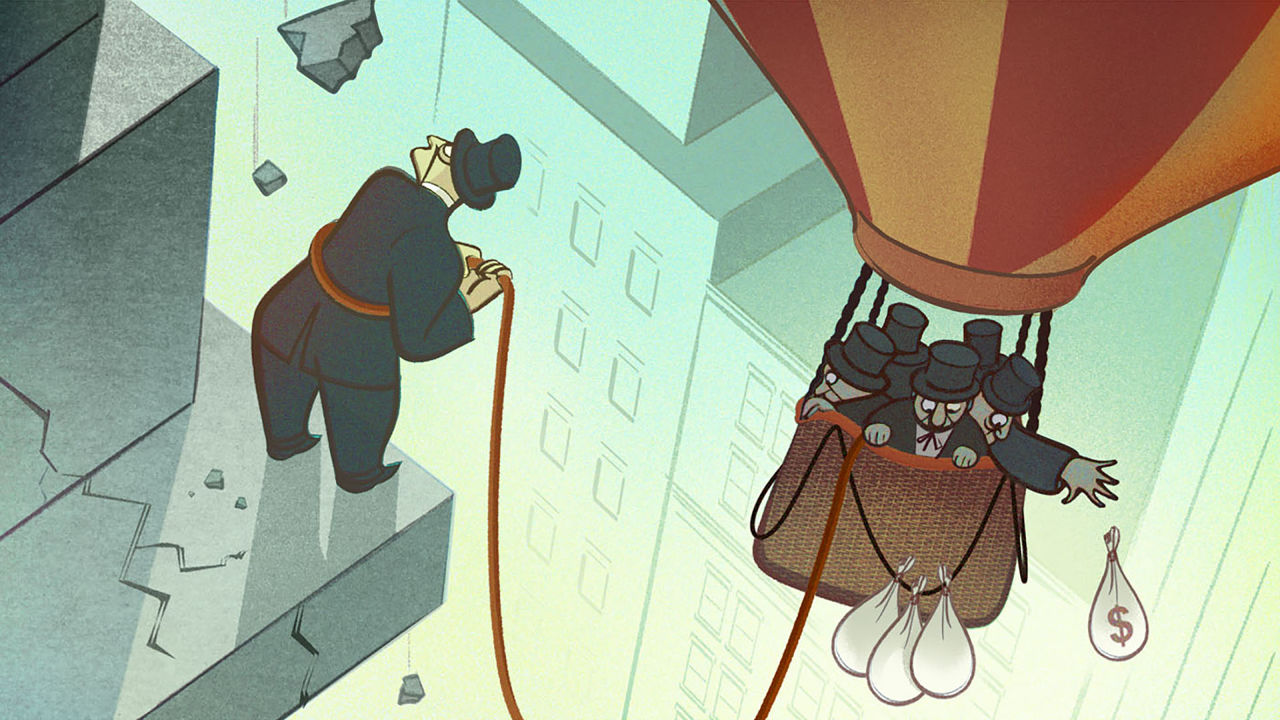

Welcome To The publish-Work economic system

If the purpose of the economic system is to offer decent-paying work for everyone, that economic system naturally is not doing a just right job in the interim. real wages for many americans have not elevated in forty years. actual unemployment—which contains the “under-employed”—is above 10%. many jobs are actually part-time, flexi-time, or “gigs” and not using a advantages and few protections. And, we spend some huge cash to subsidize so-known as “bullshit jobs“: greater than 50% of fast meals staff receive some form of public assistance, for example.

And, even for people who find themselves employed, work regularly isn’t that enjoyable. For all of the discuss of the which means and goal of our jobs, the general public see them in basic terms as a way to an finish. best 29% of employees in North america say they’re engaged (global, the number is 13%). And the reality is that a variety of work will quickly be carried out via pc. Processing-type expertise has already eradicated many “movements guide” and “movements cognitive” actions, notably in factories and offices. And new artificially sensible machines are possible to take away more, even inside skilled occupations. Forty-seven p.c of jobs are at risk over the next two decades, one find out about showed.

in fact, there are a lot of conventional methods lets care for this, including making improvements to schooling and coaching (so more people can work up the wage-scale and past the ability of robots) and elevating minimal wages. however, over the long term, it can be questionable whether even these tactics will likely be enough. the elemental downside can be that work is shedding its value. the object that provided—that allowed families to prosper and folks to build a way-of-self—is underneath attack.

