Wireless Generation: Why Sports Bras & Bralettes Are Disrupting Women’s Underwear

The athleisure apparel trend, hardwired into millennials’ shopping habits, even extends to underwear these day—and it’s having a major effect on the lingerie industry.

A new study shows that today’s youth have overthrown the yoke of body-poking wire bras for seamless and activewear alternatives. According to the NPD Group, 41% of millennials say they wore a sports bra in the past seven days (compared to just 21% of older women). “Comfort has always been—in the modern era of the past 50 years—a key driver for bras,” explains Marshal Cohen, chief industry analyst of the NPD Group. Nowadays, however, women expect every part of their bra to be comfortable—”comfort has changed from slightly to completely,” says Cohen.

In 2015, the American lingerie market generated $13.2 billion, and industry growth is expected to increase in the next five years, especially since more traditional retailers—such as Topshop, Aritizia, Mango, and Forever 21—have amped up their intimates sections.

Sports Bras Aren’t Just For The Gym Anymore

The athleisure craze transformed how we used to think of sports bras: gray, thick, and strictly for gym class. Today, women wear their “gym clothes” at all hours, no longer distinguishing workout wear from other categories in their closets. That’s partially because exercise is very cool these days.

“There is such an awareness around fitness trends, whether it’s going to a cycling class or a boot camp,” says style expert and Today Show contributor Lilliana Vazquez. “Sports bras have almost become women’s badge of honor from their workout and having a body that’s fitting of just wearing a sports bra.”

Victoria’s Secret and Victoria’s Secret Pink still enjoy the biggest piece of the lingerie market pie, but more and more companies now cater to millennials’ underwear needs. Perhaps one of the biggest brands of the Instagram generation is none other than Forever 21, which has witnessed a huge interest in sports bras. Their collection features design details such as graphic prints, plunging necklines, mesh overlays, and unique straps.

“Our customers want an edgy look going to and from the gym or even on a casual day,” says a representative for the company. “With the current street-to-gym trend, we have seen many of our customers gravitate toward athleisure pieces, and [millennials] are looking for novelty that is sexy and functional.”

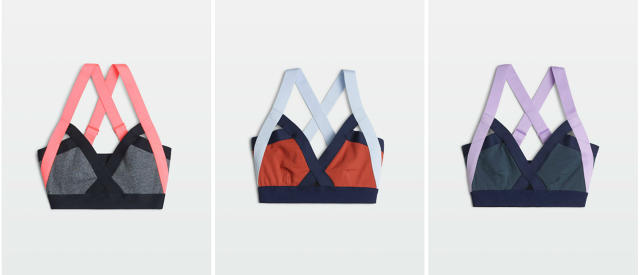

Even C9 Champion, the athletic brand Target produced in collaboration with Hanes, has ramped up its offerings. Earlier this year, it unveiled its reinvented sports bra category—and it looks nothing like Jane Fonda’s workout attire—with fresh cuts and fun colors like “aurora purple” and “deep sea coral.”

“Recognizing the importance of the category, a significant amount of product testing was conducted and several styles were invented to better serve consumers,” a spokesperson tells Fast Company, noting the goal was to marry comfort and style at affordable prices.

These brands are heavily investing in fabric quality, relying on high-end materials that can withstand a woman’s long and busy day. Aritzia, for example, uses breathable, organic cotton-modal jersey—with spandex added for stretch and shape retention.

“We search high and low for soft elastics and fabrics that are comfortable to wear,” says Aritzia merchandise director Erin Meadows. “Our selection of lifestyle bra tops are made from many of the same great fabrics we use for our leggings.”

Move Over, Push-Ups, And Make Room For The Bralette

The sport bra’s more feminine cousin, the bralette, has also seen a dramatic uptick in popularity. The latest fashion fads show off a lot of skin, and for that, a cool bra is necessary. Bralettes are nearly everywhere now; it’s the “it” undergarment. You can blame models for this trend.

“So much of what’s trending is open back and super low-cut in the front, and while that’s fine for Kendall Jenner or Gigi Hadid, for the average woman you need coverage to wear that day-to-day,” explains Vazquez, who looks to brands like Michi, For Love and Lemons, and the activewear e-commerce site Carbon38 for underwear options that can be worn under such body-bearing outfits. “A bralette is a great way to participate in that trend and have a tiny bit of coverage for all of us non-supermodels.”

Aeropostale’s activewear line, Live Love Dream, has “grown exponentially” in the past two years, according to the company, with bralettes especially popular with customers looking for lace styles reminiscent of more traditional intimates. The brand’s wireless bras, featuring unique cuts like high necks and strappy details, can be incorporated into everyday looks: You’ll definitely see them peeking out of backless T-shirts, crop tops, or oversized dresses this summer.

While millennials might be driving this trend, plenty of companies see a similar movement in the market with older generations.

