US businesses’ CX scores down from last year’s all-time high

The average score dropped in 10 industries and rose in three, almost the exact opposite of 2021.

U.S. companies have taken their eyes off the consumer and the result is worse customer experience, according to a new report.

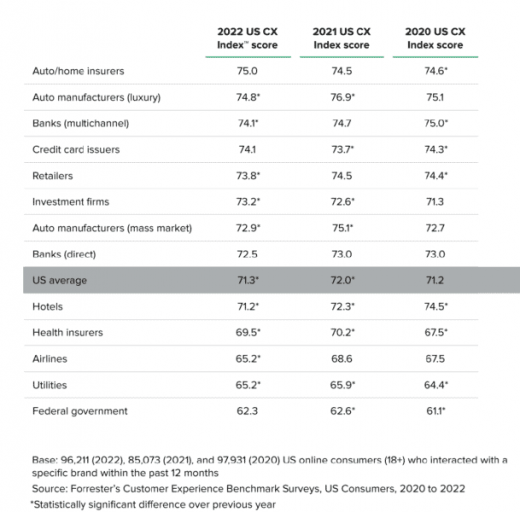

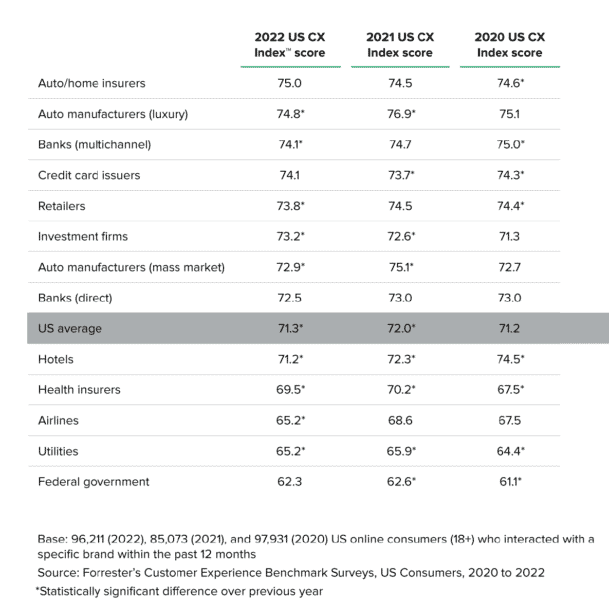

The Forrester study found CX, which hit all-time rating highs last year, is now back down to pre-pandemic levels. The overall CX Index score fell from 72 in 2021 to 71.3 in 2022 on a 100-point scale. The company says that while this may seem small, it is “statistically significant and meaningful in the real world because [it reflects] changes in CX quality for large numbers of customers.”

The cost. According to Forrester research, a one-point improvement in CX Index score can be worth $ 22.5 billion more in assets under management for the average investment firm and $ 1.2 billion in revenue for the average mass-market auto manufacturer.

Across the board problems. The 2022 U.S. Customer Experience Benchmark report examined 13 business sectors. The average score dropped in 10 industries and rose for only three. That’s a reversal from last year, when three fell and nine rose. These industry-level losses leave nine industries with average scores lower than or essentially equal to their 2020 levels.

Who fell the furthest. Not surprisingly, two industries hit the hardest by labor shortages did the worst. The hotel industry average was 74.5 in 2020, now it’s 71.2. Similarly, the airline industry had a not-great 67.5 score in 2020 and is down 2.3 points this year.

The report also found:

- CX quality fell for 19% of brands this year, about twice as many as the 10% of brands that gained points. Further, this year’s brand-level losses were larger than the gains: The average loss was 3.8 points, the average gain was 3.1 points. Six brands lost between 5 and 10 points, while no brand gained 5 or more points.

- Digital-only CX has gotten worse, dropping 0.4 points from 2021 to 69.3. As a result the quality of digital-only CX now trails physical-only CX by 2.5 points. Digital-only CX worsened for 10 industries; for six industries, this is the second loss in two years. The mass-market auto manufacturer industry had the biggest digital-only drop, going from 71.7 in 2021 to 69.2 this year.

- Customers’ perception that a given brands’ values align with their own has fallen to pre-2020 levels. This year only 45% of customers across the 12 verticals studied perceived value alignment, a 4-percentage-point drop from 2021. What’s more, every vertical peaked in 2021 and backslid in 2022.

- Experiences are neither easier nor more effective. On average, 70% of customers said their experiences with brands were either easy or effective, 1% lower than the year before.

Why we care. Best case scenario is that CX peaked in a year when most consumers were behaving the same way. Last year saw people working from home and ordering on-line. Now, for some reason, businesses want workers back in the office (where multiple studies show they are less productive) and people are back to behaving in many different ways. Forrester says its because businesses lost their customer focus. Might be both, actually.

The post US businesses’ CX scores down from last year’s all-time high appeared first on MarTech.

(23)