How Charles Schwab Fought Back Against The Robo-Adviser Startup Invasion

Once upon a time, a scrappy San Francisco startup shook up the staid business of investing by rethinking its business model, embracing new technology, and generally defying the rules established by the industry’s giants.

The era? The 1970s. And the startup in question was Charles Schwab & Co., the first discount brokerage.

Chuck Schwab’s new approach proved successful—so much so that the company became a giant itself. It now has $2.5 trillion of money under management, revenues of $6.3 billion, and more than 15,000 employees. By any definition, it’s part of the financial industry’s establishment.

And once again, scrappy startups are shaking up investing. Companies such as Wealthfront, Betterment, and FutureAdvisor offer “robo-adviser” services. Rather than investing money based on the decisions of a human expert, they use technology to manage a portfolio and recalibrate it on an ongoing basis. Doing so allows them to grind down fees, and poses a threat to the conventional business model of a company like Schwab, which is very much used to monetizing the wisdom of human beings.

In June 2014, rather than leaving the robo-adviser idea to startups and hoping that it didn’t prove too disruptive, Schwab decided to face it head on with an offering of its own. The service it created, Schwab Intelligent Portfolios, debuted the following March. Other robo-adviser services carry low fees; Schwab one-ups them by not charging a fee at all for the service itself. Not that it’s doing this out of the goodness of its heart: It makes money from the fees investors pay for individual exchange-traded funds, or ETFs, in their portfolios, and all portfolios include some cash managed by its Schwab Bank. (Competitors have contended that this approach is less transparent than charging an overall fee for the robo-adviser service.)

For Schwab, building Intelligent Portfolios was an opportunity to try creating something new in a new way. It organized its team—which started with three people and grew to 300—using principles unlike those it typically employed. It worked at an accelerated pace, trusted the instincts of its in-house experts, and tried to create an end product that felt like it might have been produced by an small, intrepid company rather than an enormous financial institution.

“Let’s do something different,” says Schwab Wealth Investment Advisory president Tobin McDaniel, recalling the internal rallying cry. “Let’s change the image of Schwab, to some degree. And modernize the way we do things. Let’s take a blank slate. Let’s build the right client experience—very modern, very simple—and let’s use the parts of Schwab that make sense, and let’s completely redo the parts that don’t work.”

The category remains nascent, and there are no guarantees that Schwab’s take on robo-advising will thrive forever. But in less than two years, the company has gone from sitting on the sidelines to leading the category in terms of assets under management. Counting the version designed for use by independent investment advisors, Schwab Intelligent Portfolios now has 75,000 clients and a total of $6.6 billion in assets under management. That compares to over $4 billion for Betterment and $3 billion for Wealthfront—figures that are themselves pretty impressive considering that both companies are startups. (Of course, Schwab, unlike startups, has a huge head start in the form of 9.9 million brokerage account clients and one million banking customers to whom it can market its new service.)

It Started With A Memo

Schwab had been toying with the idea of offering an automated investing service for a few years. But the Intelligent Portfolios story really began with an eight-page internal document that McDaniel drafted in mid-2014.

The memo aimed to explain “why the time was now, what we could do, and how we could do it,” he says. “Technology had gotten to the point where you could do it very well. Consumers had gotten to the point where we thought they’d be open to investing this way. If you can trust a car to drive itself, you can trust an algorithm to manage your portfolio.”

“It was a frantic weekend of writing it,” McDaniel remembers. “I remember going home to my wife and saying ‘I’m going to work all day tomorrow, because we have a little bit of a window to do something pretty fantastic. And we’ve got to make sure we tell the right story.'”

“I think I got my first draft of it at 10 p.m. at night,” adds Schwab CTO Tim Heier. “Within a week were talking about putting together a project team. Within two weeks we had 10 or a dozen people who became the key leaders on the project. For us, it moved extremely fast. Those were exciting moments.”

From the start, Schwab saw the journey of building a robo-adviser service as part of the reward, which was one reason why it rejected the possibility of simply acquiring one of the startups already in the category. “One of our objectives in doing this was not only to build this great platform for users and advisers, but use this as a lever for reinvigorating our own development process and how we build products and platforms,” says Neesha Hathi, executive VP for Schwab Investor Services. “Given that that was an objective, we had to build it.”

