How To Brand, Market, And Sell Weed Without Breaking The Law

It ain’t easy going green. Just ask the folks at Dixie Elixirs & Edibles.

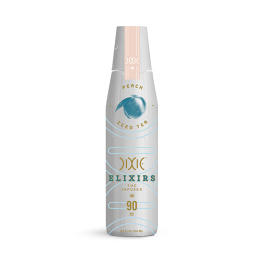

Earlier this year, Dixie Elixirs & Edibles, perhaps Colorado’s best-known cannabis brand, took its THC-infused drinks off the market. It had no choice.

That’s because a couple of weeks later, on February 1, new packaging regulations for recreational marijuana edibles went into effect in the state and the screw top aluminum bottles were no longer compliant.

The new rules require that drinkable cannabis products come in childproof, resealable packaging. Dixie also had to come with a way to measure out a single dose, like the tiny plastic cup on a bottle of cough syrup.

Dixie enlisted a Colorado packaging company called TricorBraun to design a new bottle that met all the specs, but by the time the new bottles reached dispensary shelves last week, the company had lost 90 days of selling its flagship product.

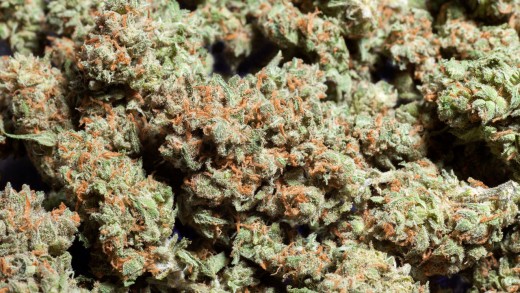

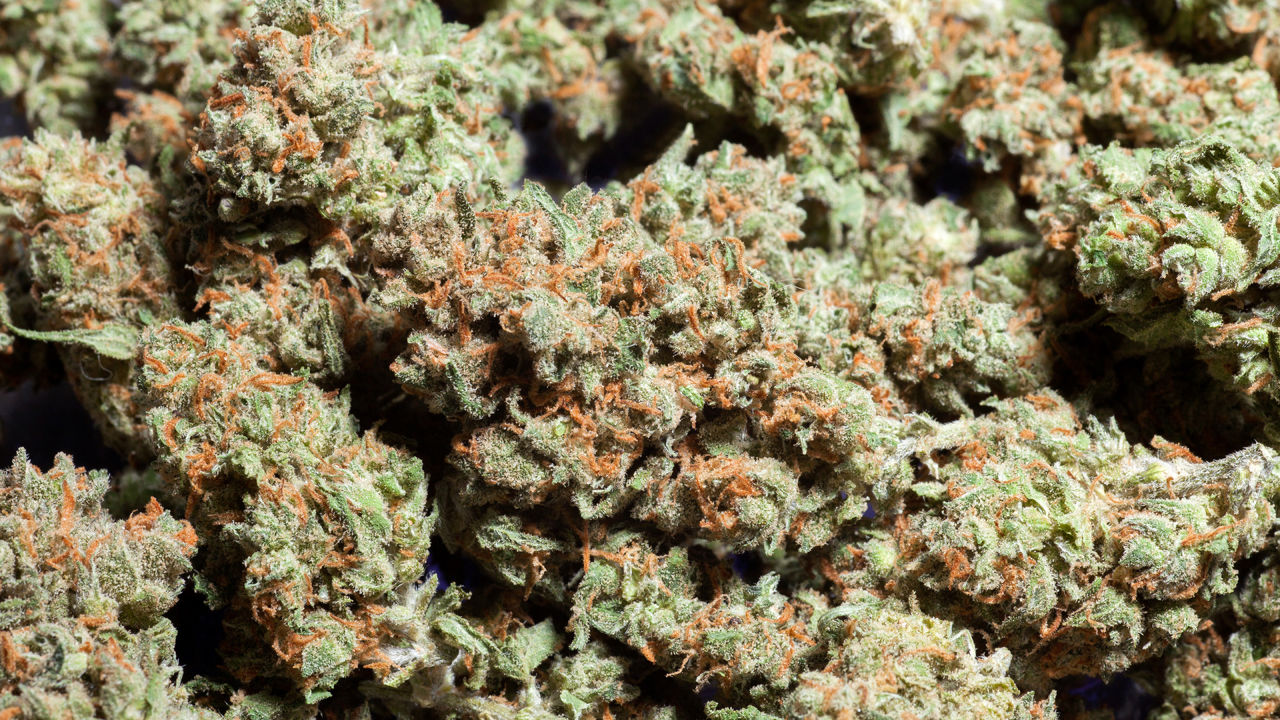

Until fairly recently pot was sold in pretty much one way: dealers distributed green buds in small plastic baggies for $10 or $25 bucks a pop. But as the legal cannabis industry becomes a normal part of life in Colorado, Washington, and elsewhere, packaging has emerged as both a safety issue and one of the few ways brands can distinguish themselves from competitors whose products also get people high.

Seeking to expand their customer base, companies are spending big on packaging that resembles what you find in high-end grocery and beauty stores and pharmacies. While some companies use their labels to wink at the industry’s edgy past, shrewd brands believe the right packaging will attract older and professionally established users. That is to say: parents—and their parents, too.

Since recreational marijuana went on sale in Colorado last year, the marketing of edibles has presented a considerable challenge. Parents fear that cannabis-infused candies, cookies, and other treats could appeal to their kids. And since edible products don’t kick in until an hour or more after they’re consumed, consumers are sometimes tempted to eat more they than is advisable. (The data is spotty but Coloradans legalized medical marijuana in 2000, and for the last decade the state appears to have had a higher rate of marijuana-related emergency room admissions than the rest of the country.)