In response, many are actually calling for a “common normal income” (UBI)—where the state provides everybody enough to live on. this may put a floor underneath the class of people we’re calling the “precariat,” folks for whom work would not lead to elevated financial safety. it could free us from the bullshit, permitting everyone to take advantage of automation, now not just the lucky few. And it might go away us more time for inventive, satisfying issues, taking part in the “abundance” that new technology affords (suppose how useful and low-cost computers are these days and imagine what they would possibly let everybody do at some point). There are several UBI trials deliberate in Finland, Switzerland, and Canada (and, indeed, a couple of reasons why the idea is attractive).

Critics of UBI say it is unaffordable, impractical, and at risk of result in tens of millions of layabouts living off the government dime—and possibly they may be right. These criticisms are reasonable. however earlier than pushing aside UBI too quick, it can be crucial to imagine the speculation not within the context of our current economic system, but of what the economic system could develop into at some point. UBI isn’t so much an idea for now; it’s an idea for an economy the place capitalism is not as socially productive as it can be historically been.

To keep in mind the kind of financial system we now have and the way it’s now not providing for a lot of people, you need to read Postcapitalism, a profound and essential guide with the aid of Paul Mason, a British economist and journalist. Mason makes the case for UBI, among a bigger set of modifications necessitated by means of the failure of the current machine. providing a protracted financial history displaying how innovation and prosperity rises and falls in waves, he shows how our present preparations aren’t as progressive and prosperous as we tend to suppose (the invention of fb is not as momentous as the coming of the steam engine).

Mason says we want to move towards a “postcapitalist” financial system, the place working for money loses its centrality, the place goods, data, and intellectual property are shared, and the place financial actors collaborate in new ways, whether it’s credit union-kind financial institutions or co-operative-sort retailers. Importantly, Mason also displays how present financial orthodoxy—based totally around “free markets,” globalization and an oversized position for the financial services business—isn’t some historic finish-state, perfecting the whole lot that went earlier than. fairly, it is the results of a selected set of alternatives, starting within the Eighties, that benefit some individuals over others.

Mason’s ebook accommodates plenty of fresh ideas, but the main thrust is that capitalism is creaking below its own weight, and that we need an alternative. He gives three main reasons:

monetary meltdown

The 2008 financial crisis showed the inherent instability of the current system. We had a problem as a result of valuable banks stored money cheap for a very long time by means of maintaining interest rates low, sustaining the associated fee of property and inspiring everyone to borrow. We took on bank cards, auto loans, and mortgages, substituting debt for the weak point of wages (while incomes have stagnated because the Seventies, debt within the U.S. economic system has doubled). Wall side road traded our loans in repackaged devices, producing income. however then subprime debtors could not repay what they owed, asset costs fell, and the playing cards began falling.

but even as the financial system collapsed, the banks failed to retreat from their low-cost money policies. Following the monetary trouble, banks in the U.S., Japan, and Europe have printed $12 trillion in new cash, mopping up the old money owed and inspiring new ones. And now the seeds of debt-derived catastrophe are being replanted, simplest this time it’s questionable whether we are going to have the tools to bail out the systemically important avid gamers.

“The fiction on the heart of neoliberalism is that everyone can enjoy the client lifestyle with out wages rising,” Mason writes. “which you could go on developing money eternally but when a declining share of it flows to employees, and yet a rising part of profits is generated out of their mortgages and credit cards, you are sooner or later going to hit a wall. one day, the expansion of financial revenue thru offering loans to stressed customers will smash, and snap again.”

Western capitalism, Mason argues, is built on financialization (whereby shopper debt is made tradable), fiat or paper money (which isn’t in response to the rest tangible, like gold), and global imbalances between creditor international locations (like China) and debtor international locations (just like the U.S.). it can be a device inclined to increase and bust that masks an underlying truth: the true financial system isn’t rising very quickly and most definitely hasn’t for some whereas.

knowledge items

modern economies are increasingly based around data. information “desires to be free”—as the pronouncing goes—however free things are unhealthy for capitalism, as a result of capitalism is about competitors and making income.

knowledge items are not like bodily items. Intrinsically, a pc application isn’t like a car. constructing every new BMW is as hard because the one earlier than; growing every other copy of a computer program is straightforward. as soon as you have obtained the recipe, every further unit is basically free. which is great for information giants like Google, fb, and Apple. It means that as soon as they have got a recipe, they are able to watch the cash rush in. however sustaining the idea that what they are promoting is efficacious requires a definite inventiveness. They wish to attraction to mental property rules (a notoriously messy space of the law). They wish to maintain monopolies, like Google’s de facto monopoly over search. Sorry Bing. Or they wish to give the product away, then promote something else (fb sells your personal data to advertisers). None of these things are intrinsic to the principle capitalistic alternate since the old law of supply and demand has damaged down. we’ve got moved from an generation of scarcity to an technology of abundance.

