This App Will lend a hand Freelancers steer clear of Tax Penalties

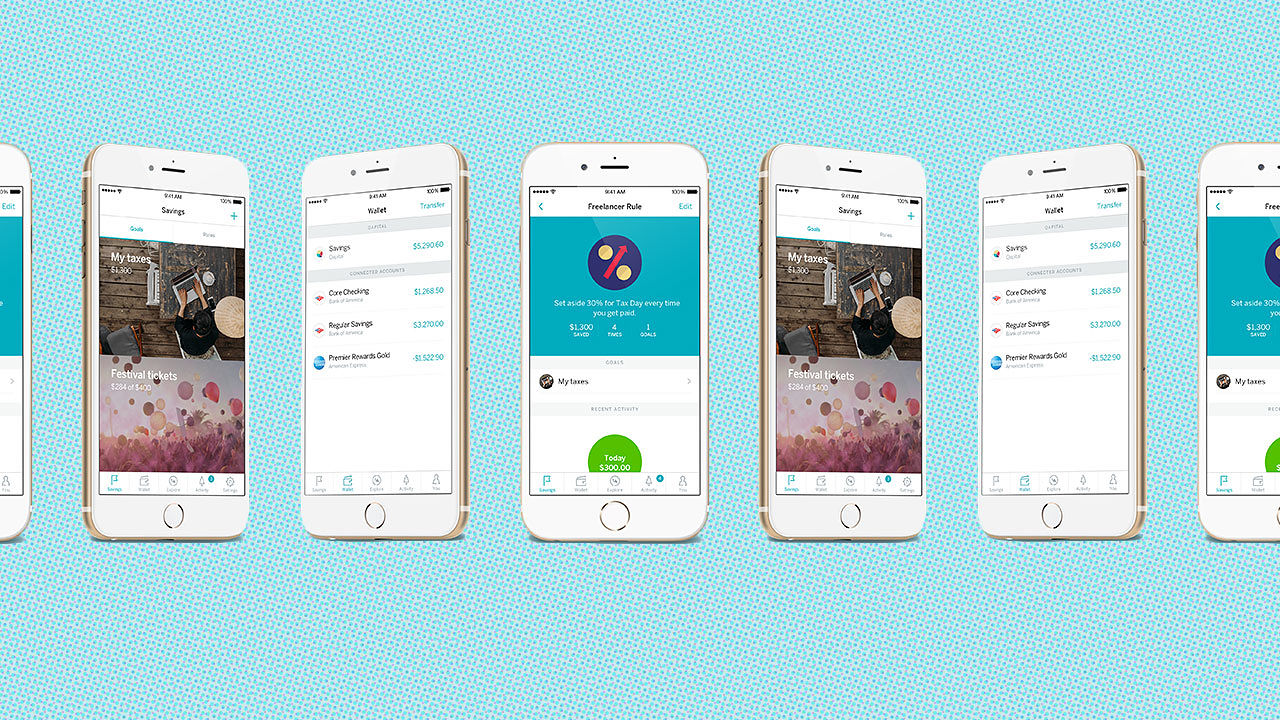

cellular banking app Qapital is including the flexibility to automatically put aside part of your earnings for taxes.

September 14, 2015

nobody enjoys filing taxes. but for freelancers and contractors, the process is even more sophisticated, partly as a result of they are able to be required to pay estimated taxes on a quarterly basis, and face steep penalties in the event that they miss these deadlines. for employees beholden to those ideas, the ultimate quarterly payday of 2015 is true around the nook—on Tuesday.

Qapital, a cash management app that makes it more practical for customers to save lots of, unveiled a characteristic these days that would help freelancers save up enough for those pesky tax payments. Dubbed the Freelancer Rule, Qapital’s new instrument will routinely take a predetermined proportion out of your paycheck—say, 30%—and set it apart for estimated taxes. (it’s not too totally different from how your company withholds taxes out of your paycheck if you are a full-time staffer.) When the IRS comes knocking, Qapital customers merely must fork over that money, quite than scrambling to make the cost.

Qapital is via and big concentrated on a younger crowd: The app was based to capitalize on uneven millennial saving practices. In June, the corporate presented IFTTT (If This Then That) performance, which intended customers might arrange financial savings targets in accordance with their spending habits or different movements; if they spent x selection of bucks on espresso, they will have to then put away y choice of greenbacks into their financial savings account. “it is transferring away from calculation and toward that goal you emotionally care about,” Qapital CEO George Friedman instructed fast firm previous this yr.

About 38% of millennials are freelancing now, as compared to 32% of the rest of the U.S. inhabitants, making Qapital’s latest move but some other play for the underneath-35 set.

fast company , read Full Story

(91)