Before February 1, recreational users could buy a cookie or candy bar infused with 100 mg of THC, the psychoactive chemical in marijuana. The state however considers 10 mg an appropriate dose. Now these edibles must be packaged in such a way that a “reasonable person” can intuit how to divide the product into doses of 10 mg or less. The new rules sent companies across the state scrambling to keep their products in stores.

Initially, Dixie, established in 2010, sold its drinks in glass bottles. At the time, only medical marijuana was legal but there were far fewer regulations governing how it looked. Manufacturing standards in the industry weren’t as advanced, and Dixie CEO Tripp Keber says the glass bottles reassured customers that there weren’t globules of oil or raw plant material—or “dingleberries,” as he put it—floating in their drink. As the company grew, it introduced the aluminum bottle. Colorado now requires all edibles to come in opaque packaging.

Dixie recently introduced a chocolate bar called the Toasted Rooster which can be broken into 12 pieces of 7 mg each. To make it childproof the box contains a tray with a tab on each of the two longer sides that stick through slots in the box’s side. The two tabs need to be pushed down simultaneously to slide the tray out, as if it contained the nuclear codes. I tried to open it recently and couldn’t do it.

Dixie also sells cannabis infused mints in two varieties, “awakening” and “relaxing,” that are orange zest and peppermint flavored, respectively. While both contain 5 mg of THC per mint, each features supplements like “Siberian ginseng,” and ashwagandha that supposedly produce different kinds of highs. This is in keeping with an industry that’s eager to diversify how consumers think about cannabis and open them to the idea that it’s appropriate throughout the day. The mints’ small box, design, and format also works as a kind of marketing.

“Candidly, it’s very easily dropped into your purse, and allows for discretion of consumption,” Keber, who is clean cut and wore a pink shirt that you might find on a fashion-forward, Wall Streeter said. “Not that we would ever encourage it but I would imagine these probably leave the state by the metric ton.”

While this may be true, it’s impossible to know for sure. Like just about every company in the industry, Dixie is private and doesn’t share revenue figures. The total legal cannabis market in Colorado last year was $700 million, and about half of that was in edibles and vape-related sales.

