monitoring.

Streamlining Retail Banking – Improve customer service reps’ attention to customers by minimizing the effort needed to access relevant content in various enterprise applications.

Takeaway

Top companies, partly out of necessity to maintain their competitive edge, and partly out of a propensity for continuous improvement through more sophisticated technology, are more likely to advance their customer insight capabilities and remain ahead of their competition. Their business depends on the value they provide their customers through visibility and insights, and technology is their enabler.

Do you know which specific companies are currently in-market to buy your product?

Wouldn’t it be easier to sell to them if you already knew who they were, what they thought of you, and what they thought of your competitors?

Good news – It is now possible to know this, with up to 91% accuracy. Check out Aberdeen’s comprehensive report Demystifying B2B Purchase Intent Data to learn more.

Business & Finance Articles on Business 2 Community

(59)