This New Tool Wants To Make The Off-Price Clothing Business Easier

In the apparel world, the term “off-price” is used for excess inventory in fashion outlets and other lower-price retail stores. Brands sell their excess inventory to buyers, negotiating discounts and conditions that make the off-price market complex. But the last real innovation to keep track of those negotiations was the humble Excel spreadsheet, introduced decades ago. Startup INTURN released a cloud-based SaaS solution in April 2015 to bring the off-price apparel market into the 21st century, and with a $9.7 million fundraising round back in January, INTURN is set to keep growing.

While brands sell their first-run apparel to all buyers at the same price (that is, “full price”), brands negotiate sale rates for off-price apparel with each buyer. The brand sells off-price apparel at a discount so they can define stipulations for where and when the buyer may resell that off-price inventory to discount retail stores and outlets. This matters because brands don’t want their off-price products to end up competing with its same product at full price.

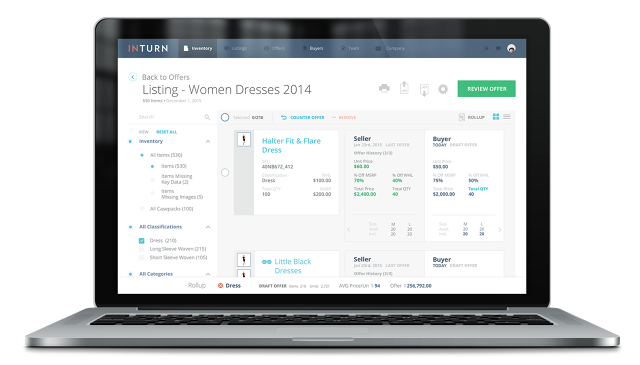

Those sale rate negotiations can get complex pretty quickly, with brands and buyers trading email offers and counter-offers. Without something like INTURN, each side’s team manually plugs the metrics for each offer (order volume, sizes, discounts, etc.) into separate Excel spreadsheets to calculate the offer’s value, then puts together a counter-offer and emails it back to the other party. In other words, it is a very manual affair, which means plenty of opportunities for human error.

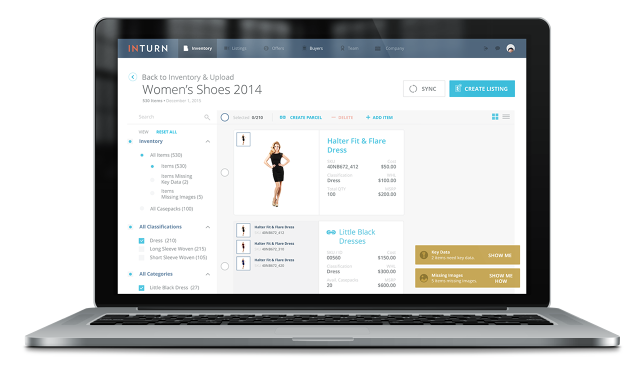

INTURN’s cloud-based SaaS software puts all the requests, offers/counter-offers, and offer calculations in one place. Instead of emails and endless Excel grids, INTURN’s software has a simple, organized what-you-see-is-what-you-get interface. It gets the brand’s inventory info by ingesting Excel spreadsheets and linking products with their accompanying images, which is actually a big deal, since product numbers are usually separated from product images across different databases. Then each side fiddles with the WYSIWG interface, changing parameters (volume, discounts, deal stipulations) that will be reflected in the offer, which can be sent from INTURN with a click.

INTURN launched 2.5 years ago to tackle the holistic challenge of the off-price inventory market, says INTURN cofounder and CEO Ronen Lazar. The INTURN team certainly learned from existing fashion industry software, but not much: The off-price market has so many different variables than the full-price market.

“Full-price retail isn’t price-elastic,” says Lazar. For the off-price market, it matters “how you package inventory and where you’re selling it. There are some years you have more or less inventory between seasons.”

Nor does off-price apparel have much in common with other data-mined industries, like appliances. Aside from having little variation from TV to TV, new TVs aren’t going to be unsellable in three months because they’ve fallen out of fashion.

INTURN’s software has three major goals. The first is to improve pre-negotiation efficiency, since too many man-hours are devoted to copying and pasting data and identifying products amid those vast Excel grids—time saved means seasonal off-price apparel has more time on the shelves. The second is to increase liquidity, improving efficiency once the deal is done and inputting those precisely negotiated values back into each system.

The third is tracking data. INTURN’s software also has a business intelligence portion to track seller and buyer activity and form predictive analytics. INTURN assures that it doesn’t commingle data between clients, who are often competing brands.

INTURN is built to improve the brand’s flexibility when it comes to selling to buyers great and small. While that has clear applications across the U.S. market, it’s the European market that INTURN hopes to help brands sell into. With multiple currencies and a very atypical market price between regions, INTURN helps manage variables within the negotiation and maintain brand integrity so the product doesn’t end up right back alongside and competing with the same product in full-price markets.

The last company that tried to do what INTURN is attempting was in the late ’90s, claims Lazar. Tech has certainly come a long way since then, and centralizing the negotiation process between brands and buyers certainly relies on the cloud-based infrastructure that INTURN built its software around.

Fast Company , Read Full Story

(28)