Retailers spent nearly 50% of mobile ad dollars in second half of 2018

The retail industry’s share of mobile ad spend increased from 35% during the first half of 2018 to 49% in the second half, according to Smaato’s recent report.

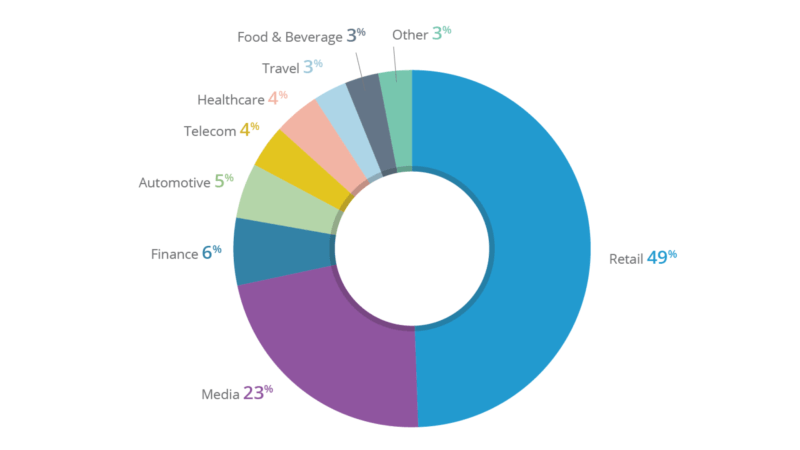

Mobile ad spending share by advertising vertical in second-half of 2018, based on Smaato customer data.

Retailers accounted for 49 percent of mobile ad spend share during the second half of 2018, according to a recent report from the mobile ad solution Smaato. Based on global publishers and advertisers on Smaato’s platform, the report looked at mobile ad trends across six industries: retail, media, automotive, healthcare and food and beverage.

Retailers take the biggest piece of the pie. Among the six industries, retail advertisers’ share of mobile ad spend jumped from 35 percent during the first half of 2018 to 49 percent by the end of the year. Retail advertising’s mobile ad share was more than double that of the media industry which came in second with 23 percent share. (Media and retail advertisers did spend on mobile video in roughly equal measure.)

Online retail marketplaces such as Amazon, Walmart were the biggest spenders in the retail category, accounting for 28 percent of all mobile ad spend across sectors.

Smaato said the jump in retail mobile advertising in the second half of the year was to be expected with the holiday shopping season.

“Smaato’s global demand is extremely diverse and includes advertisers from every vertical,” said Smaato’s president Arndt Groth in an email to Marketing Land, “This increase in retail ad spending is likely a similar trend throughout the mobile advertising industry, especially given the huge shopping holidays in H2 2018, including Black Friday, Cyber Monday, and Singles’ Day.”

Cyber Monday spend exceeded Black Friday. Smaato’s data revealed Cyber Monday mobile ad spend exceeded what was spent on Black Friday for the first time ever. Also, when comparing Cyber Monday ad spend to the average daily ad spend during November, Smaato saw a slight increase in 2018 versus 2017, up 22 percent to 26 percent.

Retailers’ share of U.S. mobile ad spend on Cyber Monday last year was ten points higher than the overall ad spend during the second half of 2018. “With retail e-commerce sales on Cyber Monday up 17 percent over last year, it is no surprise that retailers are increasing their mobile advertising budgets for this online shopping day,” writes Smaato in their trends report.

Why you should care. Retail advertisers are taking the lead in mobile advertising, which means marketers and advertisers for smaller retail brands must be more savvy in their mobile strategy, and more efficient with their mobile ad dollars, to compete with large-scale brands and e-commerce sites. With online shopping reaching record-breaking heights, and Amazon’s continued lead among competitors, retailers will need to think critically about their mobile advertising efforts.

Marketing Land – Internet Marketing News, Strategies & Tips

(11)