The Secret Power Of Amazon’s Dash Buttons: Not Sales, But Data

One year after launch, Amazon’s Dash Buttons continue to bewilder.

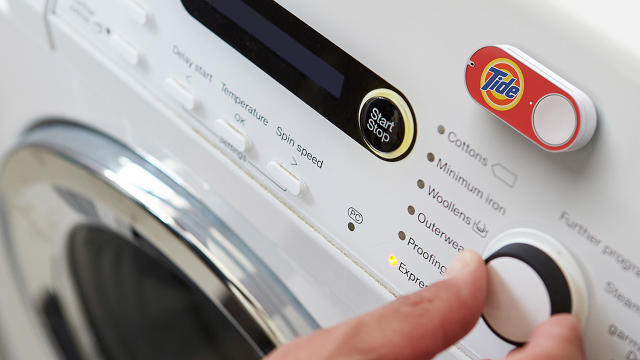

The palm-sized, battery-powered buttons, announced last year just before April Fool’s Day, allow users to order goods from Amazon with one press. Each button bears the label of a specific brand like Huggies or Tide, and Amazon’s mobile app lets users choose the type and quantity of product that a button press brings.

Plenty of tech pundits have scoffed at the concept, and it’s unclear if the buttons are a hit. While Amazon says Dash Button orders have grown by 70% in three months, it hasn’t given a baseline figure for sales or presses. And last week, ahead of an expansion with 50 new buttons—Amazon now offers more than 150 total—market research firm Slice Intelligence claimed that fewer than half of people who own a Dash Button have bothered to press it.

But to analyze Dash Button sales is to miss the bigger picture. These buttons probably aren’t meant to drive significant revenue for Amazon. The true goal, in all likelihood, is to generate data. By understanding the shopping habits of brands’ most loyal customers, Amazon has a better chance to create the shopping business of the future.

Revving The Engine

We can only speculate on what Amazon could do in the future with Dash Button data, but here are a handful of possibilities:

- Instead of standalone Dash Buttons, Amazon could build buttons into the product packaging itself. Each button would work once and would be discarded along with the package. Data from Dash Buttons would help Amazon and product makers understand what products and package sizes to offer, as an integrated button would make the packaging pricier.

- An evolved version of Amazon’s Subscribe & Save service could offer more flexible delivery timing, with Amazon’s mobile apps and Alexa assistant checking in to make sure you’re well-stocked. To make this work, Amazon would need data to understand how purchasing patterns vary for each product, and how those purchases change over time.

- Amazon’s app and Alexa could offer to add new items to your shopping list based on past behavior, along with competing products and other items bought by similar shoppers. Dash Button data would help Amazon figure out the right products and package sizes to recommend.

The common thread with all of these hypotheticals is that they rely on big data and machine learning.

“If you think about what Amazon Dash Buttons are today, it’s kind of like the hand crank on the first cars,” says Richard Crone, a payment industry consultant who wrote about the big data implications of Dash Button for PaymentsSource last September. “Its just the beginning, because we’re going to get to being able to automatically turn it on, and eventually get to self-driving cars.”

Why Dash Data Is Different

Granted, Amazon isn’t exactly wanting for data right now. The company already offers hundreds of millions of products through its online store, and sells billions of items per year. As of last year, Amazon had 304 million active user accounts, and their collective purchasing history helps feed the company’s recommendation algorithms. Amazon also uses tracking cookies to learn about the sites you visit, which in turn helps the company advertise products based on your interests.

Still, the data that Amazon can reap from Dash Buttons is unique.

If someone owns a Dash Button, there’s a chance they’ll use it as their only way to restock a given product. This, in turn, gives Amazon a better sense of how often people are consuming household goods, how much they buy at a time, and what other products they’re buying.

“In the near term, it will allow them to define the proper quantities,” Crone says. “It will allow them to adjust the packaging, and the bundling of other things. So you might see what other buttons are depressed nearly at the same time as another, and the cross-brand combinations that might come up.”

That kind of data doesn’t just help Amazon; it also helps the product makers, who Crone describes as “data-deprived.” The information they get from grocery stores, he says, is “two or three or four or five steps removed from the actual consumer action,” and doesn’t tell them anything about individual consumption levels or frequency.

That may explain why Amazon is charging brands to be part of the program, as the Wall Street Journal reported last week.

Michele Abo, chief sales officer in North America for the coffee brand Lavazza, explains that grocery stores don’t share data on what the average customer is buying, how often they’re buying it, or what demographic the customer falls into. At best, manufacturers can get total sales numbers from grocery chains, and then rely on survey panels like Nielsen Spectra to try and understand the demographics.

With the Dash Button, Lavazza is hoping to figure out what’s holding back online sales of its soft-pack ground coffee bags, which have sold well in grocery chains but haven’t taken off on Amazon. Part of that process could involve testing different pack sizes to see which ones get a better response.

“As part of selling the program—because it’s not a free program—they want to portray it as something helpful for companies to understand their consumers a little better,” Abo says.

Vacuum storage pack maker FoodSaver is also hoping to get more out of the Dash Button than just a sales boost, says vice president of marketing food preservation Ofelia Silva. The company already participates in Amazon’s Subscribe and Save program, and gets data from Amazon on the number of subscribers. Silva sees the Dash button as a “next level” offering.

“The progression that the Amazon Dash program takes over the next 12 to 24 months, as well as our success in it, will certainly affect the way we look at our replenishment model with Amazon,” Silva says. “Our participation in this program is based on the desire to increase our knowledge about our consumer, but also the Amazon business model and how FoodSaver (as a brand) can grow along with it.”

A Learning Experience

If you think this theory is far-fetched, consider that even Amazon downplayed the sales potential of Dash Buttons when the company first announced them.

“Our goal with the Dash Button is to learn as much as possible about what customers think about this,” spokeswoman Kinley Pearsall told the Wall Street Journal last year.

While Pearsall didn’t dive into specifics on Amazon’s future plans, she acknowledged that it’s silly to think people would have houses full of buttons for each product. The real long-term goal, she said, “is that you never have to worry about hitting that button.”

Dash Buttons are the first step, along with Amazon’s Dash Replenishment Service, which automatically re-orders supplies for home appliances such as printers, pet feeders, and Brita water purifiers. The next phase for Amazon will likely involve what it has learned to break out of those confined scenarios, and offer even more ways to buy stuff with minimal effort. If you never have to think about that button, it’s because Amazon is doing the thinking for you.

“It feeds this giant database that would allow them to customize further interaction with a data point that’s right inside the home,” Crone says. “It’s in your pantry. If it’s the Depends button, it’s in your pants.”

Fast Company , Read Full Story

(59)