If you wish to have life insurance, think twice prior to Getting A Genetic check

Jennifer Marie* will have to be a great candidate for life insurance: She’s 36, gainfully employed, and has no current scientific issues.

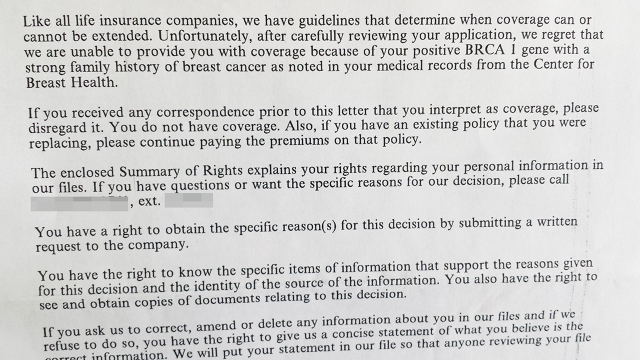

however on September 15 closing yr, Jennifer Marie’s application for existence insurance used to be denied.

“unfortunately after carefully reviewing your utility, we remorseful about that we are unable to will give you protection as a result of your certain BRCA 1 gene,” the letter reads. within the U.S., about one in four hundred women have a BRCA 1 or 2 gene, which is associated with elevated risk of breast and ovarian cancer.

Jennifer Marie provided a replica of the file to fast firm on the condition that she and her insurance coverage firm remain nameless, as she remains to be hoping to attraction the rejection.

consistent with latest estimates, fifty five% to sixty five% of girls who inherit a harmful BRCA 1 mutation will boost breast most cancers by the age of 70. against this, 12% of the final population might be recognized with breast most cancers. however the presence of the gene mutation is on no account a loss of life sentence. now not everybody with the BRCA mutation develops most cancers, and some knowledgeable patients are seeking highly efficient preventative therapies to reduce the chance that they’ll ever get ailing.

“folks who in finding out they have the mutation can substantially reduce their chance,” says Laura Esserman, a surgeon and breast cancer oncology specialist at UC San Francisco. “information is energy.”

due to the fact 2008, with the passing of the Genetic data Nondiscrimination Act (GINA), the federal govt has barred health insurance corporations from denying protection to those with a gene mutation. but the regulation does now not apply to existence insurance firms, lengthy-term care, or disability insurance. These corporations can ask about health, family historical past of disease, or genetic knowledge, and reject these which might be deemed too risky.

affected person advocates say they are increasingly involved in GINA’s limitations, given the explosive growth of genetic testing. Spending on genetic exams has reached $5 billion every year and is on target to achieve $15 billion to $25 billion inside a decade, in step with a latest learn about commissioned by using the research arm of UnitedHealthcare. The American clinical affiliation found that physicians use about 2,000 of these tests for 1,000 different illnesses. The check makers vary from Silicon Valley startups, reminiscent of Counsyl and coloration Genomics, to biotech giants like Myriad Genetics.

“GINA was once designed to free individuals from fears of discrimination so clinical research can scale,” says Dr. Robert inexperienced, a scientific geneticist and doctor who directs the genomics division at Brigham and ladies’s health facility in Boston. “i’m now wondering whether or not it worked or no longer. individuals began off afraid they usually evidently nonetheless are.”

the upward thrust Of Genetic assessments

When GINA first handed in 2008, genetic tests were dear and now not all that widespread. In 2011, the late Apple CEO Steve Jobs spent $one hundred,000 to discover the genetic foundation of the cancer that killed him. lately, a company called Illumina can sequence an individual’s whole genome for $1,000.

contemporary advancements in the box of genetics have unfolded major opportunities for scientific growth, together with the promise of past detection of illness and more personalised remedies that could wring savings from the united states of america’s multi-trillion dollar well being care tab. The White home’s $215 million Precision medicine initiative is reliant on the further dissemination of genetic tests to display individuals for ailments, and identify people who are unable to soundly take medicines.

The BRCA take a look at is now on hand for as little as $250, enabling many sufferers to pay for it out of pocket. Dozens of lab-trying out companies have developed a BRCA check, together with colour Genomics and Counsyl. The take a look at even has a star spokesperson within the type of Angelina Jolie, who underwent a preventive double mastectomy in 2013 after studying about her cancer possibility, and penned a widely circulated op-ed on her expertise.

