The Brazen Fraud Case That May Help Determine The Future Of ICOs

On the internet, Maksim Zaslavskiy depicts himself as an experienced real estate leader and a global philanthropist who provides humanitarian aid to people in Africa, South America, and Eastern Europe. He’s also the author of three books, has an LLM degree, and claims to have worked for several Wall Street banks.

But on a cloudy Friday morning this winter, Zaslavskiy barely resembled the high-profile entrepreneur he portrayed online. He was one of many defendants to walk into the Brooklyn federal courthouse to face criminal charges that day. Looking tired and dressed in jeans and a fuzzy sweater, Zaslavskiy arrived for his hearing more than an hour early. He appeared calm as he leaned against a railing in the park across the street–but once he was inside the courtroom, his temperament gradually changed.

As he watched other defendants take their turns–including a handcuffed, tattooed man wearing a prison jumpsuit–the Brooklyn businessman became jumpy and increasingly anxious. When the judge called him, after an approximately 20-minute delay, Zaslavskiy stood beside his public defender, did not refer to the judge as “Your Honor,” and declined to hear the charges being brought against him.

Less than five minutes later, the potentially life-changing arraignment was over. It was December 1, and 38-year-old Zaslavskiy–who is also facing civil charges–had just formally been indicted with securities fraud conspiracy, a charge that carries up to five years in jail. It was not the outcome he predicted when he launched what he described as an innovative, money-making opportunity just months earlier.

“Join the global real estate revolution,” instructed one of Zaslavskiy’s promo videos for REcoin, a virtual currency for which he had sought investors over the summer.

Related Video: This Businessman Set Up Two ICOs–Both Of Which Were Allegedly Scams

“An innovation in the cryptocurrency market . . . The first ever cryptocurrency backed by real estate,” declared another video, which featured triumphant and uplifting instrumental music and a collage of flashy images.

The series of videos–combined with press releases, a social media campaign, and a white paper Zaslavskiy says was written by people in Ukraine–marketed REcoin as a revolutionary cryptocurrency that would grow in value through investments in real estate.

“REcoin is founded by humanitarian and entrepreneur Maksim Zaslavskiy,” a company profile stated. “It will allow investors from all over the world to convert their currency and savings into a stable, inflation-proof cryptocurrency.”

Through press releases sent to financial news sites and posts on Reddit and Facebook, REcoin was said to be led by an “international team of attorneys and programmers” and its funds would be invested in “the highly regulated real estate market.” REcoin was further described as “an attractive investment opportunity” that would “grow in value”–with expected profits ranging from 9% to 67% a year–court records show.

But federal authorities argue that was all a scam that fooled about 1,000 investors out of hundreds of thousands of dollars. Zaslavskiy raised the money through initial coin offerings (ICOs), an increasingly popular, largely unregulated fundraising method in which startups sell digital tokens to investors, often to fund a new project or company. In most cases, investors use cryptocurrencies like bitcoin and ethereum to buy those tokens, which work like vouchers for services or products that could be nearly anything, from smart contract-powered retirement plans to synthetic rhino horn-fueled erection pills.