In time, technology is more likely to pressure many things to “zero marginal cost.” vitality, as an example, is not going to be topic to market forces. we’ll simply have a sun panel on the roof and every kilowatt hour will essentially be free. when we need something for the house, we are going to simply print it with a 3D printer. And when we have now an internet of things, everyone will probably be related, enabling unparalleled co-advent and collaboration.

“as of late, the main contradiction in up to date capitalism is between the opportunity of free, ample socially produced goods, and a system of monopolies, banks, and governments struggling to take care of regulate over energy and data,” Mason says. “the whole thing is pervaded by using a battle between network and hierarchy.”

local weather change

prior to now, governments and businesses have said that market mechanisms are one of the simplest ways to take care of world warming. but all proof suggests that they may be unsuitable. consider the numbers. to stay under the 2-degree threshold agreed via governments and scientists, we need to burn no more than 886 billion heaps of carbon with the aid of 2050, in line with the global energy agency. And yet fossil gas corporations proceed to invest heavily in exploiting reserves that, if burned, will lead to many times that amount of emissions. In economics-talk, climate trade represents an incredible market failure.

“the true absurdists will not be the climate-alternate deniers, but the politicians and economists who consider that the present market mechanisms can cease local weather exchange, that the market must set the limits of local weather motion, and that the market may also be structured to ship the biggest re-engineering challenge humanity has ever tried,” Mason writes.

lifestyles past capitalism?

In taking a look past the present system, Mason stops in need of offering a blueprint. however he says we must socialize factors of the finance industry (to stop it from taking all of the earnings whereas leaving society with bail-out payments), socialize data (so Google and facebook do not enjoy knowledge asymmetry), motivate collaborative work and nonprofits, and nationalize utilities. In Mason’s financial system, we might “privilege the free Wi-Fi community in the mountain village over the rights of the telecoms monopoly.”

A basic earnings is vital in a non-market economy. it is what permits people to volunteer at nonprofit companies, arrange meals co-ops, or design something the use of a 3-D design module. It wouldn’t stop folks from working—these with well-paying, satisfying jobs would proceed to do them—but it might cease people from having to do issues that machines can do more easily and more safely.

A basic profits is a solution to spread the rewards of work across socially useful activities, most effective a few of that are at present rewarded, economically speaking. “A common earnings says, in effect, there are too few work hours to move around, so we want to inject liquidity into the mechanism that allocates them,” Mason writes. “The lawyer and the daycare employee would each want so that you can trade hours of labor at full pay, for hours of free time paid for via the state.”

the biggest challenges to introducing UBI are political and cultural, say Nick Srnicek and Alex Williams in Inventing the long run, some other new book that calls for a normal profits. Political, as a result of folks naturally resist the idea of gifting away free cash, simply as these days they withstand conventional welfare. And cultural, as a result of “work is so deeply ingrained into our very id.” Even when work is degrading and depressing, we still associate it with self-reliance, self-awareness and something redemptive. (Srnicek and Williams gloss over how one can pay for UBI, though they mention reduced militia spending and will increase in carbon and different taxes).

it can be doubtless that many individuals will recoil from the tips of submit-capitalism as a result of capitalism is this kind of normative part of life in the usa and in a lot of the developed world. Most of us here, left and right, imagine in the idea of free markets, because we have now been instructed that’s what lets in the economic system to develop, and the way people must be: free in our interactions.

the whole lot else sounds like socialism, even though what Mason is suggesting is not the rest just like the previous kind of socialism. instead, his ideas are an try to run with the grain of know-how and accept the sector as it is, now not the neoliberal paradise we imagine it to be. in point of fact that capitalism—with its tendency to profits inequality, knowledge monopolies, and financial power—is working out of steam. it’s time to start fascinated by something new.

See the remainder of the world changing concepts Of 2016

fast company , read Full Story

(10)