U.S. companies keep away from Paying Billions In Taxes—And you’re paying for It

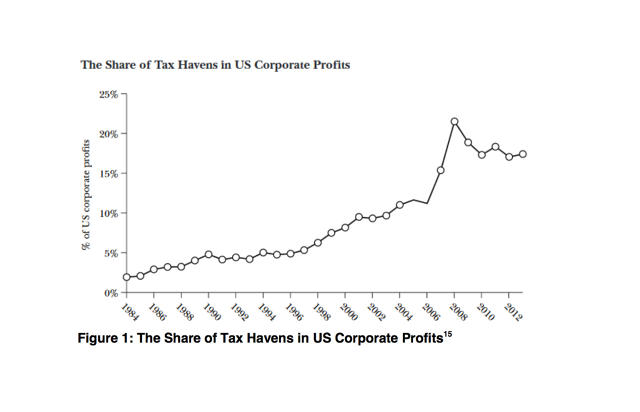

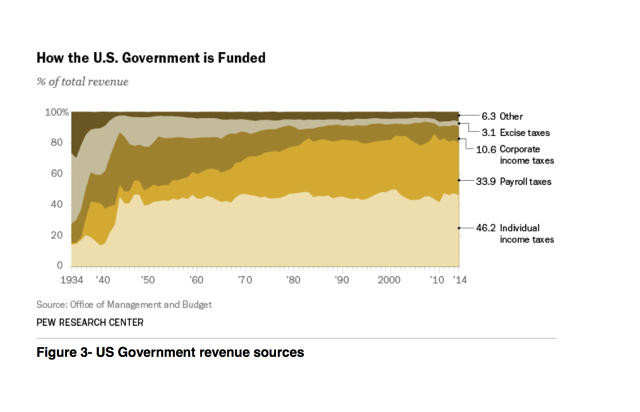

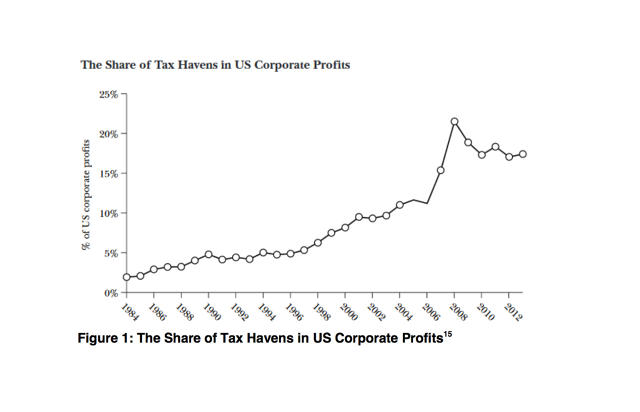

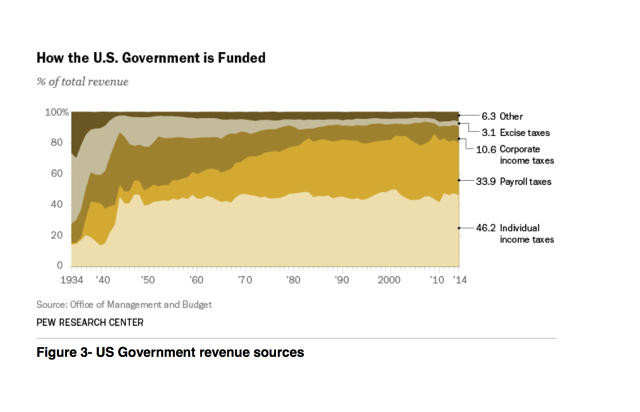

Tax dodging by way of multinational corporations is estimated to price the U.S. executive as much as $111 billion a 12 months. at the same time, firms steer clear of paying $a hundred billion in taxes to growing international locations, UN figures show. Tax “leakage” (the well mannered time period if you don’t want to ascribe any agency to the businesses that are very intentionally doing this) has reached epidemic dimensions, and we really should care more than we do. This lack of income jeopardizes public packages and usathe quantity different taxpayers need to pay.

