I don’t owe this money! Aggressive debt collectors are more likely to chase you in these states

Maybe the only thing worse than spam calls are calls from debt collectors—especially if you don’t owe any money.

A new report from LendingTree analyzed collections complaints to the Consumer Financial Protection Bureau (CFPB) for the past three years. A whopping near 80% involves fraudulent or mistaken debt. More than a quarter (26%) concerns fraudulent or nonexistent credit card debt, and in 23.5% of instances, there is no identification of the type of debt to the person who allegedly owes money. One in five people reported that the debt did exist but was either paid off or resolved in bankruptcy.

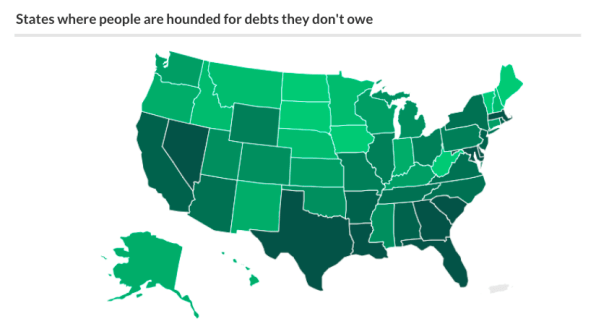

This is a bigger issue in the South, where the LendingTree report finds the highest incidence of complaints from consumers claiming that the collectors are hounding them for debt they don’t owe. Topping the list of states with the most incidence of this is Georgia, where residents are three times more likely to be called on to pay what they don’t owe, and where consumer protection laws earned an F grade from the National Consumer Law Center (NCLC). Following closely behind are Texas and Nevada. Washington, D.C., has the lowest rate of complaints.

It’s important to note that CFPB complaints aren’t verified but are still likely a good indicator of where the problem is worse. According to Federal Trade Commission data, older citizens and members of the military are often targeted for fraudulent claims. LendingTree chief credit analyst Matt Schulz says to avoid scammers, it’s important to pay attention to what they’re saying.

“Generally speaking, debt collectors can’t claim to be from the government, threaten to have you arrested for not paying your debt, force you to pay debt that you don’t owe, or harass you verbally or physically,” Schulz says, “If that starts happening, don’t stand for it. Complain to the CFPB, and make sure that you’re heard.”

You can see the full state-by-state list here.

(30)