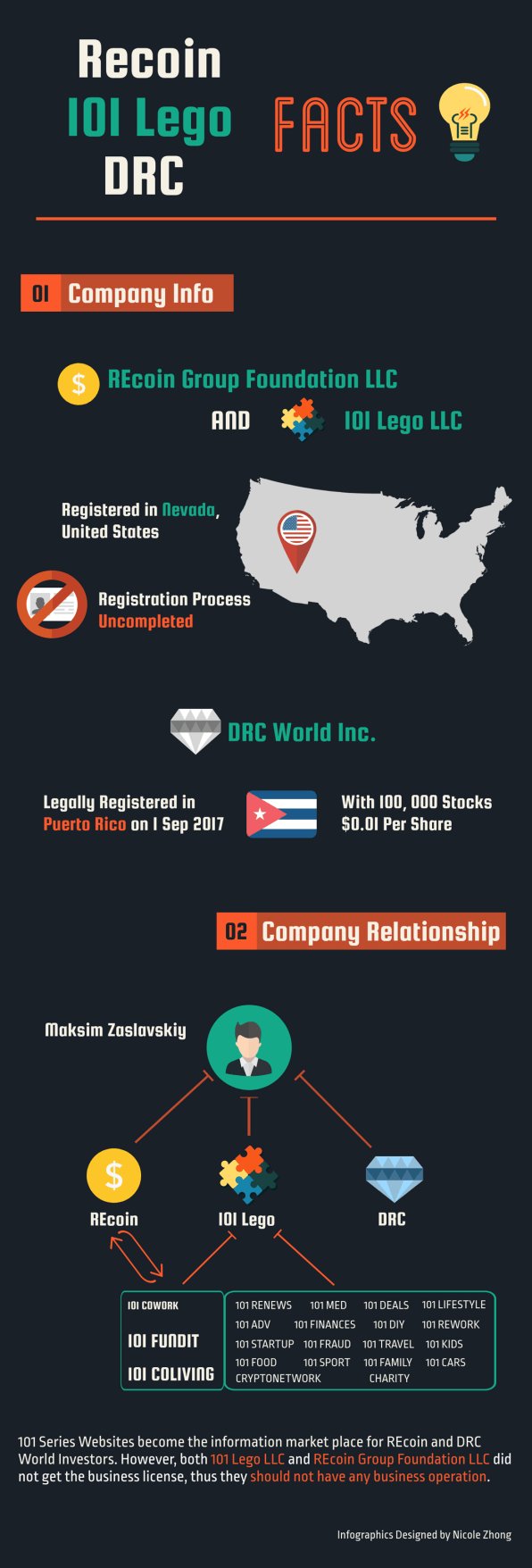

Authorities claim Zaslavskiy scammed investors through two ICOs–REcoin and another, DRCWorld, that promised profits off diamonds. Participants used both credit cards and cryptocurrencies to invest in Zaslavskiy’s projects–but there’s no evidence that a token or digital asset was ever actually issued to any of those investors or that Zaslavskiy was even running his ICOs and their “smart contracts” and “secure transactions” with blockchain technology. He has since become one of the first people to be charged with fraud in connection to an ICO–just as the fundraising practice experiences a gold rush moment.