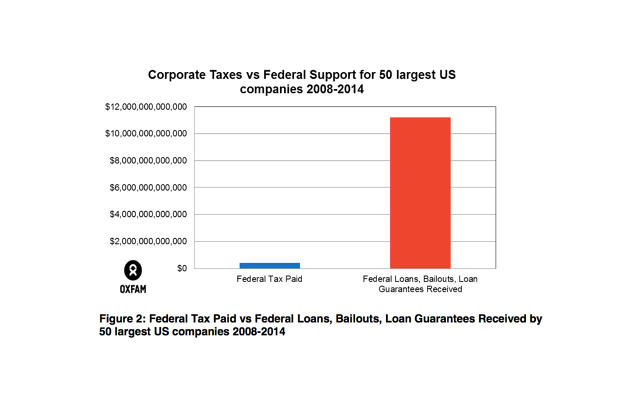

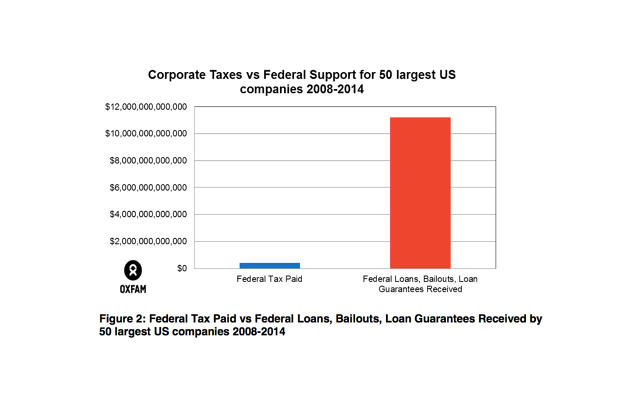

A new file from Oxfam the us sheds gentle on this dark space of company task. The world charity analyzed publicly on hand knowledge for the 50 greatest U.S. companies, taking a look at how they stash profits out of the country (to keep away from taxes at dwelling) and the way they benefit from more than a few tax breaks and loopholes. The numbers are jaw-shedding. Between 2008 and 2014, the corporations obtained 27 times more in federal loans, loan ensures, and bailouts than they paid in federal taxes. They stored $1.four trillion in income offshore (just 4 monetary institutions had 10,688 offshore subsidiaries in 2014). they usually paid an effective tax charge of 26.5%—neatly below the statutory fee of 35%. (Oxfam’s estimate is likely conservative; others have put the effective rate at nearer 20%.)

check out the interactive table right here. It presentations what the 50 corporations obtained in loans, ensures, and bailouts; what they paid in taxes; what they held offshore; and how so much they spent in tax-associated lobbying. Heavy machinery workforce Caterpillar is an efficient example. Between 2008 and 2014, Oxfam says it obtained $5.5 billion in federal fortify, had $three.7 billion in earnings, paid $837 million in all native and federal taxes, got tax breaks worth $459 million, and held $2 billion offshore in 72 subsidiaries. at the comparable time, it spent $26 million in tax-related lobbying, and had an effective price of twenty-two.6%.

Usefully, the Oxfam file explains how firms avoid taxes. First, they declare earnings are “permanently reinvested” in locations like Bermuda. (In 2008, the federal government Accountability administrative center discovered 18,857 subsidiaries registered at a single workplace within the Cayman Islands.) but this cash is not pointless. they may be able to still use it as collateral in opposition to home borrowing, in impact repatriating it in some other kind.

2nd, corporations can shift assets similar to intellectual property to offshore places, then pay royalties to that location from the U.S. base, accordingly decreasing their taxable profits. expertise firms are in particular adept at this. in line with a record in Fortune, Uber has transferred its IP to Bermuda, leaving less than 2% of internet revenue taxable in the U.S. Airbnb does one thing an identical.

third, they do what’s known as “income stripping,” where a subsidiary in a high-tax us of a will borrow money from a low-tax jurisdiction, permitting the parent company to pay passion to itself. the corporate as a complete does not lose cash, but it may possibly convey fewer profits within the vicinity the place it is taxed at a better charge, to that end decreasing its tax bill.

And, at last, and in all probability most egregiously, companies can carry out an “inversion.” which is where they purchase a international competitor for the sole goal of organising a tax base in a lower-rate place. That used to be the maneuver in the back of drugmaker Pfizer’s proposed (but now rejected) merger with Dublin-based totally Allergan. (eire’s tax laws make it a typical area for tax-dodging schemes, which is why many corporations inexplicably have a Dublin place of job.)

Oxfam concedes that its 2008-2014 federal support figures are inflated via the Wall street bailout and the auto bailout, and that quite a lot of federal loans are back with passion. alternatively, it says “the data comes in handy to watch in mixture as a result of it places in stark aid the taxpayer-financed advantages huge companies typically revel in with regards to the taxes they pay.”

also, it says one of the tax calculations are most certainly generous to companies, as a result of they’re based on their own disclosures and embody “deferred tax liabilities,” that are monies firms owe (and book as taxes) however do not in fact pay.

The report shows company tax avoidance working amok, enabled with the aid of complicit lawmakers, an in depth offshore trade of legal professionals and accountants, and a normalized moral calculus that claims dodging taxes is k as a result of everyone is doing it.

except everybody is not doing it. corporations say they do quite a few just right with the money they do not supply to government, including job creation, charitable giving, and producing modern products. however the question we now have to ask is that this: How come it is ok for multinationals to go to out of the ordinary lengths to keep away from taxes, when small businesses and individuals need to pay the whole price? it’s this double standard that needs addressing.

(18)