How everything–everything–changed for Netflix this week

Remember the first half of the second week of July? Those really were the good old days. Netflix was riding high, its stock at almost $419 a share. Rivals were fighting over Fox and Sky in the hope of competing with Big Red.

And then, it happened: On Monday the 16th, Netflix badly missed its subscriber growth forecast. The stock plunged as low as $344, recovered a bit and then trended downward to close Thursday at $364.23. More hot takes were launched (or relaunched!) by both bulls and bears than new Netflix series.

Amid the market hubbub, though, several things happened that signal a new trajectory for the streaming giant. Let’s take a look!

1. Netflix is going to promote its blockbuster franchises the same way Disney does

Earlier this year, Fast Company honored Chris Jaffe, Netflix’s VP of product innovation, as one of our Most Creative People in Business. In interviewing him about how he approaches his work, he pooh-poohed the Disney-style marketing approach of ladling out teaser trailers for the real teaser trailer and releasing still photos which reveal which A-lister will be appearing in the background as some obscure character who appeared only in Iron Man comic No. 342 in a movie that comes out in 2021.”I’ve done exhaustive testing,” Jaffe said. “Nine, 12, 18 months out—and it doesn’t seem to resonate.” Rather, he stated that Netflix uses a variety of means to alert people to new content when it’s “actionable,” which I interpreted to mean when one can add it to their watch list and be reminded when it’s available.

So, how then to explain Netflix releasing a still on Monday of Olivia Colman as Queen Elizabeth II in season 3 of The Crown, which comes out sometime in 2019? Or, Wednesday’s drop of the first look at Helena Bonham Carter as Princess Margaret?

Hope. pic.twitter.com/BFeE54Ro6C

— The Crown (@TheCrownNetflix) July 18, 2018

Did I mention The Crown‘s new season debuts next year?

How about the season 3 teaser trailer for Stranger Things, which also dropped on Monday? Or the first look on Wednesday at Narcos: Mexico for that series’ reboot? I haven’t been this teased since high school!

These first looks aren’t really “actionable,” right? Should I print them out and tape them to the back of my phone? Maybe the desired action is to get me so amped that I sign up for Netflix today, which it may be!

The company has previously hyped a series well before one could do much about it. In 2017, for example, Netflix bought a Super Bowl ad to tease Stranger Things season 2, the spot airing eight and a half months before the series’ release.

That said, there’s something a little sweaty about the efforts of this week when you combine them with some of the earnings info. Marketing spending rose 92% in the second quarter compared with a year ago, to $526.8 million, and yet subscriber growth missed estimates by 1 million. The company projects spending $2 billion on marketing in 2018, which is a 56% increase from the year before.

Then you have the commentary from the earnings interview, where CEO Reed Hastings said the company was exploring how to “help title brands really maximize their potential in the overall system and we’re doing lots of tests trying different methods in different countries, learning what’s the most efficient ways to build demand for a title. So there’s tremendous amounts of learning going on there.” CFO David Wells followed up by noting that 80% to 85% of that marketing spend was around “title brands,” meaning individual series like The Crown and Stranger Things.

I would take away a few things from this evolution. One, this is as clear a sign as any that what got Netflix to 130 million subs is not necessarily going to get them 260 million, and they know they have to adapt. If it means embracing Disney-style marketing, why not steal from the best?

Two, as we previewed last year when Disney first announced its streaming strategy, Netflix has to build up these title brands into cash gushers, and promotion is only the start of it. To offset all that marketing expense, expect to see more merchandising to make money beyond the $8 to $14 a month Netflix currently gets from subscribers.

In particular, keep an eye on gaming. Although Netflix denied that it would launch its own gaming service, as rumored last month, it is launching a Stranger Things-themed version of Minecraft: Story Mode with Telltale Games later this year. Gaming revenue from license deals like this could ultimately become an important source of additional revenue for Netflix.

2. Netflix is no longer just a video streaming service

Just as the video streamer doesn’t have to launch its own gaming service to generate revenue from gaming, it doesn’t have to launch its own streaming audio service to create revenue opportunities in that space.

On Wednesday, Sirius announced a deal to program its own comedy channel on Sirius XM satellite radio starting in January 2019. This partnership got some play but not enough! Five and a half years ago, Netflix more or less owned nothing. Now it so dominates the popular art form of stand-up comedy that it can make this deal to program what is essentially a 24-hour ad running on another service. It is not clear from reports what Netflix is being paid to populate this comedy radio network but typically a content owner would reap licensing fees for such a valuable library of material. So Netflix gets paid, it reaches 33 million Sirius subscribers to woo them to sign up for Netflix or spend more time watching it if they’re already subscribers, and it amortizes the crazy prices it’s been paying to dominate standup.