As these assessments transform more pervasive, affected person advocates are ramping up their campaign to finish so-known as genetic discrimination.

“Our biggest concern is that folks aren’t aware that this information can be utilized against them,” says Lisa Schlager, vice president of neighborhood affairs at force, a nonprofit workforce that supports women with hereditary breast and ovarian most cancers.

Northwestern Mutual, a lifestyles insurer that has been fairly express about its approach, does no longer require an applicant to bear a genetic take a look at. however firm spokesperson Betsy Hoylman says that actuaries do routinely ask about scientific and diagnostic testing, which may embody genetic checking out, to be able to “treat present and potential customers reasonably.”

“A consumer’s failure to cooperate during the underwriting process may end in an insurance company declining to difficulty a policy,” says Hoylman. Oncologists say this form of discrimination would possibly discourage folks from getting genetic tests.

Schlager has considered each men and women sharing their experiences about genetic discrimination on pressure’s personal facebook team and other on-line boards. while her workforce hasn’t performed any analysis or polling on the topic, they imagine it is well-liked enough to warrant more attention. “it’s a peculiar loophole,” she explains. “however there are quite a lot of these. And these Precision medicine initiatives have not in reality caught up.”

but some well being insiders say that it won’t be straightforward to change the rules. Sharon Terry, a patient advocate who spent more than 14 years preventing for GINA, says the opposition from the insurance trade is still as sturdy as ever. Terry is the CEO of a Washington D.C.-based totally nonprofit called Genetic Alliance that advocates for the health benefits within the field of genetic analysis.

“in the beginning of this decade-lengthy saga, the bill [GINA] included each kind of insurance,” says Terry. however early proponents of the invoice threatened to drop their give a boost to if it integrated disability, life insurance, and lengthy-term care. Genetic Alliance ultimately acquiesced to their calls for.

“It was once the appropriate factor to do,” says Terry. “The invoice would never, ever, ever have passed in any form. Many payments don’t, and the opposition on this one was once robust.”

On a state stage, Terry has seen extra progress in contemporary years. California handed a invoice referred to as CalGINA that now not best prohibits genetic discrimination in employment and health insurance, but in addition in housing, schooling, loan lending, and elections. Oregon and Vermont even have vast regulations prohibiting the use of genetic information in lifestyles, lengthy-term care, and incapacity insurance.

no longer All insurance Is Created Equal

The business makes the case that the industry version would fall apart if companies are compelled to simply accept those with a high possibility of cancer and quite a lot of genetic illnesses into the pool.

there is some truth to this argument. Brigham and ladies’s medical institution’s Dr. inexperienced studied the habits of those who discovered by means of a genetic check that they had been predisposed to Alzheimer’s disease. These patients were five occasions as possible to buy lengthy-time period care insurance coverage than those in a regulate staff.

And moderately uniquely, well being insurers are ready to offset their possibility with the aid of taking in month-to-month premiums from younger and healthy americans (the affordable Care Act’s “particular person Mandate” requires that many individuals get medical health insurance or face a penalty). by contrast, a decision to purchase existence insurance or long-time period care insurance is optional. individuals who observe for policies might have purpose to consider that they want extra protections.

“All sorts of insurance coverage are usually not created equal,” says Mark Rothstein, a founding director of the Institute for Bioethics, well being coverage and regulation at the university of Louisville faculty of medicine. “I see health insurance on one aspect of the spectrum, lifestyles insurance on the opposite, and disability and long-term care somewhere within the middle.” long-term care, for example, is covered partially by means of Medicaid.

“the large query for our society is where we want to find the chance.” Rothstein has spent over a decade on this difficulty, and wrote a guide on the topic in the late Nineties: Genetic secrets: defending privacy and Confidentiality within the Genetic generation.

As Rothstein explains, all lifestyles insurance coverage corporations interact in a undeniable level of “discriminating between claims.” however there are limits. Most existence insurance coverage firms don’t discriminate on the root of race, regardless of the health disparities between totally different ethnic groups. Many companies, however, do distinguish between claims on the basis of gender, as ladies tend to live much longer than men.

