Playing the Hand You’re Dealt: How Will a No Deal Brexit Impact the Stock Markets of the UK and Beyond?

Three months can be a long time in politics – especially when it comes to the UK in the years following the tumultuous Brexit vote of 2016.

With this in mind, it’s perhaps unsurprising that the Royal Assent given to pass a law blocking a ‘no deal’ Brexit in September 2019 already looks set to be rendered redundant by the new majority Conservative government before the year is concluded.

The new government, elected by a landslide on the 12th December 2019 and headed up by Boris Johnson, continually pledged to ‘get Brexit done,’ with the supporting slogan that a Brexit deal with the European Union was ‘oven-ready.’

Five days on from their resounding general election win and prominent conservatives were already beginning to play-down the readiness of the oven-ready Brexit, with there now being clear signs that the UK will leave Europe by the 31st December 2020 regardless of whether or not any trade deals with the EU were completed – with no option to extend negotiations further.

Assessing the likeliness of no-deal

Of course, the messy subject of Brexit is a tricky one to navigate. The fact that the nation is still no clearer on its future three-and-a-half years on from the EU referendum indicates that negotiations are severely complex – and perhaps more so than MPs themselves would like to believe.

However, the arrival of a majority Conservative government could ultimately be a good thing in terms of achieving a Brexit deal. With more representatives in the House of Commons, it’s much more likely that the government will reach an agreement in the passing of the kind of deals that would’ve been voted down prior to the 2019 general election.

The most significant question here is whether Prime Minister Boris Johnson would prefer to press on with his oven-ready deal that was agreed in principle with the EU in October, or whether the leader has his eyes fixed on a no-deal exit at the end of 2020. Johnson’s eagerness to prorogue Parliament at a time when the UK was expected to leave the EU on the 31st October 2019 was seen by some as a deliberate attempt at forcing a no-deal Brexit. When the prorogation was ruled unlawful, it led to accusations of the Prime Minister lying to the Queen over his reasons.

The current Conservative Party line is that the negotiation process will be successful – with failure not seen as a viable option. But in reality, the timeframe of just twelve months to renegotiate 46 years of trade, security and foreign policy ties within the EU – not to mention come up with a satisfactory solution to the Irish border while fending off the threat of Scottish independence – seems extremely short. With this in mind, it would be unwise to ignore the prospect of a no-deal Brexit. So, let’s take a deeper look at what no-deal could mean in the context of UK and European stock markets:

The uncertain future of Sterling

(The rollercoaster five-year performance of the GBP in relation to the US Dollar. Image: XE)

Naturally, UK markets are heavily governed by the performance of Sterling. It’s been a wild ride for the Pound, having fallen into uncertainty in the months building up to the EU referendum in June 2016 and having suffered a few false dawns in the years that followed.

The landslide win for Boris Johnson’s Conservative government on the 12th December carried a positive effect for Sterling, with investors buoyed by the relative financial conservatism of the winning party – as opposed to the more radical proposals offered by rival Jeremy Corbyn’s Labour.

Sadly, the market remains nervous and this is likely to remain the case while the spectre of Brexit looms over the nation. Investing.com has already reported that the possibility of no-deal has caused the Pound to fall in light of the post-election momentum it was building – with the financial platform citing the surprising move to prevent any further extensions to the EU transition period beyond December 2020 as the prime cause.

The data available shows that the UK economy has stalled since the arrangement of the general election, but despite this wages have continued to perform well – rising above its 3% expectations to hit 3.5%. Low employment rates of just 3.9% are no doubt helping the UK’s economy to remain stable – however, it’s important for the government that these levels don’t show signs of increasing in the new year both in terms of supporting the value of Sterling and retaining the newfound faith many working-class constituencies have placed in the Conservative Party.

The FTSE and beyond

Domestically, the prospect of a no-deal could bring significant damage for the FTSE 100. MarketWatch anticipates that a no-deal would wipe 15% of the value off UK stocks while also causing the Pound to fall by a further 10% against the US Dollar. The wider implications will ripple across the Atlantic, prompting a 3% drop in US stocks.

Also heavily affected by the outcome of Brexit would be German stock prices, with the MSCI expecting a drop of 5% to hit the European superpower.

While this makes for pretty bleak reading for investors and public companies across the UK, EU and beyond, the ramifications of a ‘well-managed’ exit deal may see domestic equity markets make a healthy jump of up to 10% – with Sterling also rising by 8%.

