Visa to Tighten Chargeback and Fraud Thresholds in Q3 2019

— March 1, 2019

Visa continues to make changes to its risk monitoring programs, announcing recently plans to toughen qualifying thresholds for the Visa Chargeback Monitoring (VCMP), and Visa Fraud Monitoring (VFMP) programs on October 1, 2019.

VFMP & VCMP Defined

The Visa fraud monitoring program, or VFMP, monitors US-based accounts for signs of high levels of chargeback fraud.

When the volume reaches a pre-determined threshold, the acquiring bank is notified, and the merchant is given time to bring those levels down.

Like VFMP, The Visa Chargeback Monitoring Program has monitoring and remediation components but focuses on chargebacks, rather than fraud.

When a merchant has reached certain thresholds, Visa asks acquirers to work closely with their merchants to identify the root cause of their chargeback issues and create a plan for reducing them.

What the Changes Mean to Merchants

Visa’s aim in implementing the new thresholds is to ensure that merchants’ are using ethical sales tactics and that transactions are processed, and data stored, on PCI compliant systems. The Payment Card Industry Data Security Standard (PCI DSS) applies to companies of all sizes that accept credit card payments. So, if your company intends to accept card payments, then you need to host your data securely with a PCI compliant hosting provider. This is part of what Visa is looking to confirm with the new regulations.

Merchants with chargeback and fraud mitigation strategies already place are unlikely to be affected, but those without them will be at greater risk of entering one or both of the programs, which may result in higher fines and administrative costs.

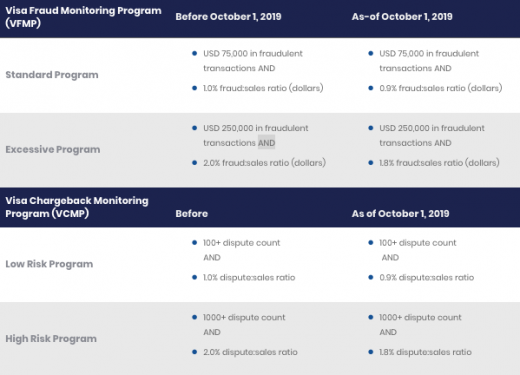

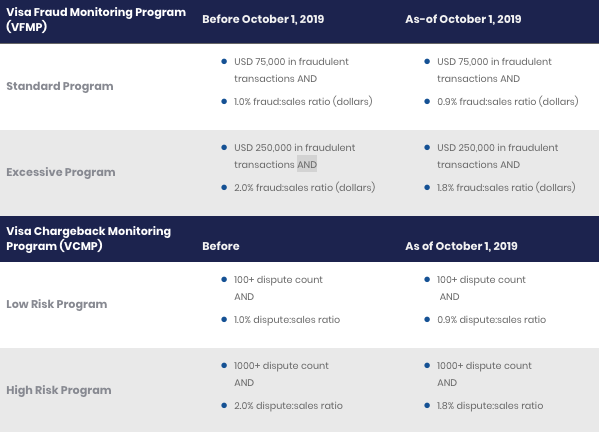

VCMP & VFMP: Before and After

The pre-Q3 2019 Visa Fraud Monitoring Program and Chargeback Monitoring Program limits, and the ones that take effect at the start of Q3 2019.

Of course, the best approach to staying within the threshold is to put the right tools and strategies in place to prevent chargebacks from happening in the first place.

Make sure your business is equipped for the new policy changes. Download your free “Impact of Visa Claims Resolutions on eCommerce & CNP Merchant” report.

This article first appeared here.

Business & Finance Articles on Business 2 Community

(9)