It continues to be to be seen whether or not society will proceed to view it as suitable for life insurers to discriminate on the root of individuals’s genetic information, particularly if it’s a genetic marker like BRCA half that doesn’t at all times lead to most cancers. A slew of latest research have shown that folks who take a look at sure for the gene mutation and subsequently initiate preventative measures, like MRI screenings and mammograms, are very more likely to trap cancers past. and a few opt for surgical processes, like mastectomies, which significantly decreases their risk. that after taking preventative measures, her chance of getting breast most cancers dropped from 87% to 5%.

but Rothstein fears that many lifestyles insurance companies don’t seem to be subtle enough of their information of genetics to delineate between the quite a lot of varieties of tests, and even fully remember the consequences. James Heywood, founder of a startup known as PatientsLikeMe, says he used to be denied life insurance coverage from one insurance company after his brother passed far from a revolutionary neurodegenerative illness called ALS. Heywood had taken a take a look at and shared the results, which showed that he did not have the chance factor for the illness.

“It’s an trade that’s a whole lot of years previous,” says Rothstein. “They make a lot of money doing things the way they’ve all the time accomplished it.”

“Chilling effect”

GINA’s loophole hasn’t simply caught the eye of sufferers’ rights groups. scientific researchers are additionally growing an increasing number of involved that it will set again their clinical trials and studies.

green directs a randomized trial to study gene sequencing in adults known as the MedSeq challenge, which relies on sufferers agreeing to retailer their genome sequencing knowledge in their scientific document. As he not too long ago said within the New England Journal of medicine, 25% of patients who declined to participate within the learn about referred to fear of discrimination from life insurance coverage firms as their main cause.

green expects that more patients will bow out of medical studies and genetic exams as they develop into aware of the downsides.

“sooner than GINA handed, a lot of people had been afraid that this new generation of genetic testing wouldn’t embrace proper protections for sufferers,” says inexperienced. “however there’s nonetheless reason to be afraid that corporations will discriminate towards whole households.”

Dave*, a father from Washington, D.C., who agreed to talk on the situation of anonymity, recently learned that his sister has the BRCA gene. His physician prompt that he get a genetic check, as males with dangerous BRCA mutations have an elevated chance of prostate cancer. Dave, who says he’s heard copious “horror stories” of people being denied life insurance coverage, ultimately decided against the test.

“On the one hand, i do know that there’s something I might do that would help prolong my life,” he says. “but i’m terrified that my insurance coverage firm will in finding out if I get a good outcome.” If a lifestyles insurance company uncovered that a affected person withheld treasured knowledge, they would possibly make a case for “guilt with the aid of omission.”

“this is not the calculation I need to be doing in terms of my well being.”

discovering A heart ground

With the rising incidence of genetic checks and instruments, the talk on discrimination within the context of lifestyles insurance has develop into more urgent and intricate. In latest months, Terry’s team Genetic Alliance has been combating towards proposed rules that would enable employers that supply well-being applications to penalize staff and their spouses in the event that they refuse to participate in quite a lot of questionnaires and surveys about their well being. Genetic Alliance argues that such bills would directly undermine GINA.

patient advocates have pushed for an extension of GINA for many years without success. however some experts see a center-ground means. Rothstein suggests that insurers should at a minimum “supply a life insurance plans masking a minimal quantity at an inexpensive fee and with out a well being questions (together with about genomics) requested.”

in the period in-between, some genetic-testing companies are taking steps to teach patients about their risks so that they won’t be blindsided like Jennifer Marie. color Genomics says details about genetic discrimination is available on its web site, and its genetic counselors will teach sufferers concerning the issue. 23andMe, which up to now supplied BRCA 1/2 tests, says it’s in give a boost to of state and federal rules to “add life, incapacity, and lengthy-term care to a listing of protections.”

Rothstein says that there’s no easy or simple brief-term solutions to the issue of genetic discrimination.

“I wish that we could snap our fingers and finish the issue,” Rothstein says. “but it surely’s a very difficult one who many people were working on for years.”

related: must This fast company Editor Take 23AndMe’s Spit test?

*The closing names of sources Jennifer Marie and Dave have been not noted to offer protection to their privacy.

have you ever been denied insurance as a result of a genetic test result? Get in contact: Cfarr@fastcompany.com

fast company , learn Full Story

(46)