How crazy CEO Pay can be Making climate exchange Worse

CEOs of fossil gasoline firms are raking it in—and their pay provides them little incentive to take into accounts the long run.

September 15, 2015

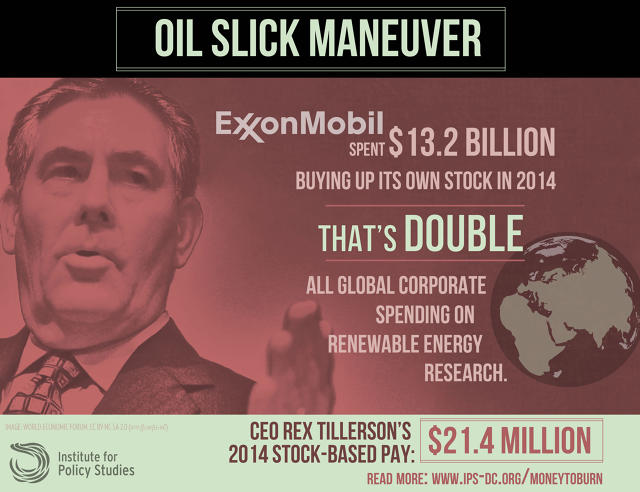

last year, ExxonMobil CEO Rex Tillerson raked in $33.1 million—including bonuses for brand new drilling within the Arctic and the Canadian tar sands at a time when climate scientists argue that burning even the arena’s current reserves will fry the planet.

How a lot does stratospherically excessive CEO pay influence climate alternate?

a brand new record from the Institute for coverage studies, a innovative assume tank that research government compensation, argues that the extra fossil gasoline leaders make, the less seemingly they’re to pursue possible choices like renewable energy.

A hefty chunk of CEO compensation at oil, fuel, and coal corporations comes within the type of stocks that vest speedy—so executives have an incentive to check out to fast push up share values without caring about longer-time period consequences.

“They regularly vest over three or four years, whereas local weather change performs out over many years,” says Sarah Anderson, one of the authors of money to Burn: How CEO Pay Is Accelerating local weather alternate.

whilst some power corporations lose money, CEOs nonetheless maintain earning more. before the coal company Peabody went bankrupt, executives cashed in on $47 million in stock options. equivalent tales took place at different coal corporations. After the coal trade started to crash, executive pay on the top corporations went up eight%.

the identical factor may occur in oil and gas sectors, because the market share for renewables increases:

the usa’s oil and fuel sector might also face concern pressures. however executives in oil and gasoline, like executives in coal, be aware of they face nearly no private monetary chance. they’re going to have, below our present government pay gadget, little incentive to innovate and shift to a brand new, extra sustainable vitality future.

CEO pay also will get a lift when firms pour cash into buying again their own shares (ExxonMobil, for example, paid $thirteen.2 billion to repurchase inventory closing 12 months, whereas shareholder value declined). the most important vitality companies spend virtually six instances more on buybacks than your entire personal sector spends on renewable power research.

Fossil gasoline executives make around 9% greater than reasonable CEOs of S&P 500 corporations—even though, on average, the oil, fuel, and coal companies don’t seem to be bigger than the remaining.

“we expect it has rather a lot to do with the fact that they’ve been in a position to truly externalize the costs of their activities—that they may be really no longer buying the burden that they may be placing on taxpayers and communities with regards to the environmental and climate damage,” says Anderson. “they’re additionally heavily backed, as we level out in the file. They’ve in point of fact been propped up, to a definite extent.”

The problem of shifting an oil firm to renewables evidently goes some distance beyond CEO pay to deeply held beliefs concerning the worth of fossil fuels. earlier this 12 months, Tillerson mocked a shareholder who brought up renewables at a gathering, announcing the corporate doesn’t put money into renewables as a result of “we select to not lose money on purpose.”

but Anderson argues that CEO pay is a good position to start, and that Tillerson’s compensation helps isolate him from new ideas. “I do think that CEOs of major corporations in the U.S. do tend to operate in form of a bubble, and i believed that comment on the annual meeting was truly reflective of that,” she says.

As a primary step, she thinks that bonus incentives for fossil gas CEOs must trade. “they have got metrics now that continue to reward executives for growing their carbon reserves, despite the fact that they are already sitting on way more than must ever be burned if we’re going to avoid a local weather catastrophe,” she says. presently, none of the 30 corporations within the study have incentives for transitioning to renewable energy. A 2nd step might be making shares vest after handiest a decade, so executives consider a relatively longer-term view.

As consideration on climate trade builds, the file’s authors are hoping that more people will start to consider the impression of CEO pay. “i am occupied with the Pope heading into city quickly, and how individuals are expecting him to claim a lot concerning the want to actually turn out to be our financial system to deal with the local weather exchange problem,” Anderson says. “i feel it is a very overpassed drawback to that a lot-needed transformation.”

[Top Photo: Hans Neleman/Getty Images]

(126)