Colorado still has a medical marijuana program and, confusingly, the packaging rules are not as strict for products characterized as medicinal. Like Dixie, many companies sell both. Medicinal marijuana products don’t have to be divided into appropriate dosing sizes and a package can contain more than 100 mg of THC.

Patients who have medical cards also pay roughly 25% less per mg of THC. Dispensaries can sell recreational, medical, or both. Dixie’s medical products include a “Scrips” line, which in its packaging and marketing goes even further in suggesting the products’ health uses. Scrips are 50 mg THC pills available in “awakening,” “relaxing,” and “pain relief” varieties, each with its own blend of dietary supplements.

“The pill format is small, it’s compact and, for patients, it’s more in line with a medicinal or pharmaceutical approach to treatment,” Dixie Chief Marketing Officer Joe Hodas says. Many patients, he says, take several hundred mg of THC daily for pain relief and they apparently prefer a “smaller footprint, higher dose” product. Hodas claims the company is developing a next generation of products that will be more tailored to specific ailments, but he declined to elaborate.

As long as they don’t attract attention from the FDA for making false claims, cannabis companies are eager to convince consumers that their products will help with a broad spectrum of health problems. Among doctors, the extent of cannabis’s medical benefits remains controversial. It’s fair to say, however, that after ingesting a 50mg THC pill, many recreational users would be well past caring about whatever supplements had been added to it.

In an industry with restricted opportunities for advertising, packaging can catch customers’ attention on dispensary shelves. But it’s also one of the most powerful tools the industry has to rebrand itself as a mass-market product.

“How many times on CNN have you seen that scraggly, gnarled finger guy who’s smoking that dirty-ass joint and blowing smoke?” Keber asks. “It’s the constant B-roll for 420. Wouldn’t it be refreshing if they showed Lindsay [Topping, Dixie’s director of marketing, who would have no trouble fitting in at a more conventional company] and her husband sitting in the backyard, consuming [a Dixie beverage]?”

Packaging from other companies promotes cannabis as part of healthy living. A Denver-area manufacturer called ebbu has created a label modeled after the nutritional information found on packaged food. It lists the THC content, which is required, but also the presence of other chemicals found in the plant that, in cannabis circles, are widely believed to have health benefits.

The best known of these, cannabidiol (CBD), also occurs in industrial hemp and could find a home in the nutraceutical and dietary supplement market. In Colorado, marijuana products containing high levels of CBD sell for a substantial premium even though its psychoactive effect is negligible. (CBD products are easy to find online even though the chemical’s legality is uncertain.)

The Ebbu label, which will appear on a soon-to-be-released vape pen and cannabis-oil product line called Ebbu Raw, will also include the cannabis strain used and any non-organic chemicals employed in the cultivation or manufacturing process.

Ebbu co-founder Michael “Dooma” Wendschuh, says the label is a way to show off the company’s scientific capabilities while also building trust with customers. The box itself is white with bold strokes of orange, evocative of an expensive personal care product.

Having seen how successful wine manufacturers have been putting animals on their packaging, some cannabis businesses have borrowed from that critter-happy playbook. The edibles company Mountain Medicine, for instance, has a goat mascot, and owner Jaime Lewis plays up the theme with slogans like “Get your goat on” and “Don’t graze and drive.” “I sometimes call myself the mama billy goat,” she says. Due to the new packaging restrictions, Mountain was forced to change its recreational products to “bites,” tablets about the size of quarters that come in a childproof blister pack. The company’s medicinal line still sells pretzels, brownies, and other irregularly shaped items.

While expensive packaging is both a burden and a source of pride for manufacturers, it’s not clear how much it influences sales. Truman Bradley, an owner at Southwest Alternative Care, a pair of medical dispensaries in Denver, suggested that packaging probably means more to neophytes than longtime users, who presumably make up more of the medical dispensaries customers. “Any kind of marketing,” Bradley says, invoking a sales adage as old as history’s first sale, “is only as good as the product behind it.”

Related: Meet the world’s first cannabis editor

Fast Company , Read Full Story

(295)