Related Video: How An ICO Works

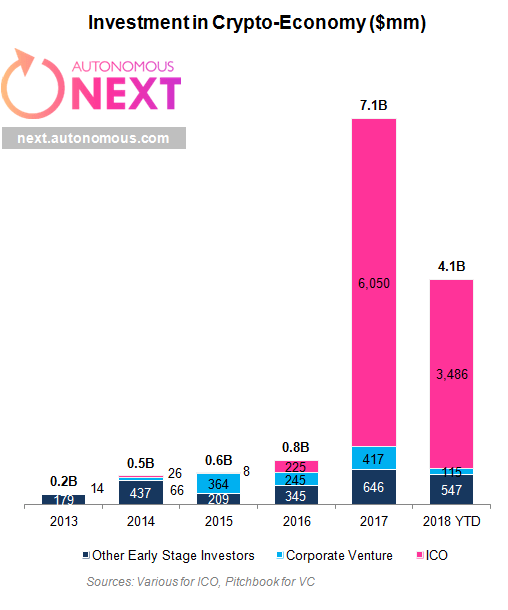

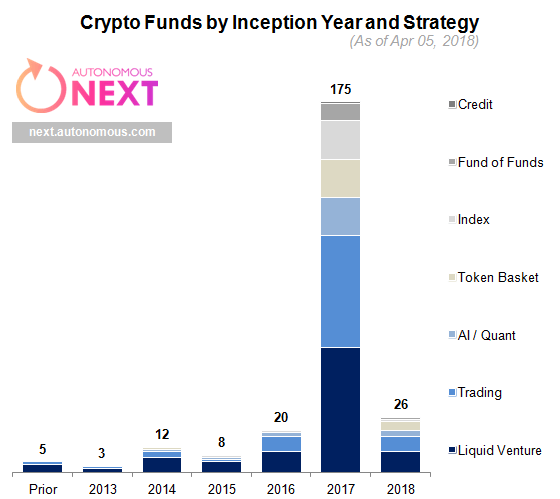

The amount of funding raised through ICOs rose from about $26 million in 2014 to more than $6 billion in 2017, according to Autonomous, a financial research firm–and the ICO market is certainly not dying off so far in 2018. “Velocity still seems to be there and it’s still real . . . It’s a blue ocean opportunity–people still see it as such,” Lex Sokolin, global director of fintech strategy at Autonomous, tells Fast Company in an email.

Such popularity in a still-young funding practice has yielded numerous fishy ICOs, some of which mythologize wild tales of potential fortune. All the hype around ICOs led the U.S. Securities and Exchange Commission last fall to issue a warning about celebrity-endorsed campaigns. Paris Hilton, Floyd Mayweather, DJ Khaled, and other celebrities have used social media to promote a variety of token sales, some of which sound “too good to be true,” the SEC said in a statement.

The government isn’t the only one worried about potential ICO scams. Preston Byrne, a blockchain technologist, blogger, and fellow at the Adam Smith Institute, is equally concerned about scams being mistaken for legit ICO offerings.

“The language people are using to describe the products they’re selling, the level of expertise they’re bringing as compared to the complexity of the product they’re offering, there’s no logical match between the marketing and the tech,” he declares. “There are some crazy ideas, and right now–because everyone is making money–those ideas are treated with a degree of seriousness that three or four years ago would never have been possible.”

Sam Radocchia, cofounder and chief marketing officer at Chronicled, a San Francisco blockchain technology company, says investors should be cautious with ICOs that seem too good to be true.

“Explicitly promising a return on an investment is definitely a no-no,” she says. “Or explicitly saying the token represents any sort of ownership is not legal. That’s offering an unregistered security.”

Radocchia points out that there are many legitimate ICOs built on real blockchain tech, backed by real services and businesses. Some are even attempting to make the world a better place. But the fundraising vehicle can be an easy scamming tool, as well.

“There are not a lot of means to validate the software the team is building, who the team is in the first place,” she points out. “You can get a white paper written on a standard crowdsourced website.”

Zaslavskiy’s real estate and diamond ICOs, though not endorsed by any celebrities, illustrate the type of language often being used in the ICO world. In a press release issued days after the ICO launched, REcoin was described as “a smashing success” that “was selling out in droves.”

The Zaslavskiy case offers a window into how the SEC may approach other perhaps questionable ICOs in the future–and might herald more U.S. prosecutions in 2018. Byrne says the theory among ICO skeptics is that regulators are going to prosecute “the most egregious cases first” in order to set the precedents needed to go after other violators.

Regulators, Byrne believes, are “looking for the first set of cases that they’re really going to bring that make it very clear and help them delineate the boundaries of what is acceptable and what is not.”

For his part, Zaslavskiy has plead not guilty and filed a motion to dismiss the criminal case against him, arguing that he was not selling securities. Last month, prosecutors filed a lengthy response rebutting his claims, saying his ICOs were investment contracts within the context of securities laws.

Zaslavskiy repeatedly declined our requests for comment, but he provided stunning (and sometimes contradictory and incoherent) statements during a nearly four-hour interview he agreed to give the SEC without an attorney in the room, a transcript of which was obtained by Fast Company. Indeed, the September 20 interview inside the agency’s New York office on the fourth floor of Brookfield Place, a high-rise building in downtown Manhattan, is likely to be the most damning evidence in his case. So damning, in fact, that the SEC filed its lawsuit and a successful request to freeze his assets just over a week after that interview. Zaslavskiy has been embroiled in legal trouble ever since.

According to his Facebook profile, Zaslavskiy was born in Odessa, a charming city in southern Ukraine known for its beaches and architecture. He told the SEC he moved to the U.S. with his family in the early 1990s, when he was 12.

