What’s happening with student debt forgiveness? 5 things to know about Biden’s SAVE plan

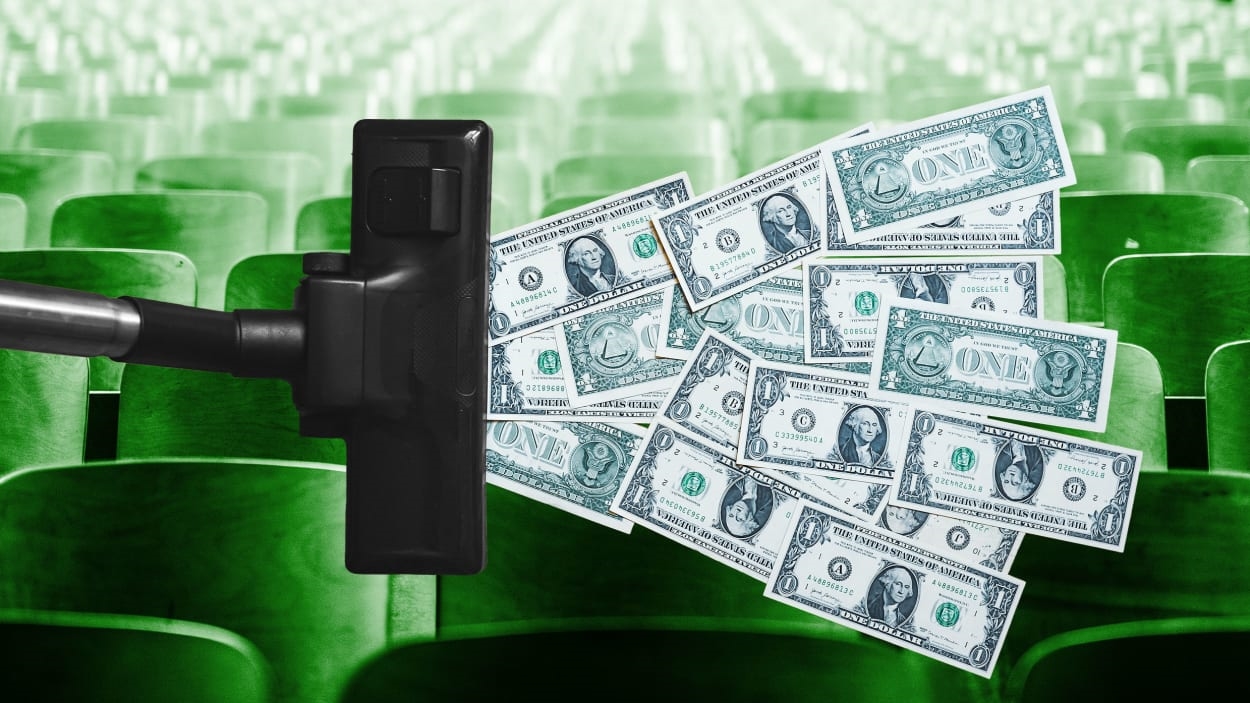

A defeat at the Supreme Court isn’t completely derailing the Biden administration’s efforts to ease student loan debt for the nation’s 44 million student borrowers. On Friday, the administration pushed forward with $39 billion in automatic student loan forgiveness, affecting more than 800,000 borrowers.

To date, the administration has approved nearly $117 billion in student loan debt for 3.4 million borrowers. Despite those figures, there’s still more than $1.77 trillion in student loan debt in the United States, which is why the Biden administration is rolling out an additional plan to forgive even more debt.

“Today, we are taking another historic step by forgiving $39 billion in student loan debt for 804,000 borrowers who have been paying down their debts for 20 years or more and should qualify for relief. Instead, many were placed into forbearance by loan servicers in violation of the rules, and others did not get appropriate credit for their monthly payments,” Vice President Kamala Harris said in a statement, following the announcement on Friday.

“Last month, President Biden announced we are pursuing an alternative path to provide relief through the Higher Education Act, and we finalized our new income-driven repayment plan – which will cut monthly payments in half for undergraduate loans,” the statement added.

The alternative path Harris that referred to is the Saving on a Valuable Education (SAVE) plan—which is a new type of income-driven repayment plan administered through the Department of Education and created under the Higher Education Act. The plan replaces the Revised Pay as You Earn (REPAYE) plan, which is currently in effect. The SAVE plan will go fully into effect on July 1, 2024.

The SAVE plan was initially announced at the end of June after the Supreme Court cut down the administration’s broader loan forgiveness plan, and per a White House release, it will be “the most affordable repayment plan ever created.” Here’s what you need to know about it:

And, for what it’s worth, the SAVE plan will cost less than the administration’s original forgiveness plan, at an estimated $230 billion (compared to $400 billion), according to the Congressional Budget Office.

(5)