Why Credit Matters

Why Credit Matters

By: Amy Hernandez

October 18, 2021

We have all heard the phrase, money makes the world go around but what if I told you that it’s actually credit that makes the world go around. Credit has become an integral part of our society since its inception, so trying to function without it can really be a hassle. Still, even though millions of people use and rely on credit, not that many people actually know how it functions which can lead to them falling short when it comes time to repay their debts with creditors. This is especially true for first-time credit card users who constantly get rejected by credit card companies when trying to open an account, that by the time they finally get approved they don’t care about any details regarding the card and start viewing credit in a negative light.

Types of Credit

Before diving into the world of credit it’s important to understand the three main credit categories.

- Revolving Credit: This is money that you can borrow at any time but comes with a credit limit that restricts how much can be used at any particular time. You usually pay this back monthly and have to pay interest if you don’t pay off your bill in full every month. Revolving credit is used for items like credit cards where you are also given the option to pay back a minimum balance instead of the full amount.

- Installment Credit: Installment credit is a loan for a set, mutually agreed-upon amount of money with a fixed, regular repayment schedule. Items such as student loans, mortgages, and car payments are in the installment credit category.

- Open Credit: This form of credit allows you to have funds up to a maximum amount of credit at your disposal, with the caveat that you must pay your full bill back every month. A charge card will fall under this category as it requires full repayment to avoid penalties and no interest rate is associated with it.

Why Get a Credit Card?

Some people will argue that credit is unnecessary if you have sufficient funds to pay for items, and although that is somewhat true, having credit can make life a lot easier. Credit, specifically credit scores hold a lot of power as they can be the determining factor on whether or not your loan is approved, it impacts your interest rates, insurance premiums, and even apartment applications. When you open a credit account, you start building a credit history which if maintained in good standing can lead to lower interest rates which will save you money in the future and make it easier for your home, auto, or loan applications to get approved. Additionally, having a line of credit allows you to have some financial flexibility.

Sometimes bills can build up and in those instances, it’s good to have a line of credit since you can pay back your debtor over an extended period of time or even perform a balance transfer. Balance transfers work best if you have multiple credit cards as you can use them to consolidate debt if your other cards have lower interests rates. Another positive aspect of owning a credit card is that credit issuers have systems in place to help you along your financial journey including rewards programs, tracking spending habits, fraud protection, cash advances, and sometimes even purchase protection.

The Significance of Credit Scores

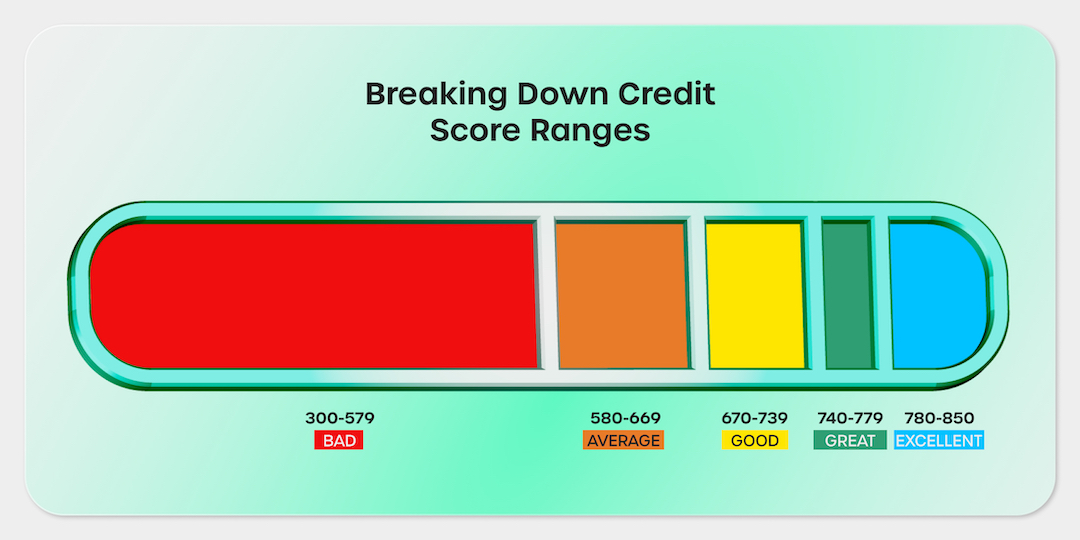

Now that you understand the importance of a credit card it’s time to learn about credit scores and the importance of maintaining a good credit score. A credit score is a three-digit number that can fall in a range anywhere between 300-850. Wherever you fall in this range is how lenders assess the risk of lending you money, based on your credit repayment history.

Let’s explore these score ranges:

A credit score in the 300-579 range is considered to be bad by credit bureaus since people within that category usually fall victim to repeatedly paying their bills late or not paying at all. Next, we have the 580-669 range which is average and where most new credit users fall if they pay their credit bill regularly the first few months. Being in this category is not necessarily bad but can be improved in order to receive better benefits from your card issuer and an increased credit line. A score between 670-739 is good in the eyes of the credit bureaus as it shows you have great financial responsibility. In fact, according to Nerdwallet “Once your scores near 700 or so, you’re considered a good risk”. With that being said a score of 740-779 which is a great standing will be when you start to see additional benefits like lower interest rates when applying for new credit cards, loans, or buying a new car. Lastly, we can’t forget the perfect credit score range which falls anywhere from 780-850 and reflects you as being an extremely favorable person to lend money to. With this credit score, you can easily pass any credit check, get favorable credit deals like low APR rates and all the benefits previously mentioned.

Improving Your Credit Score

In order to maintain or get to your desired credit score remember to keep two key credit factors like payment history and credit utilization in mind. In case it was not stressed enough, your payment history is the key factor in raising your credit score so be sure to make timely recurring payments or set up automatic payments so your payments remain consistent. Once you have a line of credit it’s important to use it but not exceed your limit. It’s recommended by Bankrate finance experts that a person should only use about 30% of your available credit in order to keep the percentage of your credit use and your total balance in the lower range. By doing this you will demonstrate financial stability and be seen as responsible by creditors who will be more inclined to raise your credit score over time.

Now that we reviewed all the basics when it comes to the importance of credit from its types, to its importance, the significance of credit scores, to how to improve your credit we hope that you will be confident enough to start your own credit journey.

About the Author:

Amy Hernandez is the Digital and Public Relation Manager at electrIQ marketing where she oversees all outreach and publicity efforts. Since its founding in 2018 electrIQ, utilizes several online marketing strategies and premier platform-based growth tactics to develop individualized and innovative methods that allow businesses to not only attract new customers with engaging content but also reinforce and restore interest with their current customer base.customer base.

About the Company:

Extra is the first debit card that helps you build credit. Unlike a traditional credit card, an Extra card is connected to your bank account so you can only spend what you have to make everyday purchases while simultaneously increasing your credit score. The way this debit card helps you establish credit is by compiling the purchases you made at the end of every month and reporting them to credit bureaus to help build your credit history. When you apply there is no credit check, instead you will be charged a monthly payment fee that starts at just $7/month. Extra can connect to over 10,000+ banks in the U.S. by using Plaid, to ensure that your banking information is safe and will never be stored.

(45)