Although Zaslavskiy has two listed addresses–one in Beverly Hills and another in Sheepshead Bay, a neighborhood in southern Brooklyn that hosts a large concentration of Eastern Europeans immigrants–he told the SEC he lives “a thousand miles up in the air.” He spent much of his time in recent years in Ukraine and Russia, he told the SEC.

“Right now, in the last nine years, I spent about 30, 40% somewhere else,” Zaslavskiy said to Jorge Tenreiro, the SEC attorney.

Zaslavskiy has a master’s degree in finance from Baruch College and a master of laws degree–a one-year law certification that he completed in 2006–from Yeshiva University. The first job listed on his LinkedIn profile is as an IT consultant for UBS, Merrill Lynch, Swiss Bank, and Salomon Smith Barney from 1998 to 2000–when he was around 18 to 20 years old. His employment could not be confirmed by Fast Company, as at least two of those banks did not find any records of Zaslavskiy working there.

Zaslavskiy vaguely told the SEC that the 2008 financial crisis was a turning point in his life, one from which it took him a while to “recover mentally.”

“I had my own businesses internationally, then I lost, in 2008, a lot of the money and not even my own money,” he told the commission, the interview transcript shows.

The experience seems to have had a long-term impact on his worldview. Zaslavskiy has not hidden his disdain for the U.S. economic system. He coauthored and self-published two e-books last year, both of which argue that the fiat paper system is designed to deceive the working class and transfer wealth to large banks and multinational corporations. One of the books, The Gold Road to Plenty: Bankers & Government vs. People, begins with the following declaration:

“We have been sold a lie that our democracy is people-oriented,” it reads. “Although the U.S. government was originally instituted to serve the ultimate good of the people, it has reneged in upholding those ideals especially to the working-class citizens of the country.”

After the housing market crash, Zaslavskiy decided to focus on charity work, according to the SEC interview and his LinkedIn profile. He even ran a charity, though it’s not clear when or whether it was properly registered. California-based Live Love Laugh Global, the website of which went offline following Zaslavskiy’s arrest in November, has a vague mission that reads: “There are people, who want to help, who earn to make the world a better place. Simultaneously thousands of people, who live under the poverty line, the countries with no budget for proper schooling and medical care. We intend to help end the shortage of helping hands by arranging an ergonomic mutually beneficial cooperation between those, who have the need to help and those who are in need of help,” according to the last version of the website, which is now under maintenance, according to a message posted in Russian under the charity’s URL.

Live Love Laugh claimed that it provided humanitarian aid in several countries, including the U.S., Canada, Russia, and several nations in the former Soviet Union. “It’s mostly, like, we gather clothes, food somewhere and give it out,” Zaslavskiy told Tenreiro more than three hours into the SEC interview. “We send a container of clothes, hygiene from the United States.”

The charity cannot be found on the California Office of Attorney General Registry of Charitable Trusts, where most of that state’s nonprofits are supposed to register.

“Most charities are required to register with the attorney general, with the exception of churches, mosques, and . . . schools,” notes Gene Takagi, managing attorney at NEO Law Group, a California-based law firm that specializes in nonprofit law.

Takagi says it is mandatory for California-based nonprofits to have their financial statements audited if their revenues surpass $2 million in a fiscal year, except for grants received from governmental entities, which do not count toward the $2 million threshold.

Tax return forms from the charity show that it received nearly $2.1 million in fiscal year 2014 and more than $2.5 million in 2015 from program service revenue, thus surpassing the threshold and making it mandatory for the charity to have its financial statement audited in both years. However, Live Love Laugh checked “No” for the question of whether its financial statements were audited by an independent accountant in its fiscal year 2014 tax return, and it did not answer the same question in the 2015 tax form.

Zaslavskiy incorporated his charity into both the real estate and diamond campaigns. White papers for the ICOs show that 2% of the revenue generated through digital tokens from REcoin and DRC World, the diamond-backed cryptocurrency, were to go to Live Love Laugh. However, the plan did not work out since Zaslavskiy did not ever issue tokens, according to the SEC interview transcript.