True & Co. collected more than 60 million data points (using a sample size of 2.7 million women) with their bra fit quiz, which customers fill out when they join so that the online lingerie company can customize their shopping experience for them. Through the quiz results, True & Co. discovered a growing preference among its user base for a more relaxed, modern look—as opposed to traditional lingerie of yore.

“I call this the equivalent of sneakers gaining share versus dress shoes in the shoe market,” explains True & Co. cofounder and CEO Michelle Lam. Her company relies on consumer feedback to adjust its collections, such as its recent push away from the Jessica Rabbit staple, the push-up bra.

According to the company’s findings, four out of five women now say they’ve ditched that sexy style. True & Co.’s push-up sales dropped from 24% to 15% in a single year, while unlined bras—wire-free styles and bralettes—were the company’s biggest growth area with its customers. Within that category, nearly half of True & Co.’s customers wanted “lightly lined” bras—which means the bra features slight molding (read: nipple-coverage), but no full-on pad.

It’s a change documented by Helena Stuart, founder of lingerie brand Only Hearts, who has seen it all throughout 38 years in the lingerie business—the vintage John Kloss era, the aerobics fitness craze of the ’80s, the Madonna molded-cup fad of the ’90s, and the introduction of the Wonderbra. The late ’90s, she explains, saw a move into demure sensuality, one that embraced a seamless silhouette.

“I truly believe we’re embarking in the next huge shift in trends where we’re celebrating the natural female silhouette,” says Stuart, who notes that women are shedding the notion that breasts need artificial padding. “So many factors—comfort, practicality, social climate, fashion trends—have led customers to embrace the ‘barely there’ look.” Only Hearts, available in more than 300 stores worldwide, has experienced a 40% increase in demand for bralettes and soft cup bras in the last two years.

“The thought process is shifting to feeling our natural shapes are sexy and beautiful as is,” she stresses.

New Horizons In Lingerie

The wire-free movement has extended beyond established brands—and even inspired some new startups.

Michelle Cordeiro Grant, a former senior merchant for Victoria’s Secret, only last year began scheming about how she might create clothing that melded sexiness with a healthy dose of confidence.

“I felt like I was always choosing between a comfortable, basic, boring bra or something super stylish,” she says, “but I didn’t feel good in it.”

Last August she launched Lively, which features a hybrid of high style and comfort that Grant calls “leisurée.” It takes “the inspiration behind athlesiure, and the cool-handed boldness of swimwear, and the functionality of lingerie” to create bralettes with substantial support.

“We look at ourselves as being the athleisure brand within lingerie,” explains Grant, whose largest demographic is women between 25 and 34 years old, followed by the 18- to 25-year-old bracket. Her company’s direct-to-consumer website went live on April 1 with a grassroots marketing strategy: a referral program for 250 of Grant’s friends and family to earn points toward future purchases for every person they got to sign up for Lively’s email list.

“We were hoping for maybe 5,000-10,000 email [sign-ups] over a three-week period,” said Grant, “and we got 133,000 in two days. Our servers crashed” from all the traffic those emails sent to Lively’s website. The message that style and comfort no longer need to be mutually exclusive concepts had struck a chord among shoppers, which certainly didn’t surprise Grant.

“You wear a bra for 14 hours” a day, points out Grant, who compares the ideal bra to that one pair of jeans you love to live in. “That’s what your bra should be,” she says.

What’s next for the future of bras? Likely even more comfort. True & Co. has witnessed a great surge of interest in a product called the Snuggle Bra, a breathable, all-day wear product marketed as “like wearing no bra at all.” It’s been been hard for the company to keep the Snuggle Bra in stock.

“We observed that women, especially new moms going back to work, were wearing sports bras under their dress shirts versus going back to figuring out their bra size,” Lam says, explaining the inspiration behind the the Snuggle Bra. “Many of these women intended for it to be a stopgap measure until their bodies returned to normal, but they were often wearing full compression for six months or more.”

It’s listening to that type of consumer feedback that will help lingerie companies evolve and grow. For example, as the NPD Group points out from their research, seamless styling needs to be part of every female underwear brand’s merchandising strategy. “Seamless bra styles are increasingly top of mind for consumers of all ages, especially millennials, and can no longer be an afterthought for manufacturers and retailers,” says Cohen.

With all these new options, women can say goodbye to the days when taking off their bra was the first thing they wanted to do when they got home. As Grant notes, it’s almost like we’re living through a wardrobe revolution.

“We have [Lively customers] who have bought more than four times already without making one return,” she says. “They’re literally swapping out their drawers—and for me, that’s a dream come true.”

“I felt like I was always choosing between a comfortable, basic, boring bra or something super stylish, but I didn’t feel good in it.”

In 2015, the American lingerie market generated $13.2 billion.