file: Apple Pay shifting to the cellular internet, might provide giant boost to m-commerce

outlets will have to be doing everything they can to extend cellular transactions.

in keeping with a record (March 25, 2016), fingerprint-enabled Apple Pay is coming to cell internet sites. One common perspective on this information is that the move will potentially reduce into PayPal’s leadership place; alternatively, the more important doable impression is the acceleration of cell commerce more broadly.

Re/code pronounced that Apple Pay for cell sites can be available later this 12 months, prior to holiday 2016:

The service might be available to consumers using the Safari browser on models of iPhones and iPads that possess Apple’s TouchID fingerprint technology, these people said. Apple has additionally considered making the carrier to be had on Apple laptops and pcs, too, although it’s now not clear if the corporate will launch that capability.

one of the vital big causes that mobile commerce considerably lags cellular site visitors is payment friction. in line with GfK research, mobile gadgets account for best three % of transactions in america, although seven p.c from youthful mobile customers.

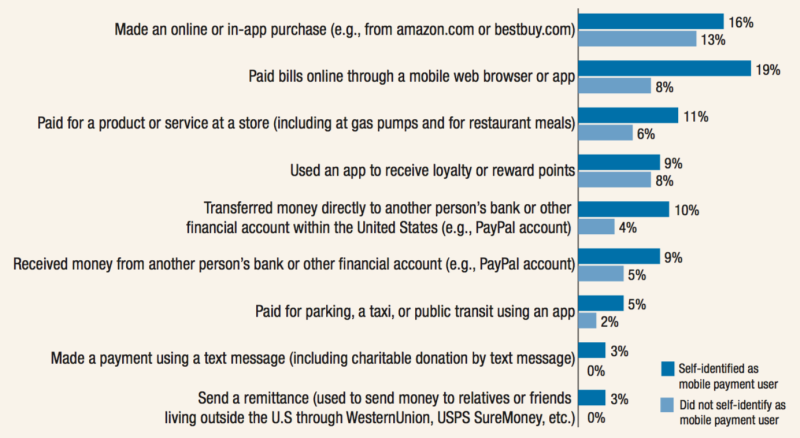

A 2015 US Federal Reserve learn about on mobile payments and banking discovered that “22 % of these with access to a mobile phone pronounced that they made a mobile cost in the ultimate three hundred and sixty five days.” these now not the usage of cellular payments/banking recognized safety considerations as the principle this is because.

mobile cost duties for smartphone customers, by way of mobile fee self-identification

source: US Federal Reserve study 2015 (n=600)

source: US Federal Reserve study 2015 (n=600)

according to a late 2015 survey through PYMTS.com, just below 17 p.c of respondents had used or tried Apple Pay in america. the biggest reasons for not the usage of it wasn’t safety. These respondents as a substitute mentioned awareness (I forgot) and uncertainty about whether the shop in query regular Apple Pay.

Adoption of Apple Pay for in-retailer retail purchases has been restricted in part on account of sluggish or uneven retailer adoption. outlets equivalent to Walmart, target, best possible buy, Kohl’s, CVS and others are part of a consortium looking to launch their very own competing cell funds platform known as CurrentC. Walmart additionally lately presented its personal proprietary funds platform. And whereas CurrentC is destined to fail not directly, its existence delays acceptance of Apple Pay or Android Pay by using these major shops.

Any system that removes the burden on the consumer to enter credit card and related knowledge on a smartphone monitor is sure to lift mobile transactions general. whether or not Apple Pay will help will in flip be dependent on retailer and developer adoption.

whether the use of PayPal, Android Pay or Apple Pay, one would think that good retailers and builders would need to make it more uncomplicated for their customers to buy on cell devices. however as history has shown, outlets and e-tailers ceaselessly don’t do what’s best for their customers.

(Some photography used under license from Shutterstock.com.)

advertising Land – internet marketing news, strategies & pointers

(98)