Dennis Krasilshchikov, who appeared to be the IT/program director of the charity, did not accept our interview requests via email, phone, and text. We were not able to track down a phone number for Dmitry Guzik, former president of the charity. A representative of his company, Gold R Us, said “no” and hung up when asked whether Guzik was available for an interview about his role in the charity.

Zaslavskiy’s other passion is real estate, an interest he told the SEC developed early in his life. A statement on the website of another one of his businesses, 101Lego (described as a creative communications company) claims he started his career as a real estate investor in 1997, the same year he turned 18.

“I know about real estate,” Zaslavskiy told Tenreiro. “I mean, I’ve been buying since I was little and living here . . . And I have a house with my parents and I have another property–a lot of properties that I had to sell to cover certain things.”

Zaslavskiy has previously owned properties in Brooklyn, Florida, and California, and he currently owns an apartment in Queens, online property records show. Marketing materials for REcoin described him as “a real estate guru.”

“Over 20 years of leadership in real estate, nonprofit, financial, and IT sectors became a solid basis for his further confident and effective leadership in these fields,” read a description on the 101Lego website, which is now offline.

On LinkedIn, Zaslavskiy claimed to have worked for a San Diego real estate investment firm from 2012 to 2015, but a bankruptcy document casts doubt on that claim. Zaslavskiy, who filed for Chapter 7 bankruptcy protection in 2015, when he had at least $450,000 in debt, wrote in his bankruptcy filing that he had no income for two years.

101Lego, was used to market both REcoin and DRC World, the diamond ICO. Zaslavskiy promised investors they would have access to exclusive services provided by 101Lego, a chain of at least 18 brands–most of which are news aggregation platforms, covering topics like finance, advertising, crowdfunding, travel, food, sports, cars, and family.

“You get to draw from the well of wisdom end [sic] experience of the 101Lego’s stellar staff of professionals, its extensive client list is at your disposal, its affiliate partners are waiting for your call, and its database is ready for your business,” Zaslavskiy claimed in a September 11, 2017, statement to investors.

Nevada-based 101Lego never finished its business-licensing registration process, just like REcoin, which is also based in that state. Nevada imposes no corporate income tax or fees on corporate shares.

Despite the marketing and big promises, by Zaslavskiy’s own admission, it seems that much of what he told his investors about his ICOs was not accurate. During the September SEC interview, enforcement attorney Tenreiro asked Zaslavskiy whether it was accurate that the value of REcoin tokens could grow through an increase in real estate value. The defendant said, “Of course not,” an interview transcript shows.

The interview transcript also includes the stunning admission that neither Zaslavskiy, REcoin, nor any of its employees ever purchased any real estate before, during, or after the ICO launched, despite the fact that he had claimed to investors that his offering was backed by real estate holdings.

Zaslavskiy also admitted that only $300,000 was raised, not $1.5 million (or $2.8 million as he claimed at least once), according to the transcript. Zaslavskiy told the SEC the million-dollar estimate was based on a verbal agreement with a Ukrainian banker–whose exact name he could not remember–and that there are no records of their negotiation because Ukrainian bankers “like face to face,” the interview transcript shows.

And when asked that morning whether REcoin was led by “an experienced team of brokers, lawyers and developers,” as his company’s promotional materials stated, Zaslavskiy responded, “No.

Zaslavskiy’s apparently fraudulent claims about the team behind RECoin aren’t necessarily unique in the ICO world, highlighting the need for investor diligence. “You see all these teams that are coming together and the question is, are they even a valid team or have the images of these people been robbed off of Google Images?” Radocchia says. “I’ve heard a few cases of that happening.”

Though we know now that there was no real estate backing the tokens he was selling, things appeared to be going well for Zaslavskiy’s REcoin ICO early last summer. He launched the campaign in August and secured about $300,000 from investors (despite claiming much higher figures) for several weeks.

