Mind the Surge

— January 10, 2019

Stock markets surge. Oceans and rivers surge. But do companies and the people in them surge? And if they do, is it a strong representation of buying behavior?

The answer is an unqualified maybe. In fact, if not interpreted correctly, a surge could be a non-event, or even lead you down a rabbit hole.

Let’s examine the concept of a surge and what to look for when trying to determine if it’s significant and requires your immediate attention.

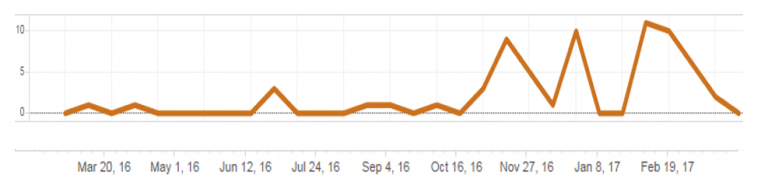

This graphic (above) illustrates a surge of interest by a prospective account as reported to a client organization as something worth noting.

The numbers to the left represent the total number of signals picked up. The signals could indicate any number of actions taken by individuals inside a prospect account, and could include: pages consumed in the category of interest across the Web, emails received/opened/possibly clicked through, webinars or events visited, syndicated content downloads, etc. In this case, it looks like the total number in this surge is 4.

As you can see, there is a period of time previous to this surge where no activity exists, and a period directly after where, similarly, no activity exists. I would argue, that as a moment in time, the jury is out — and without other inputs or historical data, not much can be discerned here.

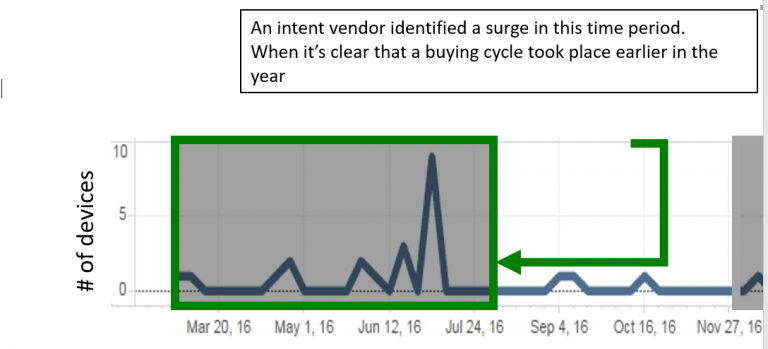

Now, let’s look at the same ‘surge’, but in the context of the entire buying journey of this prospective account thatends in a successful Closed/Won for the client:

Now that we have exposed the entire timeline, the ‘surge’ previously referenced as a moment in time is seen happening in the early stages of the buying journey. This context is absolutely essential in determining what actions should be taken at that particular time – if any actions should be taken at all. And therein lies the rub: if you are going to use buyer intent behavior as a key part of your ABM strategy, it’s important to develop and automate your next-best-action playbook; allowing you to intersect with these various moments in a group research journey on the way to a purchase decision.

The discovery of an early ‘surge’ should put in motion a number of activities and gathering of intelligence that will set you up to intersect with the relevant audience inside of a targeted account with the appropriate messaging. But it doesn’t mean it’s time to release the hounds and hand this off to your sales organization. Yet, this often happens because intent vendors are not delivering historical context.

As a matter of fact, if you do not employ a historical view of an account and use enough data both 1st and 3rd party, your intent vendor can be sending you ‘surge’ data that is not only not a ‘surge’ but is a view of an account that has already bought something in your category 4 – 6 months before the current ‘surge’:

Another issue with a moment-in-time ‘surge’ is it does not tell you what the normal behavior inside of an account is as it relates to that category. So, while an intent vendor is delivering data to you representing ‘surges’, without knowing the normal interaction with that category – the average number of signals seen across time – a ‘surge’ can be meaningless.

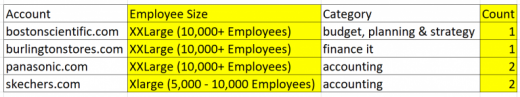

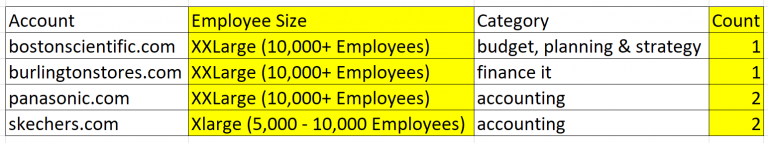

And that is what we see in the following example. Here, an intent vendor is delivering ‘surge’ activity to a client telegraphing that these are all important moments in time. Yet, when pushed up against a checklist that asks:

- Are these signals above the norm for this account?

- Is there activity sustained over a longer period of time than average for that account?

- Are the signals you are using from diverse data points that include your own first-party data – as well as third-party sources?

- Is there a team tasked with a research/evaluation assignment?

If you are like me, you would be dubious about the claim of a ‘surge’ where there are only one or two signals coming from a company of 5,000 – 10,000 employees. Are these individuals pulling down or reading content in these categories because that is part of what they do for a living? Are they pulling it down because they are prepping for a job interview? In a vacuum, without any other context – these actions are meaningless if the goal is to identify a group of people tasked with an initiative that utilizes research as a major component in coming to a decision.

In fact, when a client asked us to look at another intent vendor’s reporting of over 24,800 ‘surges’, we could only agree on approximately 3,200 of those – meaning that there was enough conclusive evidence to say anything was going on in over 20,000 of the other reported ‘surges’.

To truly help clients find the Total Active Market – those accounts in market TODAY – you must be transparent and open about just how difficult relevant reporting really is, and give historical context to separate the wheat from the chaff.

Do you know which specific companies are currently in-market to buy your product?

Wouldn’t it be easier to sell to them if you already knew who they were, what they thought of you, and what they thought of your competitors?

Good news – It is now possible to know this, with up to 91% accuracy. Check out Aberdeen’s comprehensive report Demystifying B2B Purchase Intent Data to learn more.

Business & Finance Articles on Business 2 Community

(11)