This new credit card helps build a credit score for people who don’t have one

In his home country of Ecuador, Andres Mosquera felt pretty good about his finances. Mosquera, who has a master’s degree in business education, had two credit cards with a combined limit equal to around $20,000, and he never had any trouble paying them off. But around nine months ago, the 27-year-old moved to Long Island, New York, with his wife for a job in the insurance industry, and shortly after, they had their first child. Given his strong financial background in Ecuador, Mosquera figured it wouldn’t be too difficult to get a new credit card in the U.S.

That turned out to not be the case. Like many new immigrants, Mosquera quickly learned that his financial track record in Ecuador would not help him in the U.S.; from the perspective of the banks he applied to in New York, he had no credit history. “It was like starting all over again,” he says. To start building credit, Mosquera could only qualify for secured cards, which came with limits of around $200 or $300–nowhere near enough for a flight home, should he need one.

But his Facebook algorithm registered all his searching around on the internet about credit cards, and offered up an advertisement that proved useful: Petal, a new company that connects people with little to no credit history with a line of credit of up to $10,000. Instead of relying on the narrow criteria of U.S. credit scores, the company takes into account a person’s whole financial track record to determine creditworthiness. Mosquera signed up for the card last fall.

For Petal founder Jason Gross, launching the company last fall was all about extending credit to people who have previously been locked out of the system. For immigrants like Mosquera, lack of credit history in the U.S. makes it difficult to access a good line of credit (another company, Nova, is building out a product that would help immigrants bring their credit scores with them from their home country). Low-income people, especially those that are unbanked, often struggle to get approved, even for a low-limit credit card. A study from the U.S. Federal Reserve found that only 42% of people earning less than $25,000 per year have a credit card. Also, the fees attached to mainstream credit cards can be prohibitive: High interest rates on balances not paid off at the end of the month, as well as annual and overdraft fees, often end up adding to their financial pressures.

To enable people to receive a line of credit without a traditional credit history, Petal analyzes a combination of factors: regular payments like rent (which New York State is working to incorporate into credit scoring), checking account cash flow, or history with prepaid debit cards or secure credit cards, like the ones Mosquera used when he first moved to the U.S. “People with no credit history in the U.S. are often treated like they have bad credit history,” Gross says. Petal’s approach aims to expand the criteria used to assess a person’s ability to manage a line of credit.

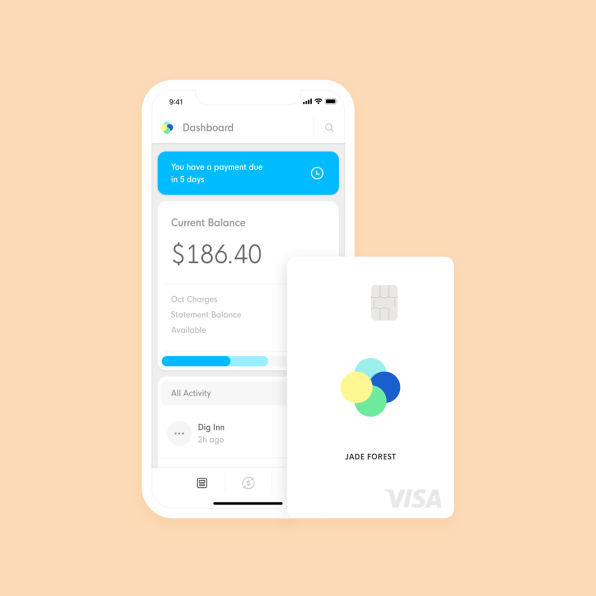

And in the process, the company doesn’t want to burden people with extra costs. The Petal credit card has no annual, over-limit, late-payment, or international fees attached. When people sign up for the card, they’re given access to an app that advises them on money management decisions–the app will tell people it’s good to aim to pay off their whole credit bill at the end of the month, but will not penalize them if they can’t.

Petal is not a bank, but it partners with WebBank, the online financial services platform that also powers PayPal and LendingClub. The company also feeds data into the three major credit bureaus–Equifax, TransUnion, and Experian–so people can begin to build a traditional credit score through Petal.

The company is heavily backed by venture capital–in October, Petal closed a $34 million funding round, right as it launched its card to the public, and in January, it secured another $30 million through a funding round led by Peter Thiel’s Valar Ventures.

It’s still relatively new, but Gross says Petal has issued credit cards to thousands of people so far. “They’re having the impact that we were hoping for,” he says. “We’ve been able to approve a lot of people that would not have been given a fair shake by the big banks, and given them access to more credit for less money.” The hope, Gross says, is to build a customer base in the tens of thousands this year, and open up a dialogue around the mainstream credit industry, and if it’s working for the people who depend on it.

(17)