Meet Relay: Stripe’s New, Simplified, cost-Processing gadget

The payment-processing firm at the back of firms reminiscent of Lyft will can help you make purchases while not having to awkwardly fill out online forms.

September 14, 2015

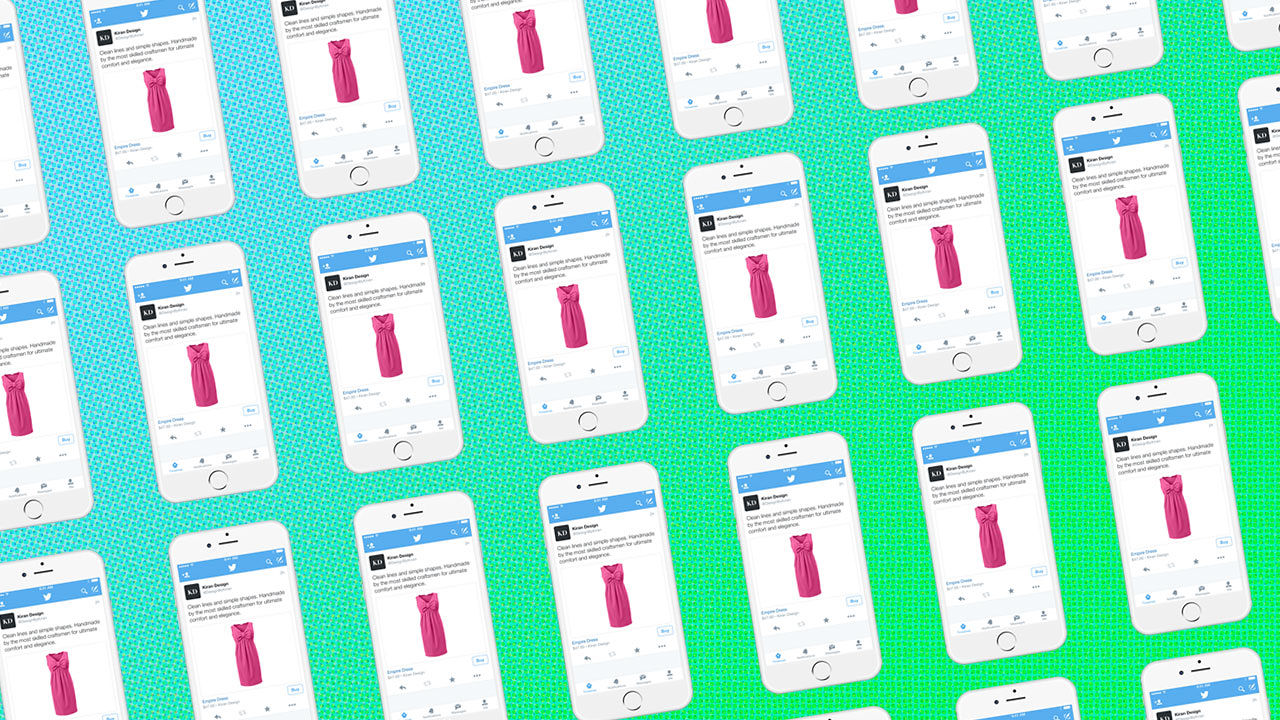

even though you have not heard of Stripe, you will have used it when you’ve known as a automobile on Lyft, ordered a supply on Postmates, or backed a venture on Kickstarter. The younger firm that approaches billions of dollars a 12 months for tens of heaps of businesses and startups lately presented Relay, a provider that provides one-click on shopping for to mobile apps, most notably Twitter. It additionally lets individuals buy straight from the ads that run in mobile apps.

“the purchase float on mobile, that itself is totally broken lately,” said Patrick Collison, Stripe’s 27-12 months-previous CEO and cofounder, studying from his speech at a gathering in San Francisco this morning. “nobody in their right thoughts would need to go through it. it is as if we’ve got deliberately designed something to discourage purchases.” He made the purpose by exhibiting on a large reveal the process from clicking a hyperlink on a mobile instrument to filling out a huge order type. It took as a minimum a minute, and that assumed no typos within the delivery deal with, bank card information, or different small print.

Stripe’s proposed repair, Relay, builds the entire shopping for course of right into an app that integrates it—and Twitter was once the biggest example introduced today. as an alternative of clicking on a link in the Twitter app and going off to an e-commerce site like Warby Parker’s, somebody can now click on proper on a buy button within the tweet and end the acquisition inside of Twitter. “Twitter is already being utilized by merchants of all sizes and styles as a direct-to-shopper distribution and conversation platform,” introduced Nathan Hubbard, Twitter’s head of commerce, all through Collison’s presentation.

So how does Twitter have my credit card info and tackle? It does not, and neither does Warby Parker. that’s all saved with Stripe—should you’ve already bought from any web page the usage of the Stripe Checkout carrier and agreed to let them store your shopping for information. “The more that [customers are] happy with the saving of the cardboard, the quicker and the more frictionless the experience is going to be,” Claire Hughes Johnson, Stripe’s COO, informed fast firm.

So who the hell is Stripe? may well be the next question a consumer asks. Hughes Johnson thinks that will not be a priority, as a result of individuals will trust an app like Twitter and will not concern in regards to the plumbing that makes the purchase conceivable. “i believe that is nearly all of this situation, that it is actually with Twitter,” she said. “And we just energy it.” in truth neither Twitter, Warby Parker nor some other company using Stripe or Relay has your bank card info. that all sits with Stripe.

along with Twitter, Stripe announced another companions, together with purchasing site and app ShopStyle, which lets customers peruse merchandise from 1,four hundred outlets, and Saks Fifth Avenue. “we don’t allow funds for Saks Fifth Avenue,” says Hughes Johnson. “but now we’re enabling them to sell products although an integration thru Stripe’s Relay.”

every other place you’re going to see Relay—whether or now not you need to—is in these little ads that appear at the backside of mobile apps. Inmobi, another firm you needn’t really feel bad for not recognizing, serves around 6 billion of these advertisements per day on about 1 billion gadgets per 30 days.

buying right from Twitter was once that you can think of ahead of as of late, however only for the enormous guys, like McDonald’s, that constructed a customized integration with Twitter, but Relay is the plug-and-play possibility for the little guys, in line with Hughes Johnson. “that you may think about sites would have consumer integrations presumably with prime partners,” she says. “but when you truly need to let merchants across the world and the web to promote thru your app, you are most definitely no longer going to have the bandwidth and the engineering energy to allow for that remainder of [the world].”

(88)