MSCI analysts Aniko Maraz and Thomas Verbraken are unanimous in their agreement over the impacts of a no-deal Brexit: “In short, equity markets would drop, with the U.K. bearing the largest impact. Sovereign yields would decrease in the U.K. and Europe, while corporate spreads would widen. Both the pound and euro would lose value relative to the dollar.”

Some silver linings

The re-emergence of a no-deal Brexit may be an uncomfortable one for investors and public companies alike, but the installation of a Conservative majority has had some mitigating factors on UK stocks.

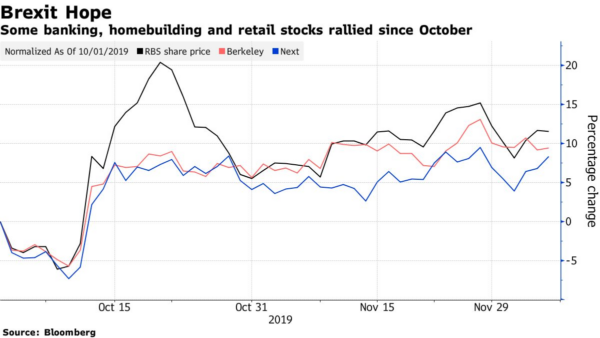

(Amidst uncertainty, some UK stocks remained buoyant. Image: Capital)

The chart above illustrates that the security of a Conservative majority government has already shown signs of encouraging healthier levels of risk appetite among investors. This comes as a result of the unease that rival party, Labour’s campaign manifesto brought in terms of taxation for higher earners and large corporations.

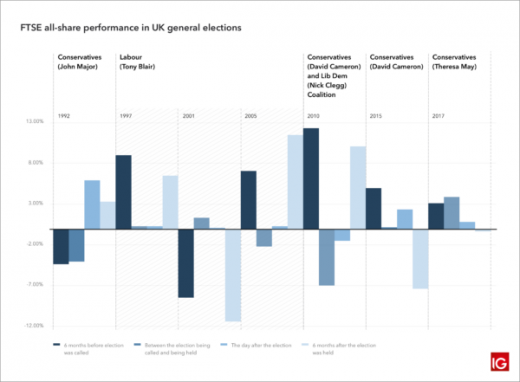

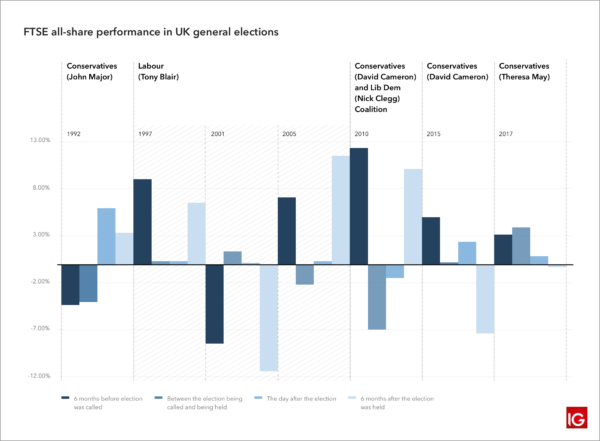

(Elections can have varying effects on the economy, but investors generally feel optimistic among Conservative governments – in spite of surrounding uncertainty. Image: Capital)

Here we can see that even in spite of Brexit haunting the previous Conservative campaigns, investors generally trust that their interests will be upheld within a Tory government.

With the expected confirmation that Brexit will ‘get done’ one way or another by the conclusion of 2020, the chances of the UK, Europe and even the US feeling the pinch of a no-deal has greatly increased.

There’s little doubting that this will have a widespread negative impact for years to come for the stock markets of Europe, a real test of Boris Johnson’s mettle will come in the form of how the Prime Minister steadies the ship amidst the choppy waters of stock market jitters. Currency needs to be managed, the Union maintained and the markets kept healthy. If Johnson can instil some confidence among UK businesses, there may be a chance that the costly implications can be mitigated.

Failure to respect the significance of a no-deal Brexit would otherwise lead to a worrying start to the decade for world economies. Of course, Johnson’s oven-ready deal with the EU could help to save the nation from much of the upcoming chaos – but with so much negotiating on the horizon and potential conflicts of interest over the kind of Brexit Johnson and his contemporaries want, it could prove to be a case of too many cooks spoiling the broth.

Business & Finance Articles on Business 2 Community

(38)