But then investors were told, on September 7, that Zaslavskiy was “changing our strategy.” He told investors the government had “interfered” in the real estate project, so he was pivoting from real estate to diamonds via DRC. It was a bold move, given that a few months later, during his September SEC interview, Zaslavskiy admitted that he had not purchased any diamonds with which to back his new offering.

“On August 7, REcoin went live raising over $1.5 million in direct REcoin token purchases during the first three days of the resale,” the press release said. “The trust in our project became so vast that another $2.3 million in expected earnings were generated as a result of the REcoin pre-sale success.”

“Unfortunately, at that point the U.S. government did what it does best–interfered. In no uncertain terms, it let us know that we’re not allowed to take steps to maintain the level of liquidity of our real estate holdings to keep your investments safe and secure, and our community truly decentralized and rid of any outside influence.”

It’s not clear whether or how the government may have interfered in the REcoin ICO. According to a court document that prosecutors filed in March, the SEC contacted Zaslavskiy twice regarding REcoin, on August 15 and 29. In response, Zaslavskiy told SEC staff attorneys that he was traveling and would not return to the U.S. until later in September. During the interview with the SEC in September, Zaslavskiy told Tenreiro his claim that the government interfered with his ICO was a mistake by one of his employees in Ukraine.

“What is that?” Tenreiro asked after reading the claim.

“A fuck-up,” Zaslavskiy said.

Tenreiro: “I’m sorry?”

Zaslavskiy: “I didn’t write all of that. But, the person who wrote this, this and this, he screwed it up . . .”

Tenreiro: “Did anyone in the U.S. government let you know in–”

Zaslavskiy: “No.”

Tenreiro: “So, that’s not true?”

Zaslavskiy: “No.”

The defendant then tried to explain, though not very clearly, that he abandoned the real estate ICO because “we were changing the hedging and the way he wrote it, it’s basically stating that we made the mistake as far as legal-wise. When we didn’t make a mistake. We were afraid for hedging part.”

The white paper for the new venture he launched in September, DRC World, was registered in Puerto Rico and stated that the new diamond coin “is hedged by physical diamonds which are stored in secure locations in the United States and are fully insured for their value.”

“After all the diamonds are forever, especially stores [sic] in secure locations in the United States and fully insured for their full value,” Zaslavskiy claimed in a press release. “This way they are truly not susceptible to any government manipulations.”

In the statement, Zaslavskiy told investors that as incoming DRC members they would remain entitled to all the benefits they had as REcoin “owners.”

“All the bulletproof technological aspects of the token, the hedging, the mining, the side chain policies, the partner programs, and charitable activities–as the Led Zeppelin would put it, ‘The Song Remains the Same,” Zaslavskiy told his investors.

After the REcoin stumble, Zaslavskiy described the diamond initiative as an IMO, or an initial membership offering, instead of an ICO. Investors were promised membership in a club.

“The Diamond Reserve Club founded and self-financed by the humanitarian, philanthropist, and entrepreneur Max Zaslavskiy is the answer to the question of exclusivity in the ever-widening tokenized membership pool,” the DRC white paper stated.

But the SEC argued the diamond move was “an attempt to skirt registration requirements of the federal securities laws.”

“In reality, the supposed ‘memberships’ are in all material respects identical to the ownership attributes of purchasing the purported (but, indeed, nonexistent) ‘tokens’ or ‘coins’ and are securities within the meaning of the securities laws,” the commission said in the September 29 complaint.

A month after the SEC complaint was filed, Zaslavskiy was arrested and charged with securities fraud conspiracy in a criminal probe led by the FBI and the U.S Attorney’s Office in Brooklyn.

“As alleged, Zaslavskiy and associates led their victims to believe they were hedging their bets on cryptocurrency secured by real estate and diamond investments,” William Sweeney, the assistant director-in-charge at the Brooklyn U.S. Attorney’s Office, wrote in a statement. “Much like a diamond, however, their promises were flawed, and the investments didn’t exist.”

Zaslavskiy was released on a $250,000 bond secured by his parents’ house in Sheepshead Bay and indicted in late November.

