Why Apple Shifted Music From Download Dominance To Streaming Sameness

Competing with Spotify, Rdio, and the rest won’t be easy. Then again, Apple doesn’t have to beat them for the effort to be worthwhile.

Last week’s launch of Apple Music represented a turnabout for Apple when it comes to how it delivers music. The company, which had long been a dominant leader in downloadable music—all the way back to the iPod era—has seen the market shift to less-profitable streaming services with greater reach and apps for multiple platforms, most notably Spotify.

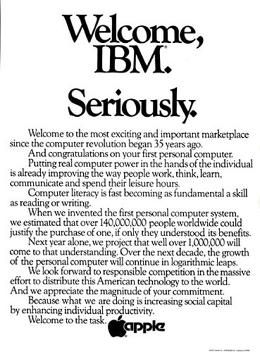

A tongue-in-cheek “ad” tweeted by another such streaming service—Rdio—welcomed Apple to the streaming subscription fold by parodying a famous 1981 newspaper ad Apple ran welcoming IBM to the personal computer market. Indeed, Apple has launched Apple Music long after the debut of subscription streaming services from other big players, including Google (Play Music All Access in 2013) and Microsoft (Xbox Music, originally Zune Pass, in 2011).

Apple was content to allow these giants and smaller competitors such as Rhapsody, Rdio, and Slacker scramble to educate the market on the benefits of subscription music as it reaped profits from downloads. For the purchase price of 10 tracks per month, you can enjoy access to millions of tracks from a range of artists. Of course, there are some drawbacks. As outcry by the artists behind the Tidal service and Taylor Swift pulling her music from Spotify have shown, not every artist is willing to accept the paltry royalties that such services offer.

As a result of its heritage in downloads, Apple Music enters the market with a large library but few other advantages. Streaming services must play by the same general rules established by music companies, although Spotify has been able to negotiate with the labels to offer free listening from the desktop web client. YouTube, meanwhile, has become a trove of on-demand music that the company is now seeking to monetize via YouTube Music Key.

Next Stop: Video?

The move to music streaming may also be a prelude to what is expected to be an even bigger subscription bet for Apple, its long-awaited entrance into video subscriptions. For consumers, subscription-based video streaming offers even more value than music services from a pure consumption-volume-per-dollar standpoint. The price of a subscription to a service such as Netflix or Hulu is about the price of only two or three one-off video rentals.

And while such services often lag behind video stores such as iTunes and Vudu in offering newer releases, there has been more room for differentiation. Dish, for example, has integrated live television—something Apple would need for a viable pay TV replacement—into Sling TV. And Amazon and Netflix have made up for their lack of newer releases with original series.

Historically, Apple has steered clear of producing its own content. Its launch of Beats 1, an online radio station, represents a new direction, but it’s a big leap from that to creating something like Netflix’s House of Cards.

One other aspect of Apple Music is reminiscent of other streaming services: In a departure from its usual avoidance of other mobile platforms, Apple plans to offer an Android version of Apple Music. That’s likely a nod to current users of Beats Music, the service that Apple got when it acquired Beats, and which provides the foundation for Apple Music. Or perhaps it’s an acknowledgment that some iPhone users may have someone in their household who uses Android (and hasn’t yet been subject to an intervention).

The key difference between Apple and a Netflix or Spotify, though, is that the content subscription represents incremental income for Apple, not its core business. While the company’s acquisition of Beats has provided it with the ability to tiptoe its way into streaming services, it might be happy with even modest progress if Apple Music helps keep people loyal to the devices on which it makes money.

Fast Company , Read Full Story

(152)