Within the last year, Netflix has also been flirting with podcasts, launching a companion series to its Wormwood docuseries in December 2017 and then last spring, it created its first ongoing podcast, You Can’t Make This Up, which is devoted to helping Netflix subscribers discover nonfiction programming on the service.

That’s two vectors into audio, even if they’re mostly part of Netflix’s marketing efforts. The Wall Street Journal report on the Sirius deal already stated that Netflix promises to produce original content for its Netflix is a Joke channel. Hmm . . . which other companies in the tech-media sphere have streaming audio platforms and video aspirations? Apple and Spotify. Hey, didn’t Spotify make an exclusive podcast deal less than two months ago with Amy Schumer, the comic whom Netflix paid $11 million for a special last year? Now that Netflix is going to leverage its comedy dominance into radio, podcasting can’t be far behind, especially as it seeks to cement relationships with both stars and up-and-comers that drive engagement. Do not be surprised when Netflix makes a similar deal with one of its comedy stable to get into podcasting, or if it makes some kind of first-look deal with a prominent comedy podcasting network.

Netflix has been steadfast, as recently as Monday, two days before it officially entered the audio business, that it is solely focused on video. During its earnings conversation, analyst Todd Juenger expressed that “investors still want to know your desire or appetite for . . . other expansions of your platform” such as audio or gaming. To which chief content officer Ted Sarandos replied, “No change in our long-term views . . . we have such an opportunity in movies and TV shows of many types around the world that it’s consuming every bit of energy and excitement that we have.” Nope! I’ll make another prediction: Netflix also enters the gaming business directly in the next 18 months.

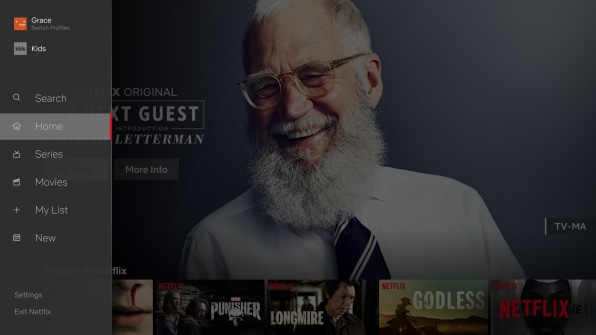

3. Netflix’s new TV interface confirms that it’s competing against YouTube as much as Disney

During that same earnings call, Netflix execs previewed that they’d be rolling out a new interface for television viewing, which they then did on Wednesday. The new UI is cleaner and makes it easier for subscribers to select between movies, series, and content they’ve saved to “My List,” as you can see below.

In introducing the new look, a Netflix director of product innovation expressly cited discovery as a key imperative in the redesign. Netflix wants users to find and consume more content, because the game is in becoming TV. It is in getting people watching as much as, and then more than, they’re watching YouTube. CEO Reed Hastings has verbalized his YouTube envy on multiple occasions.

Entertainment should not be a zero-sum game, but at these stakes, with billions being spent annually on content, with Disney acquiring Fox’s studio and library and entertainment cable channels for more than $70 billion, it has become one. To win it, viewers need not–cannot–consider any other option.

4. Reed Hastings’ book deal starts the clock on succession talk

Also on Wednesday (kind of a momentous day!), CNN’s Dylan Byers scooped that Hastings would be writing a book about his leadership strategy and Netflix’s company culture, to be published next year.

There are two kinds of CEOs who write leadership books: Ones who are interested in building a personal brand and becoming what the comedian Dave Anthony once referred to as a classic American gasbag, and ones who want to establish their legacy and tell old war stories (which by definition is a classic American gasbag thing to do). The Hastings book is almost certainly the latter.

Hastings turns 58 in October, a few weeks before Apple CEO Tim Cook also celebrates his 58th birthday. They are the oldest CEOs in the fabled FAANG group of companies that have fueled all the growth in the stock market the last few years. No one is suggesting that Hastings is too old for the job, but hell, Walmart is reportedly coming after his business again, just like it did in 2002! When you experience that kind of time loop, you’re entering the I’m-getting-too-old-for-this-shit zone. A book then has a valedictory air about it.

Of course, Hastings’ leadership tome may never get published. He could decide it would be fun to whip Walmart twice. Disney CEO Bob Iger, who is 67 and has forestalled retirement twice, signed a book deal in the fall of 2016, and there is no sign of it. But just as Iger has had to wrestle with succession issues for the last several years, so too may Hastings soon hear investors wonder out loud about who’s going to run this global tech-media behemoth after him and demand he anoint someone, or at least publicly groom candidates to replace him.

So print out this week from your calendar and tape it to the back of your phone: It feels like we’ll look back on it as the one when Netflix completely changed its course, and perhaps its destiny.

(20)