The Truth About Why Draws and Distributions Are Non-Taxable

When it comes to pass-through entities such as LLCs and S-Corps, draws and distributions to owners/investors are not subject to income taxes. Here is why. Draws and distributions are recorded on a company’s balance sheet. However, a company’s profit and loss (P&L) statement is used to report its profits. Since draws and distributions are recorded on the balance sheet and not on the company’s P&L taking a draw or distribution has no tax consequence.

Most small business founders choose one of the many entity types known as pass-through entities. By definition, a pass-through entity is not subject to income taxes at the entity or business level like it is with a C-Corp. Rather, the owners are taxed individually based on their ownership share.

When you are a pass-through entity, the profits of a business are taxable to the individual owners based on their unique tax situation. Often these owners will take cash out of the business as compensation in the form of periodic draws or distributions.

Assuming you have a profitable business, these draws and distributions are simply a mechanism that allows owners to take out excess cash from the business. Therefore, owner draws and distributions do not have any income tax consequences to the individual.

This concept often creates a level of confusion for founders not versed in a few basic principles of accounting. To understand the concept of an owner-draw or distribution, we must review a few basic accounting principles.

There are 2 primary financial statements for every business. One statement is the P&L, sometimes called an income statement. The other statement is a balance sheet. The P&L is a document to record the profit or loss of a business for income taxes while the balance sheet is a document to record the equity in the business.

In accounting, a company has what are known as a chart of accounts. Some chart of account line items are classified as income accounts and some others as expense accounts. Income accounts and expense accounts are reported on the company’s P&L. If you take income and subtract expenses, you are left with net profit, which is also part of the company’s P&L.

P&L (Revenue – Expenses = Net Profit)

Another set of chart of accounts are classified as asset accounts and others as liability accounts. Assets accounts and liability accounts are reported on the company’s balance sheet. If you take your assets and subtract your liabilities, you are left with equity, which is also part of the company’s balance sheet.

Balance Sheet (Assets – Liabilities = Equity)

In accounting, for every transaction, there is a debit and credit taking place between two charts of accounts.

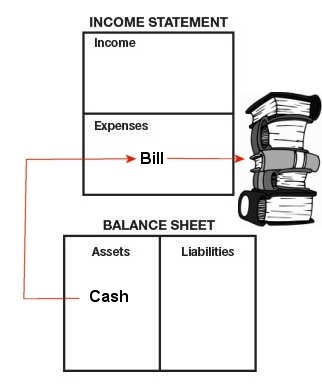

When you write a company check to pay a bill, such as when you buy some business books, you take money from a chart of account line item called cash (Cash is an asset and lives on your balance sheet) to pay a bill that lives on your P&L. Bills are allocated to their appropriate expense chart of account line item, perhaps “Books” in this example.

Since you reduced cash on your asset chart of account, equity is also reduced to keep things in balance. Equity has to be reduced because it is the result of your assets minus your liabilities. Since after paying the bill for the books there is less cash in the company’s checking account and since the company’s liability remained the same the equity which is the result of assets minutes liabilities the equity is reduced by the amount of the books. Additionally, since the cash was used to pay an expense your profit is also reduced. Profits must be reduced because it is the result of income (which remained unchanged by this transaction) minus expenses.

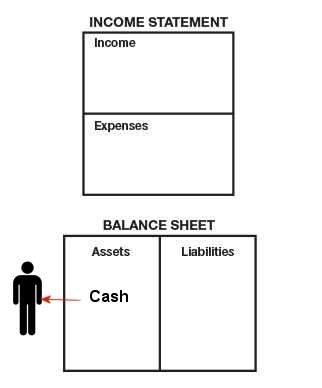

However, when you take an owner draw or a distribution, you reduce cash (an asset chart of account) and you reduce the owner’s capital (a special equity chart of account). Similarly, if you inject cash into a business, you increase cash and increase the owner’s capital.

The results of an owner-draw or distribution (money leaving the business) or a cash infusion (money entering the business) are that both sides of the transaction are restricted to the chart of accounts that live only on the balance sheet.

Since we know that the P&L is used to compute a company’s tax liability and owner draws and distributions or infusions do not touch the P&L, there are no tax consequences for doing either an owner draw, distribution, or a cash infusion in the normal course of business. An exception is when you close out the business and have a negative equity situation but that is the subject better left to your CPA.

Therefore, as a lifestyle or micro business, you only need to make sure there is enough cash in the business checking account to cover all non-discretionary expenses. All other money is at your discretion to either take out as a periodic owner draw or distribution on profits or to leave in your business as excess cash or use to pay discretionary expenses in the hopes of growing your business.

Are you following the proper accounting principles when paying yourself as a business owner?

Business & Finance Articles on Business 2 Community

(53)