Schwab CEO Walt Bettinger quickly signed off on the proposal, which involved abandoning Schwab’s typical big-company approach to product development. Normally, people from all over the organization are involved, but many participate only on a part-time basis. Some—like lawyers and staffers responsible for making sure that something complies with every relevant regulation—get dragged in only once their particular responsibilities are required.

The Intelligent Portfolios project, by contrast, had dedicated experts from all over the company involved from early on. “At the beginning, we may have thought some people could do part-time on this and part-time on other things,” says Hathi. “And it quickly became obvious, within weeks, that that was not OK.”

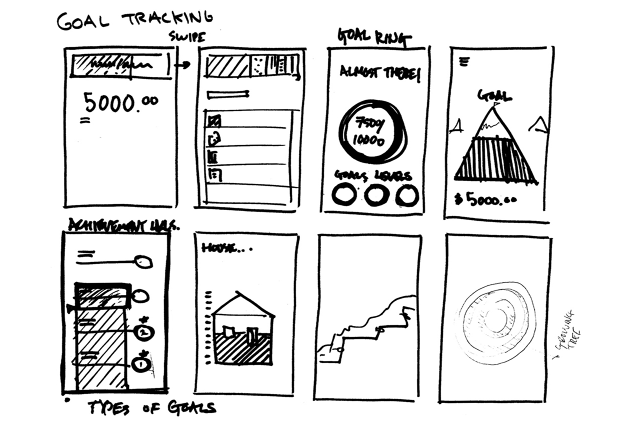

Team members devoted all of their available time and mental bandwidth to the effort. Eliel Johnson, VP of user experience, says that the collaboration between disciplines had an improvisational quality. “We had legal and compliance engaging in design thinking: ‘How can we make something like terms and conditions better?'”

He adds that because the goal was to build something rapidly and then iterate on it—rather than spending months purely on planning—Schwab Intelligent Portfolios felt real from its earliest stage, in a way that helped the people working on it make a better product. “You know the proverbial ‘A picture’s worth a thousand words?’ Well, a prototype’s worth ten thousand words.”

The project involved a far-flung group of Schwab staffers, with members from Denver, Austin, and Raleigh, N.C., among other places. But rather than relying on videoconferencing, the company encouraged those from satellite offices to make

the trek to headquarters.

“We do use a lot of collaboration tools,” says Hathi. “But I will say that a lot of our big efforts, when it’s an urgent timeline, when it’s a critical priority, we will tell the teams: ‘Spend the time in the room together, as much as necessary.’ It’s as much about everyone understanding the mission implicitly as it is about a team dynamic and the trust that that team needs to have.”

To stay true to the fast-moving-company-within-the-company approach required discipline and, sometimes, a willingness to push back on well-meaning colleagues. “There was a meeting where some very smart people with some very good ideas came in way too late in the process and said ‘Well, we have ideas on how you can communicate this to your target client,'” says Hathi. “And we were like ‘One, do you know who our target client is? And two, it’s too late.'”

Meaningfully Modern

Financial services sites and apps often have a stodgy, cluttered feel, as if they haven’t evolved much in the last decade or so and are aimed at investors who want to dive headfirst into data. From the start, the Schwab Intelligent Portfolios team wanted to build something that emphasized simplicity and polish, and that felt as natural as a smartphone and tablet app as it did inside a desktop browser. The experience begins with a questionnaire that collects information on a new client’s investment goals, comfort level with volatility, and other factors. Based on this information, the service steers the client toward a portfolio of investments designed to match that person’s profile.

The questionnaire is essential to making robo-advising work. “Getting that asset allocation mix correct, consistent with an investor’s objective, with the right risk tolerance so they can sleep at night and stay the course through those invevitable periods of volatility, is really key to helping meet their objectives over time,” says David Koenig, VP and investment strategist for Schwab Wealth Investment Advisory.

“We’re trying to balance getting as much information as we need with keeping it streamlined and getting you through it relatively quickly,” adds product director Christopher Zahner. “We let the user go up or down one model portfolio. But we don’t give them full reign to the entire portfolio selection. We feel that we’ve got a pretty good sense of where you should be. And we believe in the power of the questionnaire.”