After the SEC sued Zaslavskiy, REcoin’s website essentially disappeared and now only features a message acknowledging the commission’s actions against him and providing a hint of a possible defense strategy.

“We believe this action is the result of a lack of legal clarity as to when an ICO or a digital asset is a security,” the statement reads, adding that such lack of clarity is recognized in the DAO investigation report the SEC released in July. “While we disagree with the SEC’s claims that the tokens we sold are securities, and will vigorously defend ourselves, we are cooperating with the SEC in the hope of resolving this issue.”

The question of whether or not such tokens are securities is not without precedent. The DAO, short for Decentralized Autonomous Organization, was a venture fund proposed by a company called Slock.it. It first came to the spotlight when it launched the largest ICO to date in 2016, selling more than $150 million in digital tokens. The stateless organization would allow members to propose projects that would be voted on by curators. But it suffered a major setback when hackers stole more than $50 million of its funds.

The SEC investigated the DAO and used it as a framework for a report released last summer. The yearlong investigation determined that the DAO was an unregistered securities offering and that tokens exchanged by a “virtual” organization may be securities and can be subject to rigorous federal securities laws. Analysts saw the ruling as the first shoe to drop, setting off a series of upcoming regulations and prosecutions intended not necessarily to kill off the ICO trend, but to discourage fraudulent or reckless behavior .

But proving beyond a reasonable doubt that someone committed securities fraud with digital currency is a difficult task, the blockchain analyst Byrne says.

“That’s not easy to do by any stretch of the imagination for any crime, much less to say when you have a realm of activity where you’re dealing with very cutting-edge tech that you need to go and explain to a judge or a jury,” he says.

Byrne thinks regulators are doing what they can, given their limited resources.

“There are only so many of them and there’s so much illegality,” he says.

But even investors are starting to catch up to the risks. “The nature of the market is changing so that ICOs have to do a lot more to prove that they are worth the investment from a regulatory and technology perspective,” Autonomous’s Sokolin told Fast Company in an email.

Zaslavskiy’s public defender, who represents him in the criminal case, declined to comment for this story. Zaslavskiy’s defense team in the SEC’s civil case includes William Mateja, a former senior counsel to U.S. Deputy Attorney General Larry Thompson and James Comey (before Comey served as FBI director from 2013 to 2017). He did not return our requests for comment either.

The impact of Zaslavskiy’s ICOs was felt far beyond U.S. borders. His investors included a 34-year-old medical store owner from Mumbai, India; a security guard from Vancouver; and a drilling rig worker in Dammam, Saudi Arabia. Their investments have been fully reimbursed because they invested via credit card. It’s not clear whether those who used digital currencies to invest have gotten their money back. The only other investor we were able to reach for this story, an accountant from Dubai, had yet to be reimbursed as of March.

U.S. prosecutors say communications between Zaslavskiy and investors show that many investors quickly realized that the ICO might be a fraudulent scheme and requested their money back.

Some got a delayed response from him, while others apparently never heard back.

Zaslavskiy’s next court appearance is scheduled for April 27. He declined to give us on-the-record comments during our WhatsApp communications with him and when we approached him outside the courthouse last December. He has since launched a new business and changed his name (online and in his forthcoming third book) to Avi Meir Zaslavskiy.

But on that chilly morning outside the Brooklyn courthouse last December, Zaslavskiy offered us a short, defiant statement about the U.S. regulators working on his case.

“This was my baby and they destroyed it,” he told us, puffing on his cigarette. “And now they want to destroy my life.”

Do you have concerns about an ICO in which you have invested? We want to hear your story. Send our reporting team an email here.

The reporting team wishes to thank: Andrew Kaczynsk, Andrey Urodov, Anil Vassanji, Ashyln Still, Ben Hallman, Carla Astudillo, Chris Dannen, Craig Silverman, David Fahrenthold, Hilke Schellmann, Jay Cassano, Jay Rosen, Kevin Dugan, Lam Thuy Vo, Rubina Fillion, and Sarah Ryley.

(46)