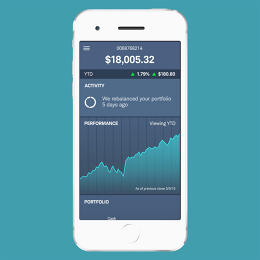

Once a client is up and running, the app continues to err on the side of approachability. “Rather than saying ‘We bought these three ETFs and sold this one,’ we can just say ‘We rebalanced your account,’ and keep it high level,” says Zahner. “If you want to peel back the onion and learn more about we did, we allow you to, but we’re not trying to overwhelm anyone with complexity.”

Features—or the lack thereof—were only part of the challenge. “Those subtleties of a design—the transitions between screens and the motion that are part of what makes a great product—we paid attention to those,” Johnson says. “It wasn’t just about the core functionality. It was the polish that makes a product feel great to a client. Some of those things are almost subconscious.” Since launch, the company has also dressed up the iOS version with features specific to that platform, including Touch ID login and (on the iPhone 6s and 6s Plus) the use of 3D Touch “peek” and “pop” gestures.

By the end of the process, Schwab believed that it had indeed created a superior experience. And so it took interface it had designed for signing up for a brokerage account—normally not the most pleasant of experiences—and made it the standard across Schwab, not just for Intelligent Portfolios.

Ready To Launch

When it came time to seriously test Schwab Intelligent Portfolios, the company drew on a large pool of engaged investors: its own employees. By the end of the testing phase, 1,200 staffers from throughout the company had accounts, helping to squash hundreds of bugs and providing feedback from a variety of perspectives.

The service evolved a bit during this testing—as it had during development—but the people in charge of Intelligent Portfolios were empowered to rely on the courage of their convictions. “We primarily went with the vision,” Tobin says. “People on the outside were like ‘You’re not doing more usability or concept testing?’ [We said] ‘No, we know we have a winner. This is a concept that is going to win in the marketplace, and we’re going to launch a product that’s great.'”

Rather than keeping the project under wraps until it was ready for public consumption, Schwab announced it in October 2014 and allowed interested parties to sign up for more information. Twenty thousand people did, providing early evidence that there might be an appetite for an automated investment service from the company.

Even though the Intelligent Portfolios effort had involved only a small percentage of Schwab employees—who had been given the luxury of cheerfully ignoring their coworkers’ advice if they saw fit—the entire company regarded its debut as an important moment. “There was a palpable buzz within the company,” says Johnson. “‘We did this. This is Schwab building something first class.'”

The billions that Schwab Intelligent Portfolios began to accrue in assets after it launched are the most obvious evidence that it’s off to a strong start. But beyond the raw volume of funds involved, the service’s higher calling is to assist people in meeting their financial goals—especially people who are engaged enough to be investing, but who are comfortable letting day-to-day decisions about their portfolio being made by an automated system.

So far, Schwab says, the data suggests that Intelligent Portfolios’ customers have the mind-set that the service was designed to support. “In the month of January [2016], when markets were volatile in the U.S., 99% of our clients stayed the course,” says McDaniel. “They didn’t change to be more conservative or aggressive, they didn’t close their account. That’s encouraging. That’s what you hope this product would do. You’re trying to give them great portfolios and a product which allows them to avoid the worst of human nature, which is to run when the market is down.”

What got Schwab over any initial trepidition about getting into the robo-advising game, McDaniel says, is the belief that “this is better for investors. “It’ll help more people. Time and time again, that’s been the right formula to win here.”

That formula was established by Charles Schwab himself. Now the company’s chairman, he’s among the people who has an emotional investment in Schwab Intelligent Portfolios’ success at both helping investors and steering the company that bears his name into the future.

“The stack of papers I have here is from a meeting that Neesha and I had today with Chuck on our user experience,” McDaniel says. “He was just curious. He loves to see where we’re headed with it, and share some ideas on how, with this product, you get new investors to convert from a saving mind-set to an investing mindset, which is a big change.”

Fast Company , Read Full Story

(44)